Market Outlook

Moving to today’s market performance, Nifty presented a mixed yet hopeful picture, slightly pressured around the 22,200 mark but managing to stay afloat thanks to significant contributions from heavyweights like Reliance and HDFC Bank. Despite a broader downtrend in the Nifty 50 universe, the performances of these giants reflected positively on the index. It’s critical to note the ongoing resistance around 22,200, a level we’ve discussed in previous sessions. With Nifty taking multiple supports around 21,900, today’s slight selling pressure below the 22,125 mark signals cautious trading as we approach the financial year’s end. Yet, if heavyweight stocks maintain their strength, we might witness Nifty breaking past this resistance, potentially paving the way towards new highs.

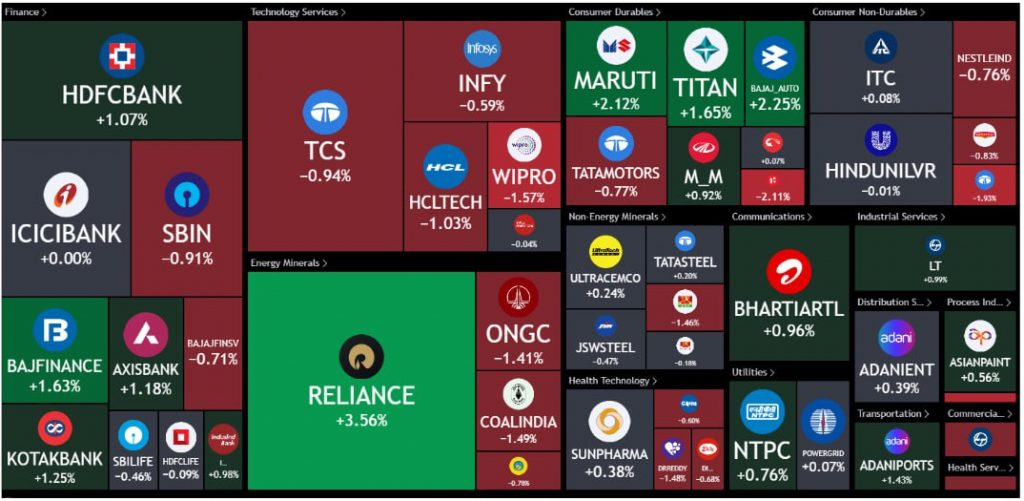

Nifty Heatmap

The sectoral overview for today shows a disparity, with infrastructure, real estate, and pharma sectors leading the gains. In contrast, IT faced challenges, influenced by global reactions to Accenture’s performance and its impact on Indian IT companies like TCS, Infosys, Wipro, and HCL Tech. Banking stocks had a mixed day, with HDFC Bank showing a notable performance, unlike the broader IT and banking sectors which faced declines. Notably, Reliance’s impressive gain of 3.56% stood out, significantly influencing Nifty’s overall performance.

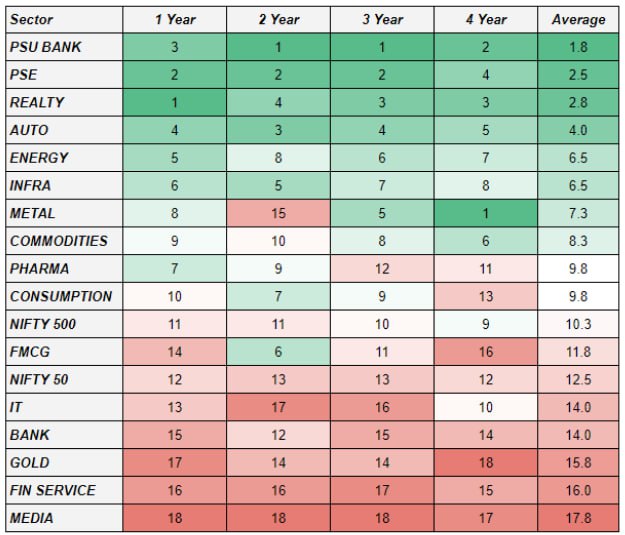

Sectoral Overview

The sectoral overview for today shows a disparity, with infrastructure, real estate, and pharma sectors leading the gains. As we approach the end of the financial year, the momentum ranking across various sectors offers a fascinating insight. Unexpected leaders like PSU banks and public sector enterprises highlight the unpredictability of market trends, demonstrating the value of a momentum-based investment strategy. This approach adeptly captures growth opportunities without the need for speculative predictions, adjusting dynamically to the market’s changing trends.

Mid & Small Cap Performance

Mid and small-cap indices showed contrasting performances, with mid-caps indicating potential for recovery and small caps maintaining a steady course

Nifty Bank Overview

The banking and Nifty Next 50 indices, however, highlighted ongoing adjustments within the market, pointing to cautious optimism as we transition into FY 2025.

Nifty Junior

Reflecting on the year’s market behavior as FY 2024 draws to a close, it’s clear that momentum investing remains a key strategy for navigating the complexities of the market, effortlessly adapting to shifts and identifying growth sectors. As we anticipate the new financial year, the lessons learned from FY 2024’s market behavior prepare us to embrace the forthcoming opportunities, staying attuned to the market’s signals and ready to adapt to emerging trends.