Market Outlook

Nifty opened gap down, aligning with overnight cues, appearing weak initially. The primary cause of this weakness stemmed from RBI action on Kotak Bank, which experienced a significant drop of 10 or 11% in the morning, signaling a potential end to the uptrend of the past four days.

However, within an hour or so, the market reversed its course, posting a substantial intraday gain of over 250, almost 300 points at one juncture. This demonstrated a very strong move for the day, surpassing the barrier set since March. Today’s candle exhibited a bullish, engulfing pattern over the last two days, affirming the continuation of the upward momentum.

Nifty Heatmap

Observing the Nifty heat map, Axis Bank seemed to benefit most from Kotak’s decline, while other banks like State Bank and ICICI Bank witnessed gains as well. Surprisingly, HDFC Bank didn’t capitalize on this opportunity despite Kotak’s setback.

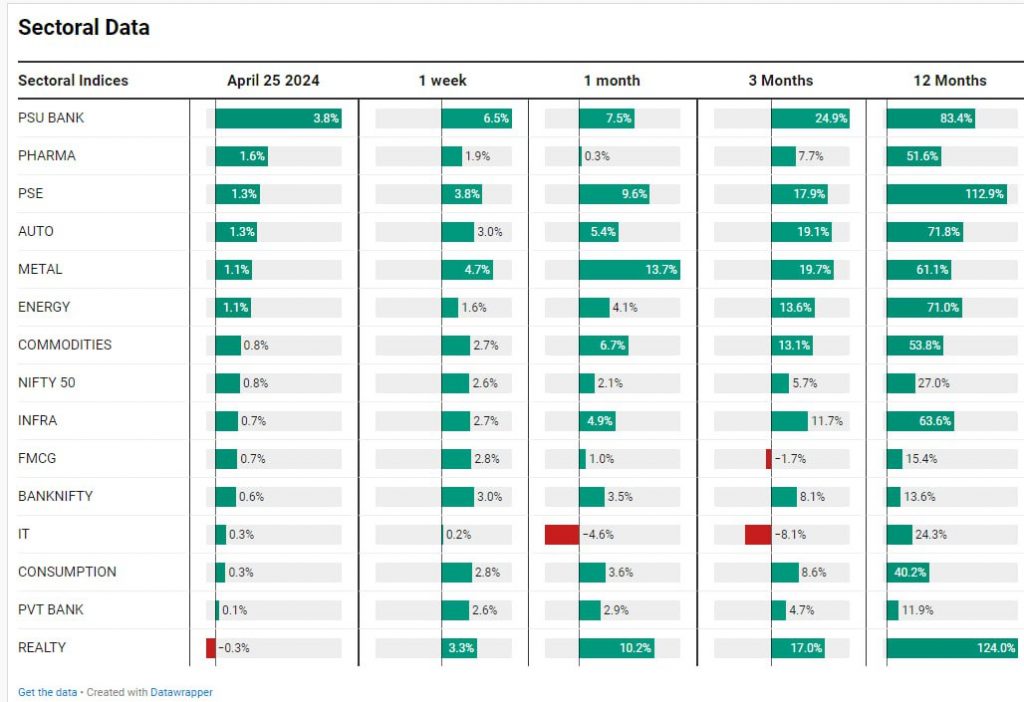

In the Nifty Next 50 heat map, notable gains were seen in various stocks including Canada Bank, Trent, TVS Motors, and others. However, Demart and Sri Cement were among the notable losers. PSU banks experienced a remarkable 3.8% surge in a single day, reflecting significant market dynamics.

Sectoral Overview

Liquidity played a crucial role in today’s market movements, influencing sectors like pharma, which saw a 1.6% increase. Public sector enterprise stocks and other sectors like autos and metals also continued their rally.

These market trends provide valuable insights for investors, emphasizing the importance of analyzing sector and stock strength for potential opportunities. Real estate, though subdued today, remains a strong sector from a midterm perspective.

Look out for opportunities within those sectors. If you are a discretionary investor, then of course you can look for swing trading within these sectors. Always look for sector strength and then come down and look for stock strength. And the setup, how it is going.

Mid & Small Cap Performance

Nifty mid caps close at a new high so all the losses of the previous sessions have been recovered. This is a new high that has been placed here.

Small Cap had another new high, 15,700 plus. As I mentioned a few days back, this looks like a inverted head and shoulders pattern along with a new high signals a very strong move is coming in the Small cap 250 stocks.

Nifty Bank Overview

Nifty bank has touched the previous resistance line and retracted a little bit. But in the last four or five sessions, again, a fantastic move on Nifty Bank.

Nifty Next 50

New highs, nearly 64,000 here, coming very strongly from 60,500. Again, no stopping this particular index. So almost all indices are at or above new all time highs.

Nifty Auto Index

Nifty auto index coming back up very strongly, closing at a new all time high.

Nifty Pharma

Nifty Pharma has made a great move today. It has been consolidating since mid February, and potentially now will move towards new highs.

Nifty PSE Index

Nifty PSE index, public sector enterprise index, also at a new high

Nifty PSU Bank

PSU bank index also at a new high, at 7400 new highs.

Why focus on All the Highs in the market?

I keep emphasizing on new high because any stock, any sector, any index hitting a new high means that there is no overhead resistance left. Now there is nobody stuck at higher levels in that particular instrument. Whether it is nifty, whether it is particular index, whether it is particular stock, and it is like a freebird. There’s an open sky above and you can go as far as the momentum will take you.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz