The markets did the impossible gap down and then closed in the green. In fact, the market made a move today, which gives me a lot of confidence for the path going forward and I’ll tell you why.

The major story of the day is this front running scare in the markets. Should you be worried what is front running? We’ll talk all about this in detail towards the second half of this video.

Market Overview

Nifty, as you can see, gapped down and took a very nice support at this previous high, which is a very, you know, technically, absolutely great point to revert from. The market opened gap down and it closed 0.16% up. It didn’t go up much, but what you can see is that over the last nine sessions, sort of a limiting market in the sense that it opened and it just didn’t go anywhere or it usually came down as you had eight out of nine candles being red.

And just the one green candle also is like a doji.

Today is that first full body green candle where the bulls have asserted themselves. They have taken the advantage of a lower gap open and the bears had to retract once again. So this, today’s, today’s move is very, very good and today’s low will now be important going forward.

Nifty Next 50 ‘

In the short term technical basis, Nifty next 50 also went below this support but emerged higher, in fact, at 0.75% higher. So again, we are quite blessed with a good strong Nifty chart right now.

Nifty Mid and Small Cap

Mid caps had no change at all ~0.24% up and still in this zone for the last six days. So nothing damaged here.

In terms of small caps, again, similar to mid caps, just in this very small hundred point zone. Exactly closing at where the previous close was.

Nifty Bank Overview

Nifty bank index also taking the same support. Can you see the consistency in all these charts where the market has taken the same support from the previous high and validating that high as being a support point and for the near future now, this important support going forward,

FIIS and DIIS

Although on net basis bank Nifty was flat FII’s and DIIs, FIIs had a sell position yesterday at 1790 crores.

Previous to that also it was a flat day for fiscal. DII’s have been buying at 1200 crores yesterday and

previous to that it was a small sell position. So no continuous buying from fiscal year. It is extremely choppy in this one month itself. You can see buying, selling, buying, selling, buying, selling, a few days of buying and then few days of selling. So there is no coherent trend on the FII front.

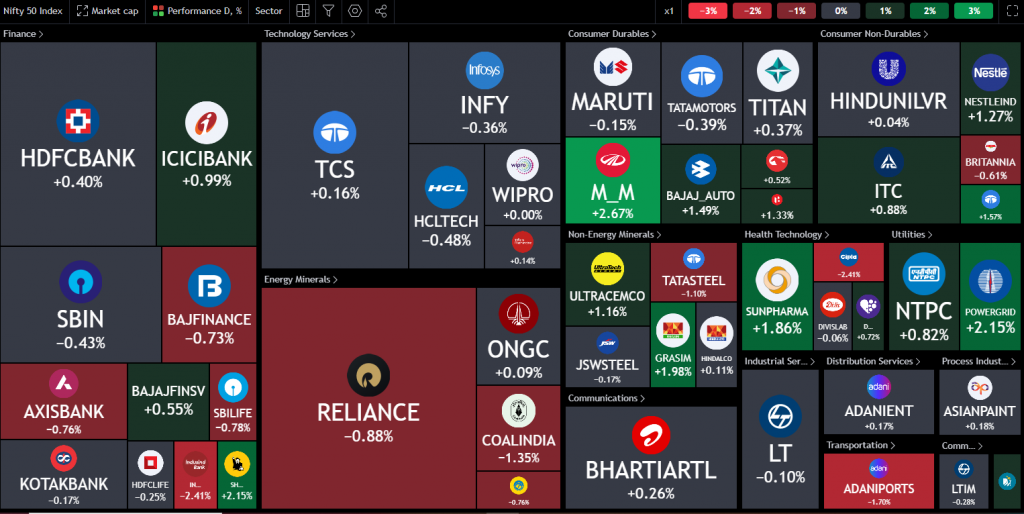

Nifty Heatmap

At least today’s heat map you can see mostly it is either grey or red. You had reliance, which was down almost a percent. Banks were kind of flat – Axis Bank, Kotak bank both flat. And you had HDFC bank go up 0.4%. ICCA bank was up 1%. Mahindra and Mahindra doing very well at 2.6%. Grasim Sun Pharma Power grid, Tata Consumers, these were some of the stocks that did well. You had Coal India, Adani port, Cipla, Tata Steel lost some ground.

In the Nifty next Nifty domain, you can see a lot more green. So it tells you that beyond Nifty the market was in fact greener. Adani Green was up 2%. Hal be all the public sector enterprise stocks, Rec, PfC all in the, all in the green.

Trent Zomato Nokri Siemens these. Some of these stocks have been running now for the last many sessions, Chola Finance, Siemens and Zomato and have been building on their ground. Jio finance, DLF also down a bit. Lic down a bit. Vedanta, Jindal Steel, pity light also losing ground. Overall, a reasonably good Nifty next 50 situation right there.

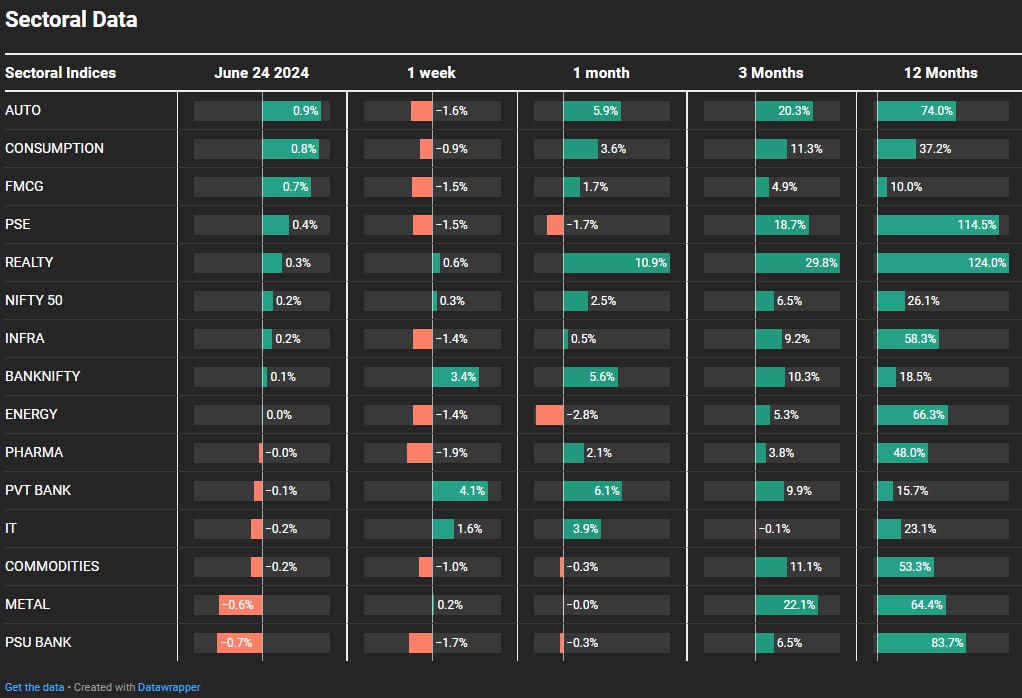

Sectoral Overview

The recent market trends indicate a mixed performance across various sectors. Consumer stocks also showed an uptick of 0.8%, driven by speculation about potential budgetary relaxations for salaried individuals in the up to 15 lakh income category, which could spur consumption. On the downside, metals and public sector undertaking (PSU) banks experienced declines of 0.6% and 0.7%, respectively. Beyond these movements, no other sector showed significant performance. This underlines the mixed nature of the market trends, with some sectors performing well while others remain soft.

Sectors of the Day

Nifty FMCG Index

Fast-moving consumer goods (FMCG) stocks increased by 0.7%, although they are now consolidating near the 56,000 mark after a recent peak attempt.

Nifty Auto Index

Autos gained 0.9%, largely buoyed by Mahindra and Mahindra’s positive movement after four days of decline.

Stocks of the Day

Bombay Burmah

In stock-specific news, Bombay Burmah Trading Corporation (BBTC) surged 19% after a prolonged period of consolidation. This rise is part of a broader trend where lower-volume, small-cap stocks are showing significant upward movement. BBTC is currently at a six-year range top, suggesting potential for further gains post-consolidation. The market has seen a large number of stocks in the small-cap or nano-cap category hitting the 20% circuit, indicating rapid movements in lower-volume stocks.

Gold Chart

Gold is flat, absolutely flat. There is no movement on gold. It had moved up to 73,000, but then it was pushed back again to 71,000. So we are still waiting for more cues on this.

Story of the Day

Front running is the news of the day, particularly noted in the morning due to a gap down in the market. This gap was driven by fears of significant selling from a particular asset management company (AMC) following a SEBI raid on suspicion of front running. Interestingly, the SEBI action was not based on a complaint but was discovered through SEBI’s regular monitoring and inspection processes. This suggests some credibility to the allegations, although the full story will only unfold over time. Media reports specifically point to SEBI suspecting front running in Quant Mutual Fund, a fund that has seen explosive growth from 100 crores in 2019 to 90,000 crores recently, making it the third-largest small-cap fund with over 21,000 crores in assets.

Front running, a persistent market issue both in India and globally, involves insiders or related parties taking positions ahead of large fund transactions to make unlawful gains. For instance, if a mutual fund plans to buy ten lakh shares of a company, insiders might buy shares beforehand and then profit when the fund’s bulk purchase drives up the price. This practice is unethical as it not only exploits privileged information but also potentially cheats unitholders out of better pricing.

There have been several high-profile cases of front running over the years. The Reliance Petroleum case in 2007-2008 saw Reliance Industries using twelve entities to sell shares before their own planned sale. In 2014, SEBI fined India Infoline for placing orders ahead of client orders in the derivatives market. A Pune broker was banned in 2019 for using knowledge of large client orders for personal gain. The 2020 HDFC Mutual Fund case involved an AMC employee barred for trading stocks for personal gain using impending large orders. The Axis Mutual Fund case in 2022 saw fund managers using non-public information for personal benefit.

TV anchors have also been implicated in such practices. In 2019, a CNBC anchor was fined for using privileged information about stock recommendations, and in 2020, a Z Business anchor attempted to profit from anticipated market moves before airing stock tips. Globally, the Raj Rajaratnam case, where the hedge fund manager was sentenced to eleven years in prison, highlights the severe penalties for such misconduct abroad. Despite these examples, India has yet to impose significant penalties or criminal prosecutions for front running, although such actions could serve as strong deterrents.

The current Quant Mutual Fund case involves a substantial fund managed by a large team, suggesting that a few individuals’ actions do not necessarily implicate the entire organization. Despite the allegations, the fund has delivered impressive returns to its investors, contributing to its rapid growth. While this situation may impact the fund’s reputation and investor confidence, it can be rebuilt over time with appropriate measures. Investors need not panic and rush to cash in their portfolios. Some selling may occur in the short term, but it should stabilize soon. The AMC must conduct thorough due diligence to prevent future incidents and restore trust.