How are the Markets Looking ?

Despite the market attempting to make a comeback and not accepting the bearish trend, the Nifty index has been indecisive in terms of its movement. While there have been attempts to cross the resistance level near 21,500, the market has been sliding towards the support level around 21,200 before recovering back to 21,350. Currently, the range between 20,900 – 21,500 is considered the support and resistance zone for the market.

If the Nifty index manages to surpass the resistance level of 21,500, it is likely that the bulls will gain the upper hand in the market. On the other hand, the bears may continue their pressure until the index reaches 20,900. However, there are other gaps to consider on the downside as well.

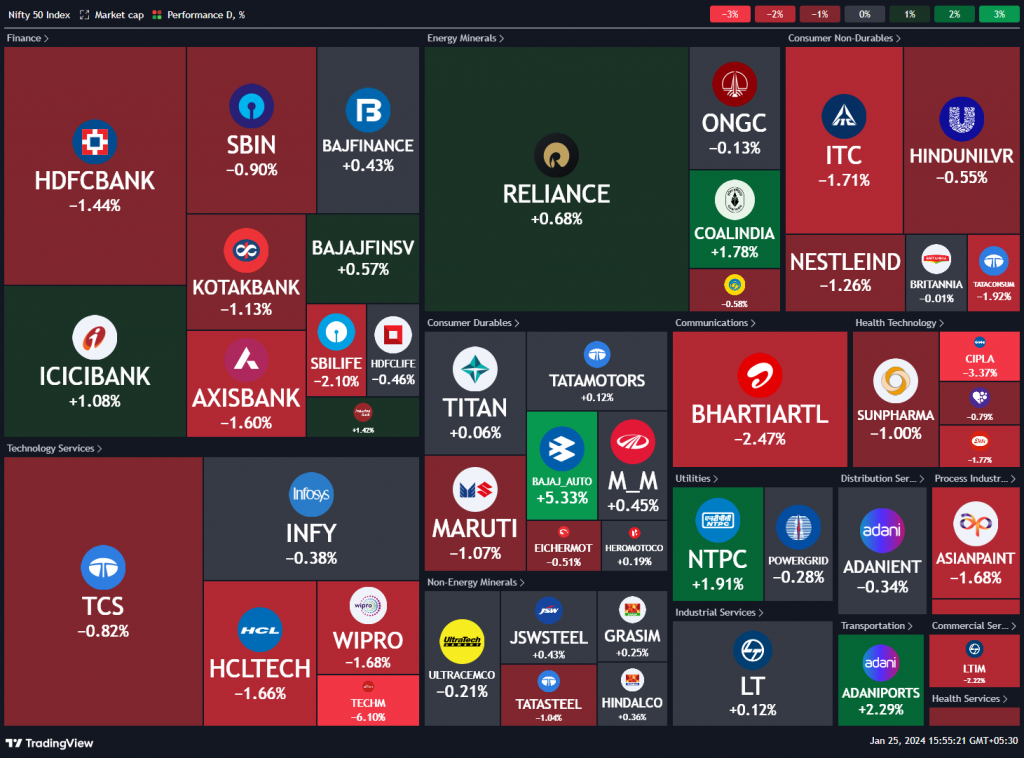

Nifty Heatmap

Taking a closer look at the Nifty heat map, it is evident that the list of losers outweighs the gainers. HDFC Bank, along with other major players like ITC, Bharti Airtel, and State Bank, has witnessed a decline of around one and a half percent. On the other hand, Bajaj Auto has emerged as a notable gainer with a five percent increase. Other gainers include Coal India, NTPC, and Adani Ports.

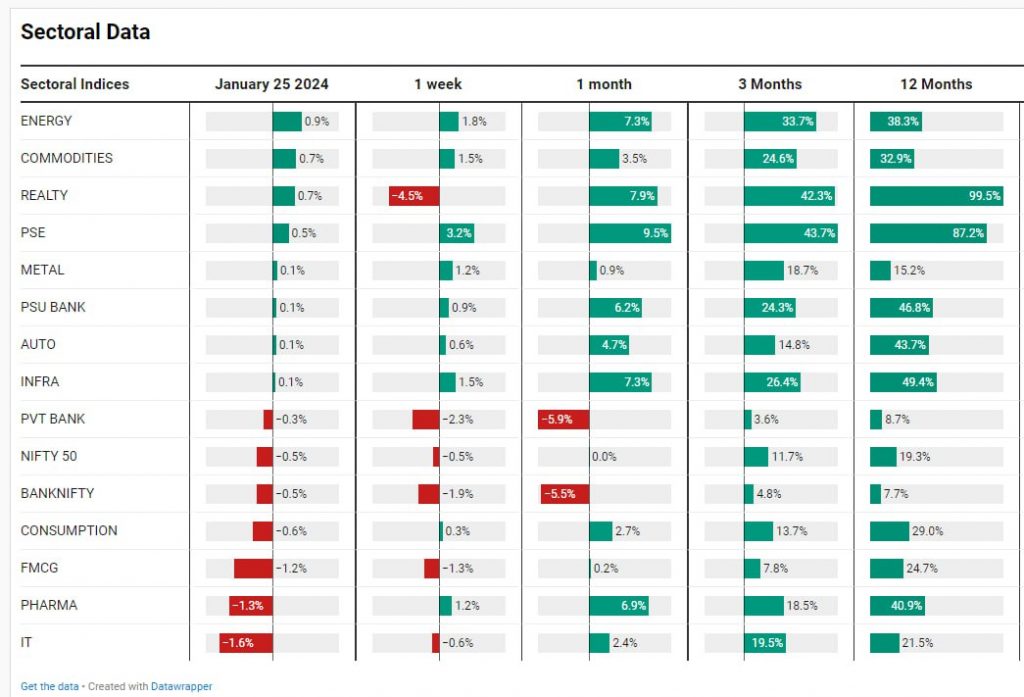

Sectoral Overview

The energy sector has shown a slight upward trend with a 0.9 percent increase, while the IT and pharma sectors have experienced a decline. FMCG stocks have also faced a decline of about 1.2 percent. Overall, the market has witnessed mixed performances among different sectors.

Mid-Small & Small Cap Performance

Amidst the market fluctuations, mid caps started the day in the green but gave up mid way, small caps have managed to make a smart recovery. These companies have successfully recovered almost 75 percent of the recent drop and are approaching their previous highs.

Nifty Bank Overview

While the overall market has faced its share of challenges, the Nifty Bank remains the weakest index of all. It has failed to surpass yesterday’s close and continues to trade below that level. It has dropped significantly from 48,600 to 44,400. The primary driver of this downward move is the fall in HDFC Bank which is now consolidating.

Highlights – Nifty Energy

In contrast to the weak performance of the Nifty Bank, Nifty Energy has been steadily climbing since October. It has managed to consolidate at higher levels, indicating a sustained upward trend in the energy sector.

Highlights – Nifty IT

Nifty IT, on the other hand, has demonstrated some correction in its upward movement.

If you have any questions, please write to support@weekendinvesting.com