Market Overview

Today, we had a rather unique trading day. The Nifty index reached a new all-time high of 23,722, while most of the broader market was either flat or declining.

The Nifty’s performance was noteworthy. After a gap down yesterday, the index moved up strongly throughout the day and continued its upward movement today. It was a minor gap up, but it persisted in its upward trajectory. This upward momentum seems to have caught many index players off guard, particularly those who were selling calls or anticipating a range-bound market. This movement in Nifty is surprising many market participants. Similar to recent sessions following the elections, the market today saw one or two sectors leading by rotation. Today, it was the turn of private banking, which dominated most of the day.

Nifty Next 50

Looking at the Nifty Next 50, it opened with a gap up but closed lower than yesterday’s close, resulting in nearly a half percent loss for Nifty Junior.

Nifty Mid and Small Cap

The mid caps saw a slight gap up, made a small new high, but closed down by a quarter percent. The downside wasn’t significant, but these stocks didn’t participate in the Nifty’s rally. Small caps were flat, reaching a new high during the day but giving back all the gains by the close.

Nifty Bank Overview

The Bank Nifty mirrored Nifty’s performance. It took support at an important level yesterday and closed at a new high of 52,600. This is a substantial rise from 46,000 on election result day, showing that Bank Nifty has caught all the bears unaware. Private banking stocks were a significant driver of this increase.

FIIS and DIIS

Institutional activity has been dull, with foreign institutional investors (FIIs) selling ₹654 crores and domestic institutions selling ₹820 crores yesterday. This indicates no institutional support at this stage.

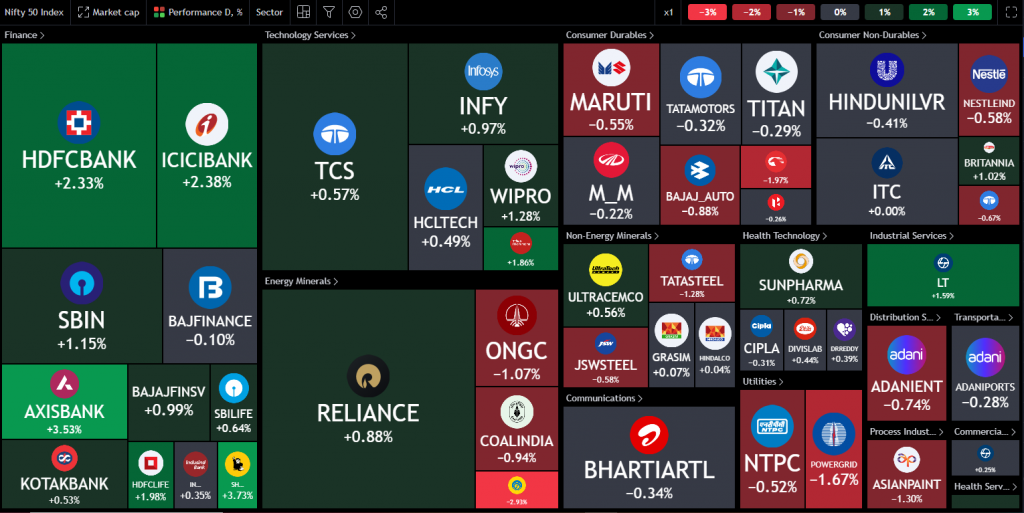

Nifty Heatmap

The Nifty heatmap showed a divided market. The left side was green, with HDFC Bank, ICICI Bank, Axis Bank, private banks, and some PSU banks moving up. Reliance was up by 0.8%, and Infosys and TCS also saw marginal gains. However, sectors like power, autos, FMCG, and steel were down, as were energy stocks. The Nifty Next 50 heatmap was primarily red, with a few capital goods and manufacturing companies doing well. Bosch and Motherson were among the gainers, while Zomato also performed well. On the other hand, LIC, DLF, IRFC, PNB, Bajaj Holding, ABB, Indigo, Dabur, and Adani Power were all down, with many stocks in corrective mode today.

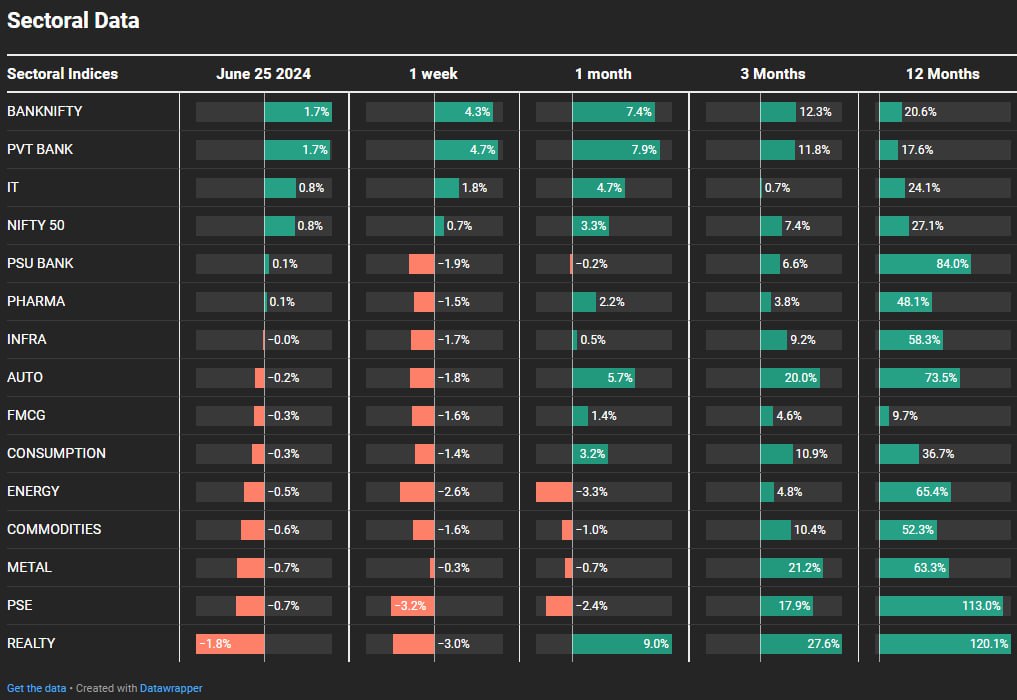

Sectoral Overview

In terms of sectoral trends, there wasn’t much to talk about. Real estate gave up some recent gains, down by 1.8% today and 3% for the week. However, on a monthly basis, real estate remains the top gainer at plus 9%. Other minor losers today included public sector enterprises, metals, commodities, and energy stocks. The main gainer today was private banking, which led to Bank Nifty’s rise. Private banks have recovered 8% in the last month, and their twelve-month performance is now at 17.6%. FMCG is one sector that has not picked up yet, down 0.3% today, and for the year gone by, it is the lowest performer at 9.7%. IT stocks did reasonably well, up 0.8%, aligning with Nifty’s gain, and for the year, IT is up 24%.

The weekly Bank Nifty chart shows that since 2022, it has been taking support at the 40-week moving average, and this time it resulted in another upward swing. The private banking index, which was stuck in a range for the most part of the last seven months, broke out four or five days ago and has moved up strongly since. This breakout was anticipated to either go a long way or crash, and it seems to be moving upward.

Within the private banking space, the last few years have shown relative outperformance among banks. For example, over the last three years, Axis Bank has risen by approximately 88%, ICICI Bank by 120%, while HDFC Bank has only increased by 21%. This highlights the importance of looking for stocks in momentum within the same space and adjusting your portfolio as the strongest leaders change.

Stocks of the Day

Amara Raja Energy

In the stock spotlight today, Amaraja Energy has seen another 20% increase, rising from 700 levels in March to 1600 at the end of June. This remarkable rally is driven by a corporate announcement about a partnership with a Chinese company for lithium-ion technology, which could further boost the stock. This stock was stuck in a range for about eight years, and breaking out of such a long-term range often results in significant upward movements.

Gold Chart

Gold prices have been extremely flat over the last six weeks, staying stable near 72,000, waiting for a trigger to move.

Story of the Day

The main topic of concern today is the dangerous flows into sectoral funds. According to a lead story in the Economic Times, sectoral or thematic funds have accumulated ₹70,000 crores in the last twelve months. In comparison, small cap funds have garnered only ₹40,000 crores, large and mid-cap funds ₹25,000 crores, and Flexi cap funds ₹20,000 crores. ELSS funds have seen only ₹1,000 crores in the last twelve months. This significant allocation to sectoral funds indicates that mutual fund distributors, advisors, and bank relationship managers are pushing these funds to their clients, often using the strong performance of specific sectors over the last twelve to eighteen months to sell them. This strategy suggests that the recent past performance is replicable every eighteen months, which is not true in the market.

Sectoral and thematic funds can be risky if you cannot time your entry and exit well, as sectors and themes will keep changing. For example, those who bought public sector enterprise funds ten years ago probably did not make any money until last year. Similarly, green energy themes that have performed well recently may not continue to do so in the next few years.

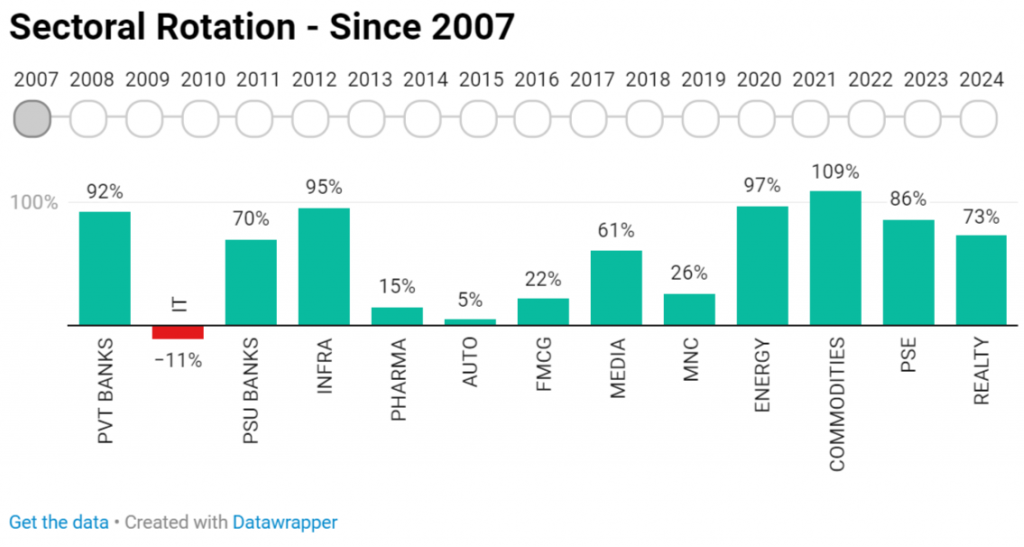

The strategy in the market should ensure you are in the right sectors. Historical sector rotation data shows that different sectors perform each year. For instance, in 2007, private banks, commodities, and infrastructure led the market, while in 2008, all these sectors were down. In 2009, auto and IT were the leading sectors, while in 2010, sectors like pharma, auto, and FMCG performed better. Each year, different sectors take the lead, and several sectors don’t perform for many years. For example, FMCG and pharma did not consistently perform well across many years.

If you get stuck in a sectoral theme that does not perform for several years, you are at a disadvantage. The seller of these funds gets their commission, but you, as an investor, might face significant losses. Passive instruments like index funds, where sectors automatically rotate, or actively managed mutual funds can help mitigate these risks. If you invested in a real estate sectoral theme in 2007, you wouldn’t have had a chance to see significant gains for many years.

The mutual fund industry often focuses on creating and selling products to generate fees, but not all these funds suit many investors. A good advisor should help you move in and out of these sectoral thematic funds. However, if you plan to hold these funds for five years without monitoring, it can be a significant risk. Awareness and caution are crucial for investors to prevent massive losses caused by ill-timed sales in the market.