Something very remarkable is happening in the markets. The Nifty continues to move on and has climbed Mount 24,000 today. However, the rest of the market is very sluggish. This hasn’t happened in a long time: the Nifty continues to move on while the rest of the market remains stagnant. This may be a sort of last hurrah for this season, with Nifty being propelled by stocks that have not done well so far, while the rest of the stocks that have done well so far are struggling to find a reason to go up higher. The flows are also not helping, but nevertheless, the market is making new highs, and we should be happy about that.

Let’s dive into the main thesis of today: misleading forecasts and how they create narratives in the market that cause people to take actions that harm their portfolios. We’ll discuss this in the second half of the blog.

Market Overview

The markets are headed strongly upwards. Nifty is up 0.74%. It opened soft, but through the day it kept going on, maybe due to the expiry impact. Four strong upward candles after a plethora of sluggish ones mean that buying is back. FIIs, who were strongly short, are now strongly long in terms of their open interest, moving completely from one end of the spectrum to the other. Having them short in the market was a cushion, but having them on the extreme long side is somewhat of a risk for the Nifty, but so far so good. At an all-time high, we really can’t complain.

Nifty Next 50

Nifty Junior is flat, recovering to close at 0.15% after being down during the day. It’s consolidating here, which is fine.

Nifty Mid and Small Cap

Mid caps had a doji day, where the open and close are at the same level, indicating a confused, indecisive market. This also suggests a higher probability that the market will change direction. Nifty small caps are slightly weaker than mid caps and other indices, down 0.5%, but still within the established range. Small caps have traveled the most since the election.

Nifty Bank Overview

Bank Nifty is slightly in the red at -0.11%, neither going up nor down, possibly due to profit-taking or consolidation after three days of gains. l.

FIIS and DIIS

Yesterday, DIIs bought significantly at 5000 crores, while FIIs sold 3500 crores. FIIs have been on a long selling spree, with only one day of good buying recently. DIIs are putting in significant amounts of money.

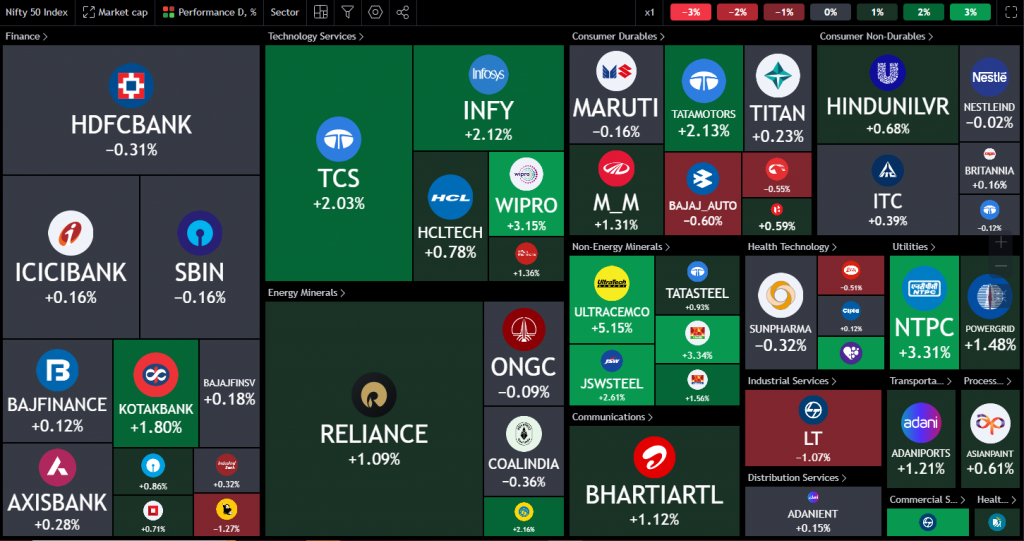

Nifty Heatmap

The market seems overstretched and in need of a significant rest. Sectors are rotating: today, IT and cement sectors were in play, along with steel. IT stocks like Infosys, TCS, and Wipro are doing well. Ultra Semco, JSW Steel, Tata Steel, NTPC, Tata Motors, Reliance, and Bharti also performed well

The Nifty Next 50 heat map shows regular gainers like Siemens, ABB, Motherson, and Bosch. Adani Green, Gas Authority, Tata Power, REC, SRF, and Havells performed well, while Godrej CP, LIC, GIO Finance, and PNB lost ground. It was a mixed but evenly poised bag.

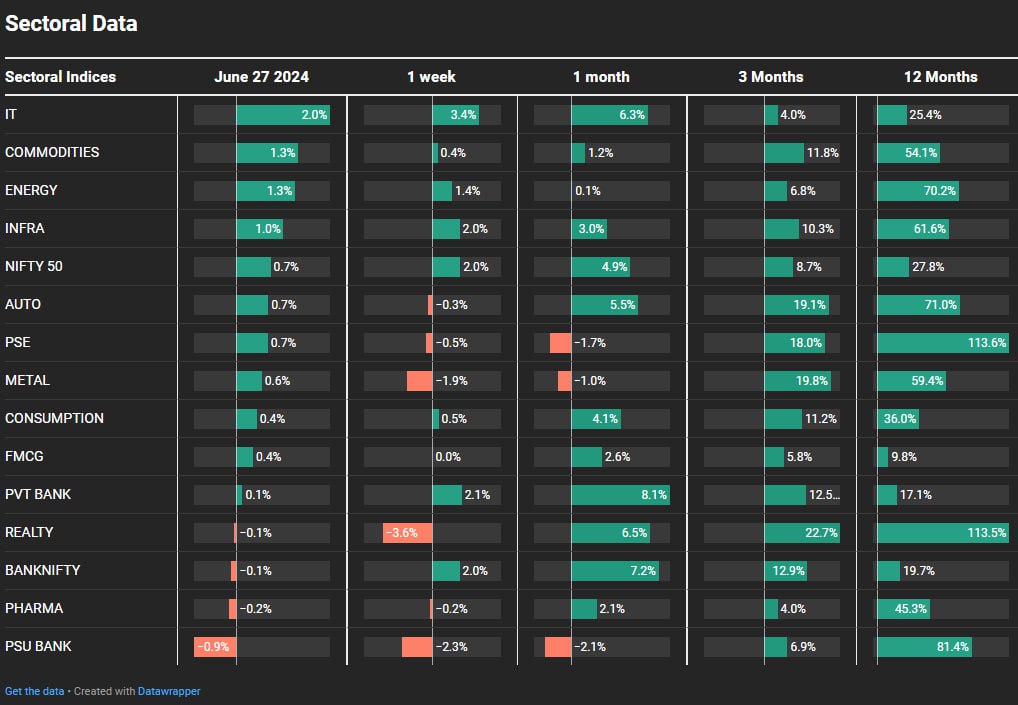

Sectoral Overview

Sectoral trends show IT leading the pack at 2% for the day, with a 6% gain for the month. Commodities, energy, infrastructure, autos, and public sector enterprises also gained. Real estate, pharma, and PSU banks were down, with PSU banks losing the most at 0.9%.

For the month, private banks have performed the best at 8.1%, followed by IT, real estate, and Bank Nifty. Public sector enterprises, PSU banks, and metals have trailed.

Sectors of the Day

Nifty Commodities Index

Nifty IT Index

The Nifty IT index has broken out and looks good for a continuation of the strong move. The commodity index is also coming back to the election day high, lagging the rest of the market but doing alright at +1.34%.

Stocks of the Day

India Cements

India Cements gained 11% on Ultra Tech’s acquisition news. However, there were market games at play, with India Cements showing unusual activity the day before the announcement, indicating front running.

But I want to point out some market games that have been going on here. Today, the UltraTech board meeting was held at 08:30 a.m. on 27 June, where it was decided to acquire 23% in India Cements. The stock jumped up on this news. However, if we look at the chart from 26 June, something interesting emerges. Ideally, nobody should have known about this transaction yesterday, but India Cements, right from the very start on the 26th, was jumping with great volume. Just look at the previous day’s volumes and then the volumes on the 26th.

It’s clear that interested parties knew a deal was happening at around Rs 260-270, as the stock was already primed up to those levels. Once the confirmation came, there was another jump. This is something you can’t hide if you’re doing something wrong in the market. Price action is transparent and can’t be hidden under any mattress. It is abundantly clear that frontrunners did their tasks yesterday. Who benefited? I don’t know, but this is something that should be looked into.

This highlights the reality of the markets. The front-running concept I talked about a couple of days back is a real problem. When genuine transactions are happening, there is a lot of front-running ahead of the transaction, and the due benefit to the right folks does not accrue because of this activity.

Gold Chart

Gold is moving up slightly at 0.5%, consolidating at 71,380. The US dollar gold chart shows a potential head and shoulders pattern that could go towards 2150 if 2300 is broken decisively.

Story of the Day

Now, let’s discuss misleading forecasts. I’m not trying to be negative about anyone making forecasts, but 99% of people in the market want to forecast, often leading to harmful actions in their portfolios. Many forecasts are driven by recency bias, with targets moving up or down with prices. In our case, we follow the market and consider the “BBC principle” (Bhav Bhagavanche) as our leading indicator. The market is supreme and discounts everything about a stock, sector, or the market itself. We can make significant returns by following trends without making forecasts.

For example, in September 2023, a research house stopped recommendations on mid and small cap stocks, citing exuberance. However, they didn’t liquidate their small cap funds. This gap between speech and action is common. Many experts advised avoiding the small cap segment in March 2024, yet small caps have performed well since then.

Forecasting is good if you position yourself accordingly, but harmful if you influence others without proper positioning. Active fund managers often don’t beat benchmarks. Forecasts can’t account for unforeseen events like wars or oil price changes. Therefore, it’s better to follow trends, hedge appropriately, and reduce exposure if feeling anxious.