Today was another exciting day, with PSU banks making a notable comeback. This is the highlight for me today. Let’s dive into the details.

PSU banks, especially SBI, have shown a strong performance with a clear inverted head and shoulders pattern forming since April. SBI, often considered the benchmark for PSU banks, broke out of this pattern towards the end of April, targeting approximately ₹838-₹840, which we are very close to achieving. The trend remains bullish with higher highs and higher lows, establishing ₹780 as a significant support level. The resurgence in PSU banks is propelling the market forward, as the banking sector typically provides strong momentum.

Market Outlook

Nifty made a new high today, surpassing 23,000 and reaching nearly 23,100, but it gave back most of these gains by the end of the day. This pullback is normal given the impressive 700-point rise over the last four sessions. A retest of the 22,800 level would be healthy, potentially setting up for a bounce back.

Nifty Heatmap

Today’s heat map shows a largely red market with a few green spots: HDFC Bank, State Bank, Axis Bank, Hindustan Lever, L&T, and Divi’s Lab were among the gainers. Most other large-cap names in the Nifty were either red or flat.

The Nifty Next 50 showed better performance with notable gains in REC, PFC, Pidilite, Torrent Pharma, Dabur, Motherson, and Bosch. Meanwhile, McDowell, BEL, DMart, Trent, and Zydus Lab saw some losses.

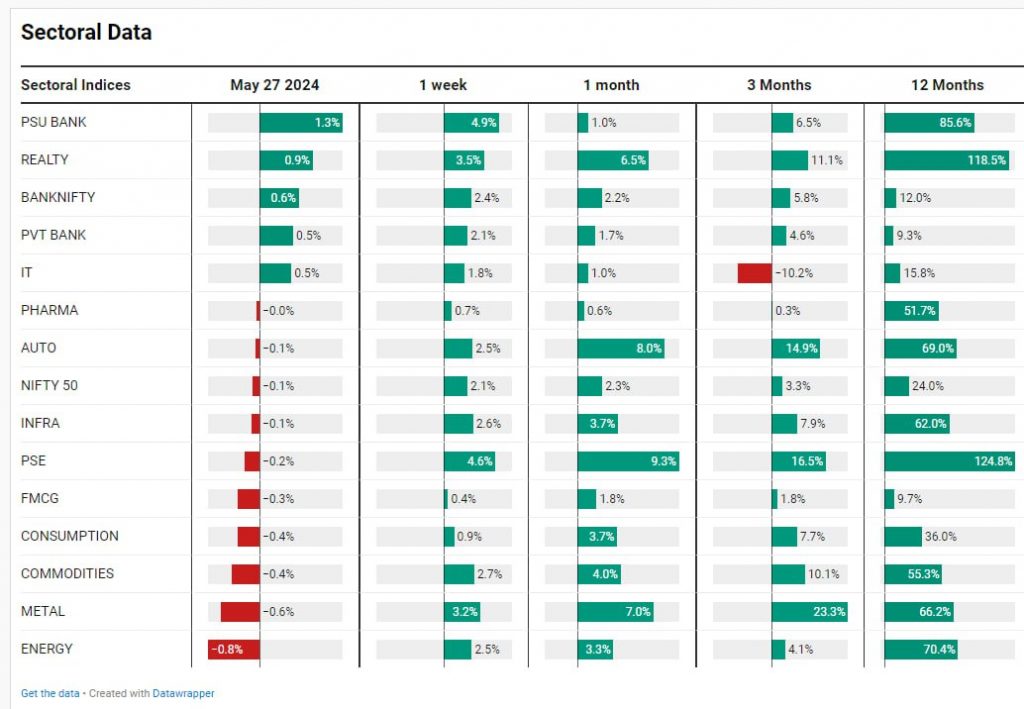

Sectoral Overview

Sector performance was led by PSU banks, which were up 1.3%, showing a green monthly performance. Real estate was up 0.9% today and 118% over the last year. Bank Nifty was up 0.6%, with private banks showing sluggish but positive movement. IT stocks were up 0.5%, reducing the three-month decline to 10%. Other sectors like metals, energy, and commodities saw some profit-taking, indicating possible buyer exhaustion.

Nifty Mid and Small Cap

Mid caps were nicely up with no change in trend, closing at a new high. Small caps have been stable over the last six sessions, closing at an all-time high.

Nifty Bank Overview

Nifty Bank nearly reached a new all-time high but faced profit-taking towards the end.

Nifty Next 50

Nifty Next 50 saw another day of a new high and close, maintaining a strong uptrend.

A common mistake among traders is going against the trend. It’s crucial to focus on the long-term and medium-term trends, and position trades accordingly. Avoid short-term pullbacks and instead align trades with the overall bullish trend.

India VIX Index

India VIX has been volatile, fluctuating between 18 and 26, which is expected before elections. We may see wild swings in the next week, but volatility should settle post-election results. Options players and leveraged traders need to be cautious during this period.

Nifty Realty Index

The real estate index remains intact, with new highs and closes after recent falls.

Nifty PSU Bank Index

PSU banks continued to show breakout potential, with opportunities to find new setups in this sector.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz