Another day of markets making a new high. You know, you get bored of seeing new highs every day. That is the problem of bull markets, and you know, it’s a good problem to have—no worries on that. There is a divergence in the market now. Large caps are moving up, while small caps and mid-caps are not. We’ll talk about that, and also about how the Indian markets’ boom can last for a long time, given the macros that we have here.

Market Overview

In terms of the markets today, you can see that Nifty has risen again, today up by 0.81%. We have now crossed 26,200. Just a few weeks ago, 25,000 seemed to be a Herculean task, but now we are engaging at 26,200.

Nifty Next 50

Nifty Next 50 also closed at a new high, up 0.7%, at 77,000, rising almost three-quarters of a percent. This too is looking good.

Nifty Mid and Small Cap

Mid-caps showed some sluggishness yesterday, and the same continued today as well, but not much damage was done. By the end of the day, mid-caps had recovered all the lost ground. Small caps, however, were down by 0.45%. It’s not too much, but yes, small caps haven’t moved since the beginning of the first week of September.

Nifty Bank Overview

In terms of Bank Nifty, this is where the major action has been since the Fed rate cut, adding another half a percent to Bank Nifty, now at 54,300. Bank Nifty is now leading the rally, and there is a sector rotation happening, I would say, every week, if not every other day.

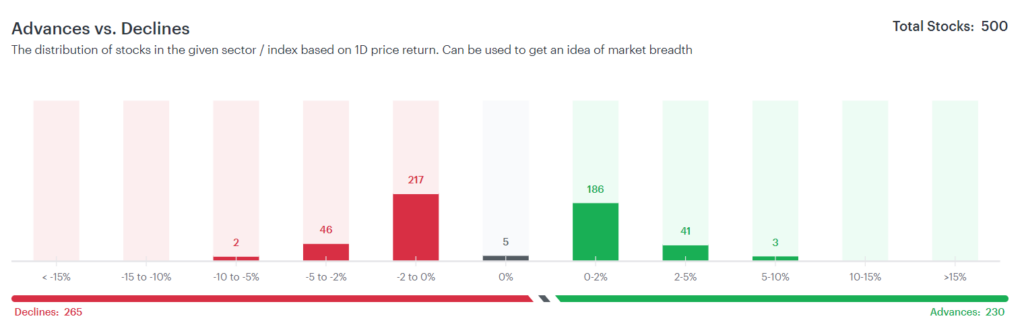

Advanced Declined Ratio Trends

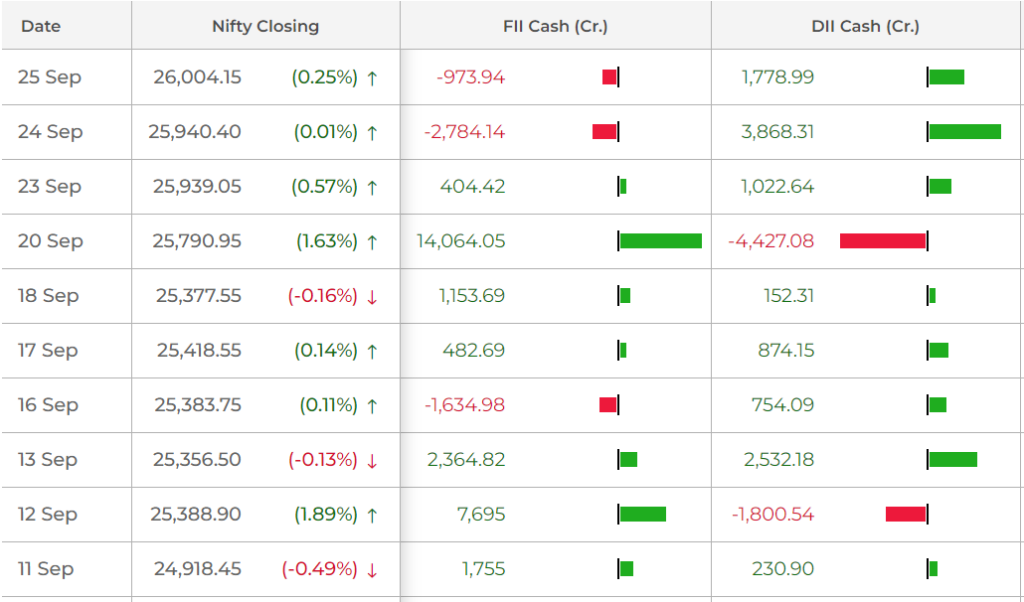

The advance-decline ratio was quite even at 265 advances to 230 declines in the top 500 stocks. FIIs have resumed selling in the last two sessions, while DIIs have increased their buying during the same period. So, net-net, institutional buying remains positive.

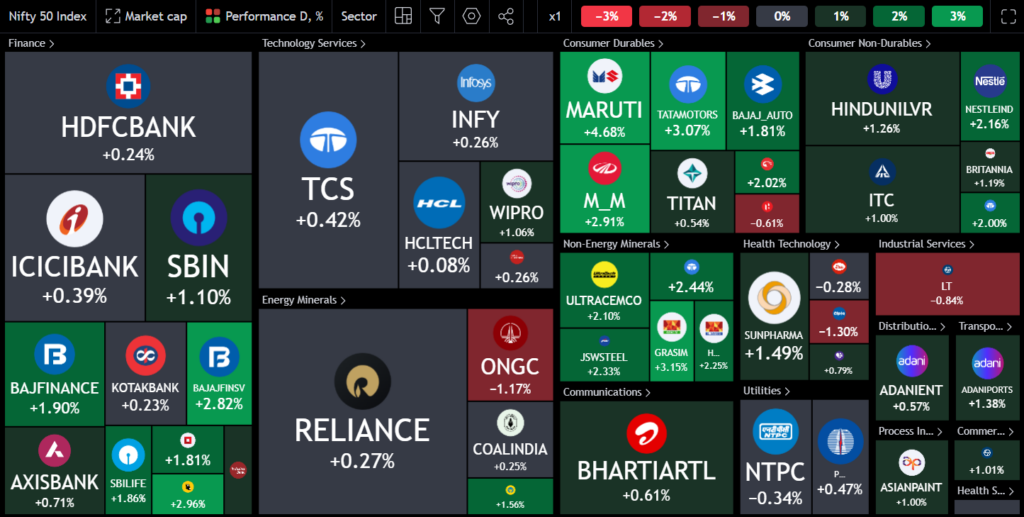

Nifty Heatmap

In terms of heat maps, the major focus today was on autos, with Maruti, Tata Motors, Bajaj Auto, and Mahindra all doing well. FMCG, cement, and steel sectors also performed well, so some of these sectors have really picked up after a sluggish start. For Nifty Next 50, you can see stocks like Motherson, Trent, Vedanta, Indigo, PNB, and Canara Bank doing well. On the flip side, there were some losses in Havells, D-Mart, VBL, Siemens, and Jio Finance.

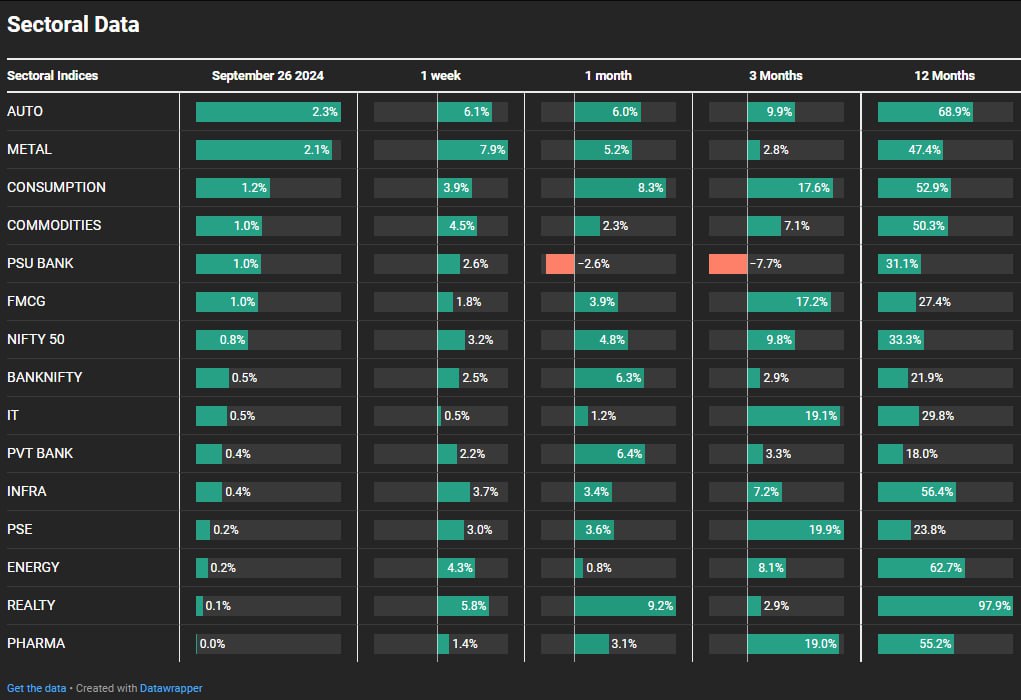

Sectoral Overview

In the sectoral trends, autos and metals have turned around this week. Autos were up by 2.3%, and metals by 2.1%, after being sluggish over the last three months, but now they are catching on. Consumption stocks also rose by 1.2%, commodities by 1%, PSU banks rallied by 1%, and FMCG gained 1%. It was a unique session where both defensive and risk-on trades rallied. Only yesterday, real estate had jumped up significantly but was flat today, and energy was also flattish at 0.2%. Public sector enterprises, however, have lost some steam, up just 3.6% over the past month. Energy has also slowed, as have PSU banks, which are leading the downward move compared to the rest of the pack.

Sectors of the Day

Nifty Auto Index

In the auto sector, you can see Maruti, Motherson, Apollo, and Tata Motors performing well. The auto index itself made a fantastic new high, with a breakout move today. In the stock spotlight, Easy Trip Planners gained 7%, trying to recover after a huge cut yesterday due to significant promoter selling. However, that selling did not happen near the stock’s highs, which doesn’t inspire much confidence going forward. But if you observe, there was a breakdown on this move, and now at the breakdown point, it could provide a good support level. Additionally, a big chunk of promoter equity is now in the market.

Stock of the Day

AstraZeneca Pharma

Story of the Day : Will India’s market boom last?

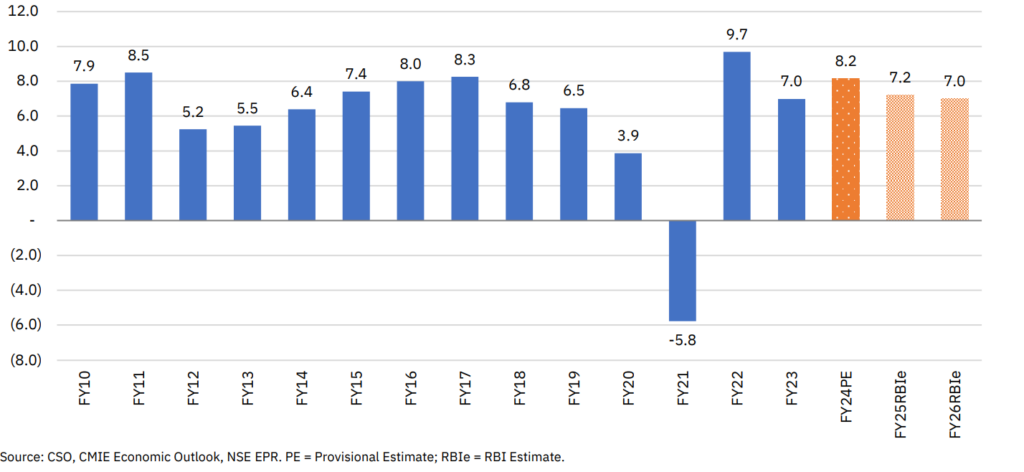

If we look at the quarterly GDP growth trend over the last seven to eight years, the slowdown that we were seeing in 2018-19, leading up to COVID, if you exclude that part, shows we’ve been reasonably stable at around 7-7.5%, or you could even say 7.8%. The four-quarter moving average of GDP reflects this stability. This is unlike the situation from 2017 to 2020, where there was a downward decline, followed by the crash. Now, the trend is very flat and chugging along well, indicating not too many headwinds ahead.

In terms of future projections, the next four quarters also look good. In fact, for FY 26, the RBI GDP projection is above 7%. If we are able to maintain growth above 7%, we will be outpacing much of the world, which will help continue the flow of liquidity towards our markets. If you look at the last 40-50 years, from 1980 to 2000, the US markets dominated over the Indian markets, even though India had its Harshad Mehta phase during that period. US markets grew by 1,400%, while Indian markets managed only 500%. But in the last two decades, the Indian market has outperformed, and this is in dollar terms. I’m comparing the Sensex in dollar terms with the US markets.

So, if you think that US markets always outperform Indian markets, please check these statistics. They will show that India is a great place to invest right now. Of course, things can change over time. But if we sustain this trajectory that we’ve been on for the last 20-25 years, I see no reason why Indian market investing will falter going forward. That said, the path to stronger and longer trajectories is always fraught with pitfalls, and that’s true for any market.

In the last year alone, we’ve seen the market come close to the 200-day moving average (DMA) twice, and each time it acted as a strong support. So, if the market dips near the 200 DMA, I believe that will be a very high-confidence, high-probability point to add more investments. Of course, it could always break down from the 200 DMA and take its own time to recover, but from a probability perspective, it’s a great place to buy.

Yes, the markets are somewhat overbought and stretched. But as they say, markets can remain irrational for a very long time. You might have noticed in the last month that many top analysts and market gurus who were holding cash or advising a move to cash are now in a fix, as their portfolios are underperforming while the markets keep rising. So, never try to second-guess the market unless you’re truly skilled at it—and 99.9% of people are not. This is why most portfolios will lag behind: investors let their personal psychology interfere with decision-making. Just because you’re feeling scared doesn’t mean the market will crash tomorrow. That correlation is unreliable.

The next ten years are likely to be golden for the Indian market, barring any major political upheavals. We are witnessing fantastic demographic changes, with a lot of young people entering the workforce. You can see the number of new Demat accounts rising, the consumption around us—it’s just incredible how the India story is playing out. But always maintain an asset-allocated approach to the market. Nothing is guaranteed, and all these projections of 15% CAGR for the next 30 years could go out the window if a black swan event occurs. So, take calculated risks, have a plan B, and diversify your investments. I’m sure, in the end, you’ll make some decent returns.