Gold prices in India have seen a significant rise from around ₹60,000 in February to approximately ₹74,000 by the first week of April. After a brief retracement to about ₹70,000 at the end of April, prices surged again to nearly ₹74,500 before pulling back to the 40-day moving average. This pullback to the moving average often signals a good entry point for investors who believe in the long-term uptrend of gold prices. For those looking to buy, this level, or even the 50-day moving average, can serve as a strategic support point for entering the market, despite the difficulty of picking the exact bottom.

Market Outlook

Turning to the equity market, yesterday was a celebration as Nifty soared over 350 points. Each hour saw an upward trend, but today experienced a slight hangover from the festivities, with the first hour down, followed by three hours up, and then a sharp dip, resulting in no significant gain. This is expected as markets often consolidate after a big move. The breakout at 22,800 may be retested next week, which is a healthy sign for the market. With FIIs unwinding their short positions and long positions showing profits, the market is in a strong position, as trapped shorts provide support during dips.

Nifty Heatmap

The Nifty heat map was not very green today. HDFC Bank was a notable gainer, which is unusual, while sectors like IT, FMCG, pharma, and energy saw losses or remained flat. It was a day of profit-taking and consolidation.

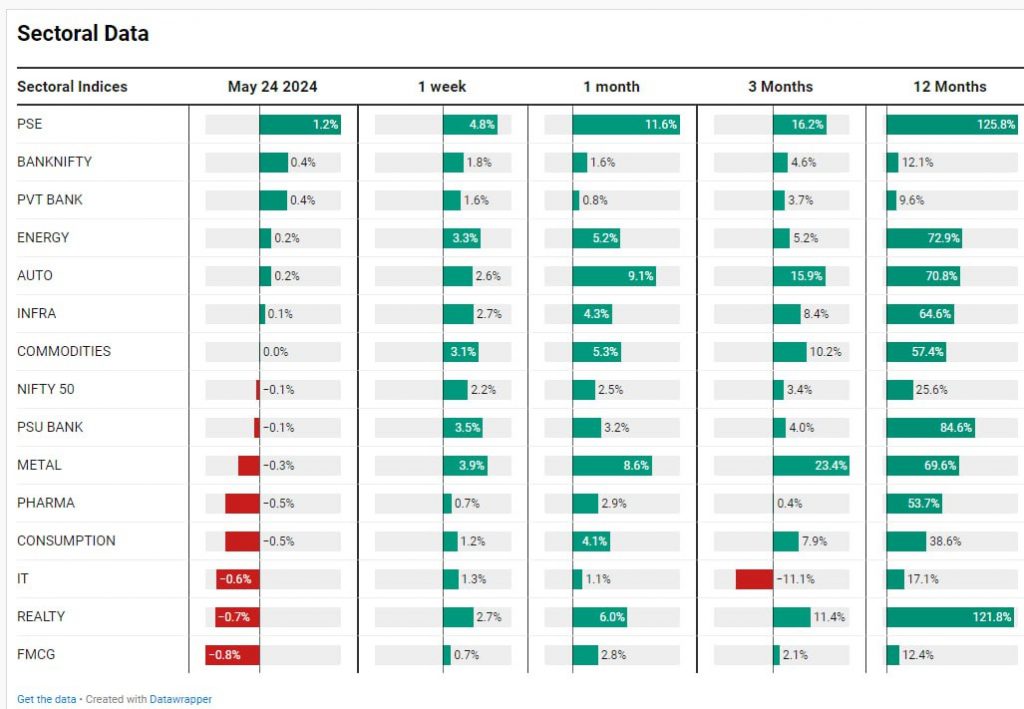

However, the Nifty Next 50 heat map showed more green, with strong performances from stocks like HAL, REC, PFC, TVS Motors, Motherson, Havells, and some Adani stocks. Public Sector Enterprises (PSE) stood out, gaining 11% for the month and leading the performance charts over the last twelve months with a 125% increase, followed by real estate stocks at 121%.

Sectoral Overview

For the day, FMCG was down 0.8%, real estate down 0.7%, and IT stocks down 0.6%, mostly due to profit-taking. Over the past month, all sectors were in the green, but IT lost ground over a three-month period. On a yearly basis, all sectors are positive, though banking and IT have lagged.

Nifty Mid and Small Cap

Mid caps were stable, showing no significant gains or losses, while small caps have not moved much over the past five sessions. A significant move in small caps might be anticipated post-June 4.

Nifty Bank Overview

The Nifty Bank index continued to perform well, edging closer to an all-time high

Nifty Next 50

The Nifty Next 50 showed strength with another gap up and a close above yesterday’s high. The Nifty Next 50 has outperformed the Nifty, with impressive gains over the past year, with some strategies tracking it, like the NNF10, showing over 100% returns.

Nifty Oil & Gas Index

A notable chart to highlight is the Nifty Oil and Gas index, which has been sideways since February. The inverted head and shoulders pattern here, typically a strong reversal pattern, might indicate a continuation pattern in this case. A breakout could suggest a further 10-12% move in oil and gas stocks, potentially led by companies like Reliance. This sector could drive market momentum post-June 4.

Nifty PSE Index

Public sector enterprise stocks have already broken out and are performing strongly, even on a day when the overall market was stagnating.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz