Market Outlook

Quite an interesting day, where Nifty, despite opening in the green, gave up most of the gains from yesterday, but the broader market didn’t. So the entire pressure of the market was concentrated on large cap names and the mid and small cap index was paired. So this largely happened due to some big caps, some big names.

Nifty Heatmap

So Bajaj Finance, Bajaj Finsurf, Kotak bank, second day running, State bank also gave up 1.4% and you had nestle dropping 3%, Maruti 1.7%, Mahindra 2.5%, Reliance, half a percent pretty much across the board, a lot of red with just small number of green stocks in tech Mahindra, which reported 40% minus fall in profit. So market expectations are running far ahead. So stocks like, for instance, Bajaj Finance reporting 20% profit growth and stock is falling 8%. So essentially there is a gap between what is expected and what is being delivered. Tech Mahindra, on the other hand, is reporting 40% down results, but the stock is up 7%. It was up even 10-11 percent at one point of time. So the market probably was expecting even more worse results. So it is all a game of expectations and what is being delivered versus that expectation, and hence absolute number of profit gain, profit loss or these kind of things really don’t matter in the market. It is all about what has been built in and what is the outcome basis there. So that’s why we say, you know, the price is gone, price is already built in, what is the expectation, and no amount of numbers can really, you know, beat that if the expectation is not getting met

The second half of the large caps, if I may call it, it was largely green. So very, very stark top 50 versus the next 50. DLF, IRFC, Vedanta, Zomato, Indigo, Pedalite, Motherson, Havels, IRtc, Kolpal, Mariko, all doing quite well. Only Dmart lost some ground today.

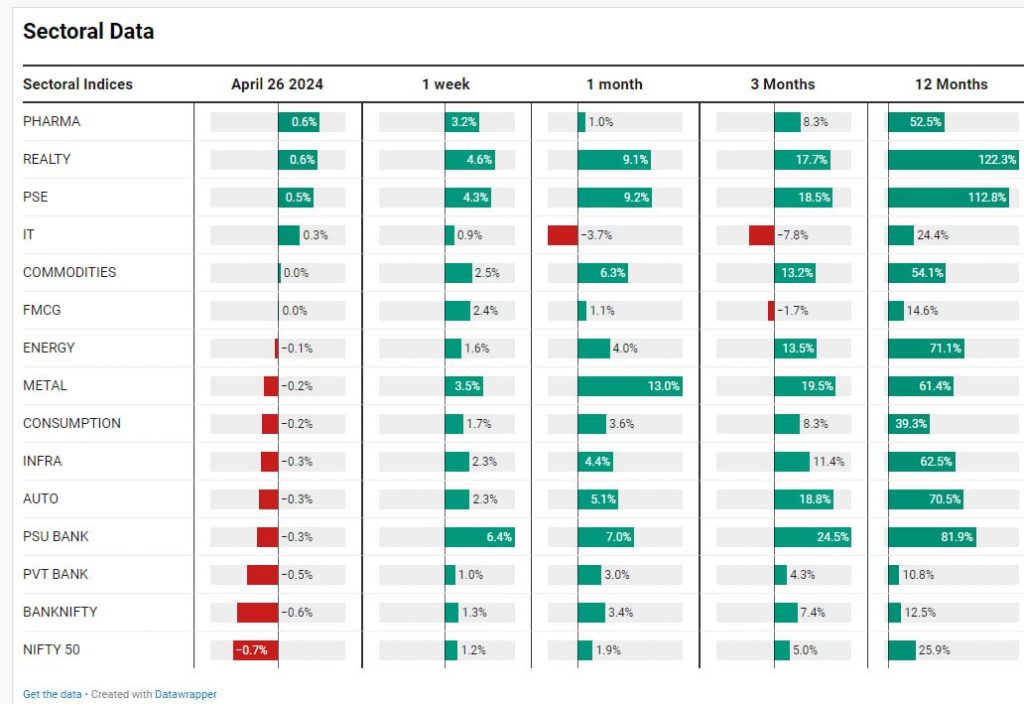

Sectoral Overview

Overall on a sectoral basis, Nifty, down 0.7%. But pharma was up 0.6%. Real estate was up 0.6%. Public sector enterprise stocks up 0.5%. It also up 0.3%. Rest, all sectors lost ground. PSU banks lost mildly. Private banks a bit more at 0.5%. Bank Nifty overall down 0.6%. So banking and finance is what really pulled the market down. And pharma and real estate were the ones which were trying to pull it back up.

Mid & Small Cap Performance

Mid caps, very, very strong new high 18,800 and days of fantastic move no problem here. Small caps also 6th day of fantastic green move no problem here at all. In fact as I was mentioning this inverted head and shoulders pattern is very much in the flow now. A retest of 15,400 probably will be good if it comes. And then of course we have to go for the races after that.

Nifty Bank Overview

Nifty bank took a serious resistance at this resistance line around 48 six point hundred and give gave back some of the gains. But I still think this give back today of Nifty and bank Nifty is not so bad. Some weak hands have been shaken off. Some results have come this way in result season. These kind of seesaws are very very common. It’s also happening in the US market. Google is going up, Microsoft is going up but you know meta is crashing after the results. Tesla is going up. So big wild moves happens in earning season and this is again what is happening.

Nifty Next 50

Nifty next 50 also up nicely giving new highs.

GOLD

Gold is starting to move back up after giving up for three days. So just see after this immense rally from 6100 to 7500. Only three consecutive down days and already we are in the second update. There is not much of give back that is happening on gold. Something is happening in gold. There were reports that China in March has imported 40% more gold than February. Something is definitely happening. We don’t know what it is.

Motilal Oswal

Motilal Oswal was the star of the day. You can see the fantastic results this company has delivered. And this is a weekly chart. So what I wanted to show here was that it was already running for the last six weeks in a very big way. From 1400 almost up to 2600. So again Bhav Bhagwan check price has already incorporated most of these gains that got declared today. Results are always late in terms of pricing and results are a rear view mirror of the past. So market already knows about it in most of the cases.

Bajaj Finance

Bajaj finance was a surprise for the market. Market was expecting better results, even better than 20% growth which is crazy for this kind of a base. But very disappointed the market was with this result and it was slammed down in a big way.

Tech Mahindra

Tech Mahindra on the other hand had a disappointing results as I mentioned before. But it was a huge up candle for tech Mahindra. Sort of a relief rally on this. So market will do everything that you don’t expect. So all this game of prediction and forecasting most of the time goes wrong. There’s no point of doing it, in my view, and hence, following the price gives you the best and most peaceful way of investing. Do follow momentum investing, do learn about it, do practice it, and you will never look back at any other kind of investing

Disclaimers and disclosures : https://tinyurl.com/2763eyaz