The budget has been presented, analyzed, and the market has reacted. Surprisingly, there hasn’t been a very strong reaction despite many tax points being raised on the markets. As I mentioned yesterday, there was a 25% hike in long-term capital gains, a 33% hike in short-term capital gains, and a 60% hike in STT on F&O transactions. So, all market participants are affected by this. Yet, the market has chosen to be almost sideways today.

Immediately after the announcement yesterday, there was some hiccup in the market, but it recovered the entire loss. Yesterday and today, there was some loss on the Nifty, but nothing spectacular. The kind of disappointment visible in social media from traders and investors is not reflected in the stock price. This is a signal from the market that it is done and dusted and we should move on. The tax angle has been eclipsed by a lot of other positives in the budget related to growth, development, infrastructure, and support for weaker sections of society. Overall, the tax points haven’t overwhelmed the markets.

However, there is one section that feels extremely short-changed: the sovereign gold bond holders. I also hold sovereign gold bonds and agree with most people that the changes are unfair to them. Of course, death and taxes are the only two realities of life, so one will have to live with that. I will discuss this topic in more detail as many users have reached out to explain how this has impacted gold investors in general and sovereign gold bond holders in particular.

Overall, simplification of long-term capital gains to 12.5% on all asset classes is a good move. If you are making money and have to pay 12.5% as tax, it is not a bad deal, especially considering personal income taxes are 30% to 39% and corporate taxes are 25%. Even globally, there are only a few places where capital gains are tax-free. For example, in California, capital gains tax is around 35%. Hence, 12.5% is not a bad tax rate, whether on capital gains or anything else.

Market Overview

Today, we saw a very muted Nifty performance at -0.27%. Yesterday was a great pullback from the bottoms. Today, the market, although a bit indecisive, stayed within the range of yesterday’s performance. It was an inside day, staying within yesterday’s range. There was no real disappointment or fallout. If there was a significant fallout, you would have seen a 300-500 point drop, but that hasn’t happened. Therefore, it is safe to say that the market has absorbed the negative aspects of the budget very well.

Nifty Next 50

Nifty Junior had a small candle today with a muted +0.3% movement.

Nifty Mid and Small Cap

Mid caps showed good performance with a +0.9% increase, recovering virtually all the loss from yesterday. Small caps saw a very good rally, up +1.8%, coming close to all-time highs. This demonstrates that the market has recovered well, with yesterday’s high being taken out—a key element in studying charts.

Nifty Bank Overview

Bank Nifty was down 0.89%, showing a different trend compared to other indices.

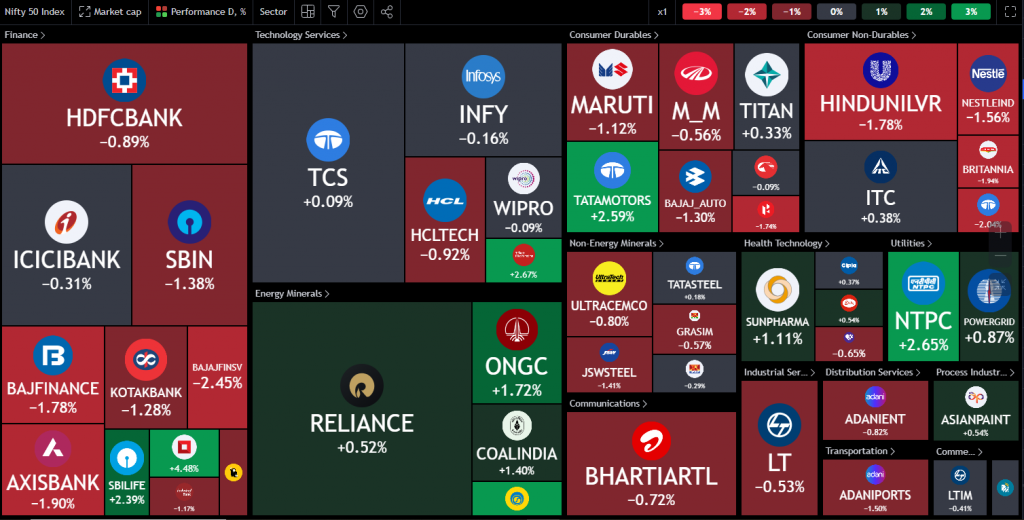

Nifty Heatmap

If the market crosses the limits of a big event day, it can trigger a directional trend.However, banks were the odd one out, being smashed down but showing a good recovery towards the end, closing at -0.89%. My sense is that it won’t go further down and seems to be finding its footing. HDFC Bank was down 1%, and State Bank of India was down 1.38%. Bajaj Finance, Axis Bank, and Bajaj Finsav also gradually receded. This might be due to the sense that too many rate cuts are not coming.

Energy stocks were slightly bubbly, with Coal India and ONGC moving up, while Tata Motors moved up 2.5% and NTPC moved up 2.6%. L&T was down half a percent, and Hindustan Lever dropped 1.7%, with Nestle down 1.5%. In the FMCG space, there was a sell-off, but ITC held on. There was a comment about how tobacco was once seen as addictive, leading to higher taxation, and now, with people addicted to trading and F&O, taxation is increasing on that. There are reports that the government may further increase taxation on F&O or introduce measures to curb speculation.

It seems the government wants to reduce India’s dominance in F&O volumes globally. We might see increased margins or criteria for trading based on net worth. With the next budget less than six months away, things may not be smooth for F&O traders. The government’s intention behind the 60% F&O taxation hike was to discourage speculation, but after yesterday’s reaction, it seems they might find this insufficient.

In the Nifty Next 50 space, there was a significant jump with LIC up 6% and ICICI Prudential up 8.7%. The reduction in TDS on insurance products is benefiting insurance companies. REC was up 1.5%, Varun Beverages and United Spirits were up nearly 4%, and DMart, Zydus Life, IOC, and Zomato increased by 2.5%. There were no major falls except in FMCG. Dabur, Godrej CP, Marico, and Colpal were down.

Overall, there were no major collapses in fertilizer stocks, rail stocks, or public sector enterprise stocks.

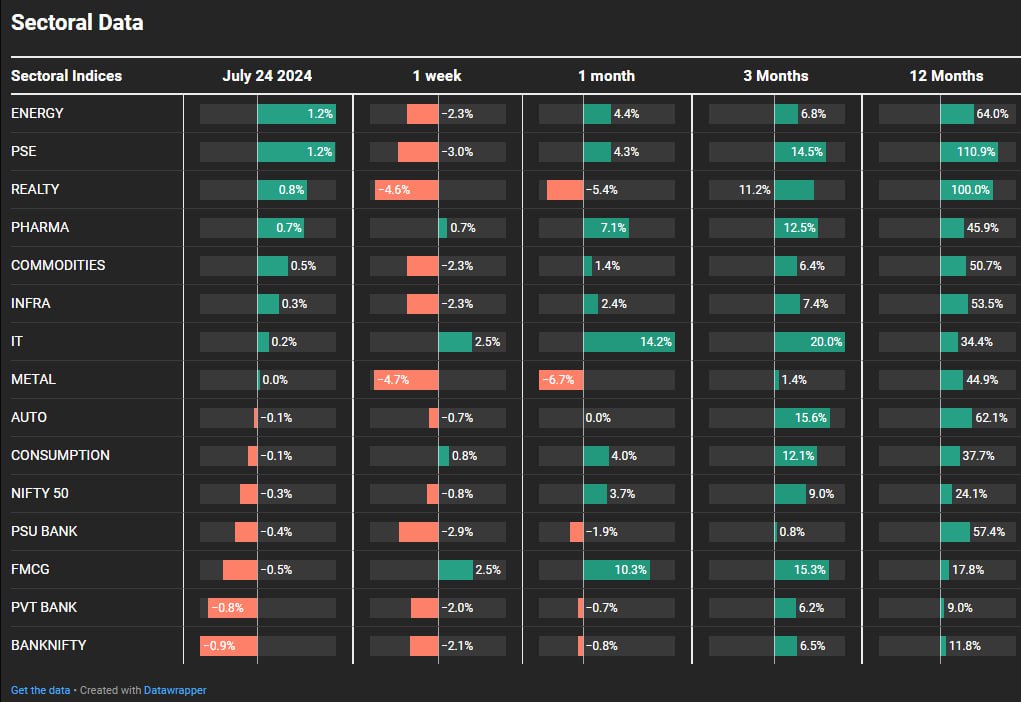

Sectoral Overview

Surprisingly, most sectors stood their ground well post-budget. Energy stocks and public sector enterprise stocks led the way with a +1.2% increase, and real estate came back with a +0.8% increase. This suggests that the view that real estate was adversely affected by the removal of indexation may not be entirely correct. I will cover the real estate aspect of the budget in tomorrow’s daily bite, but today’s focus is on gold.

Pharma stocks were up 0.7%, while private banks, Bank Nifty, PSU banks, and FMCG lost about half a percent.

Sectors of the Day

Nifty Oil and Gas Index

Oil and gas stocks recovered well, almost reaching the top of yesterday’s highs with a +1.69% increase.

Stocks of the Day

MMTC

MMTC saw an incredible 20% rise, a remarkable turnaround for a company that was recently considered for shutdown.

MMTC’s performance is notable, going from ₹20 to ₹100 in just a year. The stock has demonstrated a strong inverse head and shoulders pattern after a 99% drawdown. This pattern suggests a potential target of around ₹150. This is something sharp traders should keep an eye on.

Story of the Day

Now, let’s discuss the feeling of being cheated among gold bond holders. Sovereign gold bonds, issued by the RBI since 2015-16, have an eight-year maturity and will continue to be redeemed until 2032. The last tranche was earlier this year, and the government has not issued a new tranche, possibly realizing that it is not beneficial for them due to the gold returns and 2.5% interest they need to pay. India’s current account situation has improved, and gold import duty has been reduced from 15% to 6%. This message suggests buying physical gold is now more favorable.

However, those holding gold bonds feel cheated. Over the past eight years, a large amount of gold bonds was sold without backing gold reserves specifically for these bonds. Gold prices have nearly tripled since 2015. The redemption formula involves taking the five-day average of gold prices, which is transparent. However, the recent reduction in import duty from 15% to 6% has caused gold prices in India to drop by 9%. This abrupt change negatively impacts those who bought gold bonds at higher import duty rates.

In 2012, the import duty was 2%, which increased over the years, reaching 15%. Under Modi’s tenure, it fluctuated between 10% and 15%, eventually hitting 15%. With the recent reduction to 6%, those who bought bonds during higher duty periods have lost value. The discrepancy between the duty at the time of bond purchase and the current rate results in unfair losses for investors.

The issue lies in the fact that the sovereign gold bond terms promised gold returns based on the import duty in place at the time of purchase. The government’s control over gold prices and import duties is seen as unfair, as it affects the value of bonds issued previously. If there’s enough public outcry, perhaps SEBI and RBI will address this issue to protect small investors.