It’s been an exciting and good session in the markets today. The markets have been range-bound for the last two days, but today, after the Adani Group released a statement clarifying that their top management was not indicted for any bribery charges, Adani stocks surged. Some stocks even saw gains of 20%, while others rose by 10% or 15%. This news triggered a huge relief rally, and some Adani stocks have actually regained the levels they lost just two days ago. From that point of view, it seems like there is no longer any overhang from the Adani saga, and markets are moving forward.

Where is the market headed?

Market Overview

The market was range-bound for the third day in a row. The previous two sessions were largely spent absorbing the rally that occurred earlier, and today we saw Nifty close up by just 0.33%. Following the Adani news, the market did try to move higher but was restrained within the same range. Although no significant gains were made, the market appears to be stabilizing, and as each day passes, confidence in the current levels is growing. There is potential for the market to go higher, especially with stocks like HDFC Bank and others nearing breakout points. If any major news comes out, such as a positive trigger for these stocks, it could propel the market to levels of 24,500 or even 24,600.

If we are able to break these levels, it would provide a strong tailwind for the Nifty, and we could see further upside. However, if the market fails to break these levels and starts to drop, the first support will likely be around the 23,300 mark. As of now, the market appears to be attempting to go higher, but we’ll need to see how things unfold in the coming days.

Nifty Next 50

Looking at the broader market, Nifty Next 50 moved up nearly 1% today, breaking out of the range it had been in over the past two days.

Nifty Mid and Small Cap

Midcaps were up by half a percent, while small caps showed stronger performance, gaining 1%.

Nifty Bank Overview

Bank Nifty was relatively muted, up just 0.21%.

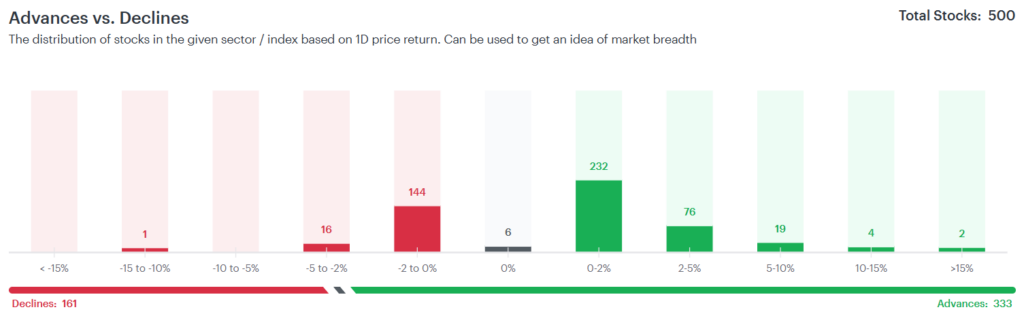

Advanced Declined Ratio Trends

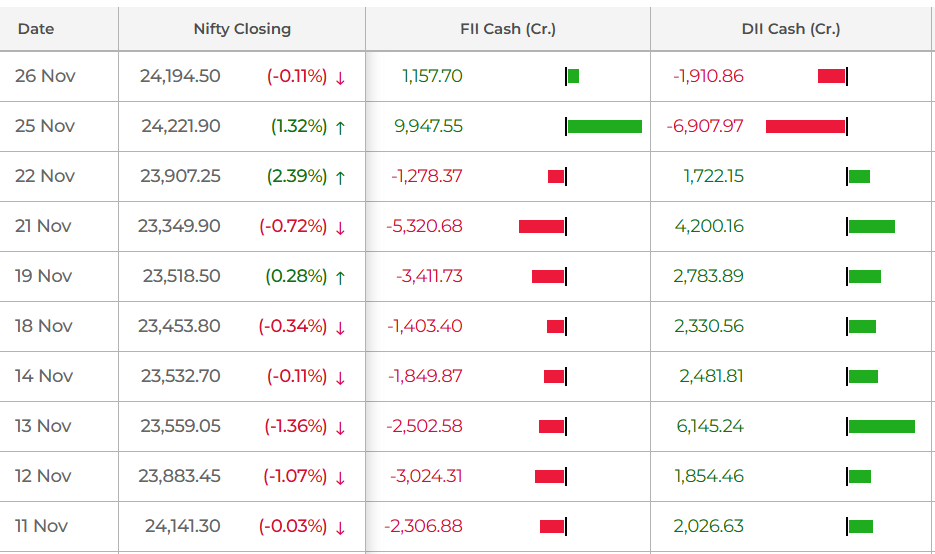

Overall, momentum trends are positive, with 333 advances to 161 declines. FIIs have bought ₹1,100 crores, while DIIs sold ₹1,900 crores, suggesting a shift in the dynamics of the market. It remains to be seen whether this trend of FIIs buying continues, as that would add confidence to the market.

Nifty Heatmap

The heat map for today was mixed, with NTPC, Maruti, Mahindra & Mahindra, Bajaj Auto, GSW Steel, Coal India, Bajaj Finance, and HDFC Bank doing well. Of course, Adani stocks were the big winners today, with Adani Enterprises up 11%, Adani Ports up 6%, and stocks like Adani Power, Adani Green, and Adani Total Gas rising by 10-20%. These stocks have recovered a lot of the ground they had lost recently, although some still have further to go. Siemens, IRFC, HAL, and Zomato also saw positive movements today.

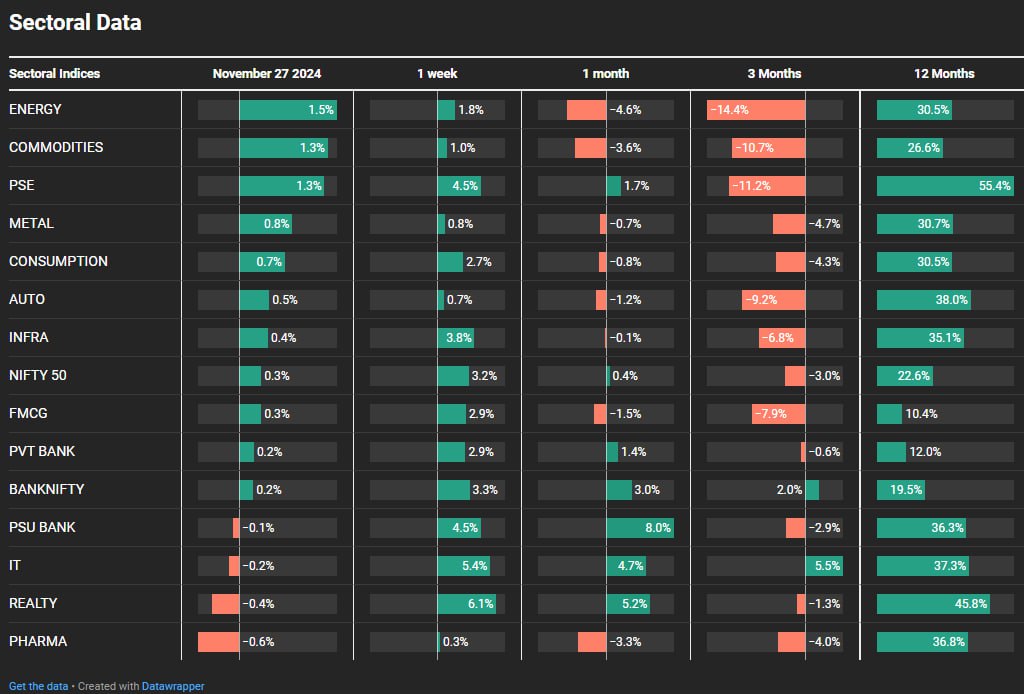

Sectoral Overview

On the sectoral front, energy stocks, led by Adani Energy, were up by 1.5%, followed by commodity stocks and public sector enterprises, each gaining 1.3%. Metals were up by 0.8%, and consumption stocks rose 0.7%. PSU banks were flat and slightly in the red, while real estate, which had surged 6.1% last week, was down 0.4%. Pharma stocks were also stagnant, showing a slight decline of 0.6% over the past week, month, and three months.

Sectors of the Day

Nifty Energy Index

Stock of the Day

Adani Total Gas

A stock in the spotlight today was Adani Total Gas, which had dropped from ₹660-670 levels but has now retraced back to ₹694. This entire saga that unfolded over the last 45 days has not resulted in any significant loss when looking at the bigger picture. However, from an all-time high, Adani Total Gas is still down considerably.

Story of the Day :Pakistan’s stock market has been witnessing a stunning surge in 2024

This is more of an informational segment, and we are not advising anyone to invest in the Pakistan Stock Exchange. However, as students of the market, it’s important to stay informed about the markets around us, and Pakistan’s stock market is of particular interest due to its proximity and recent developments.

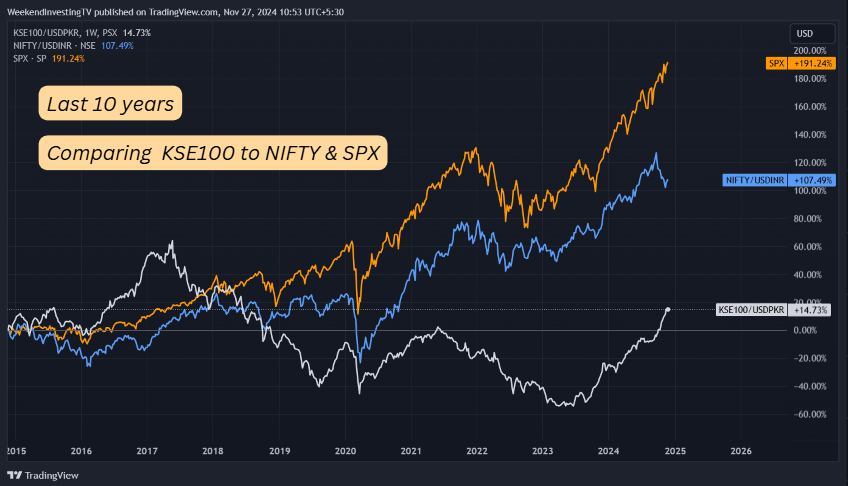

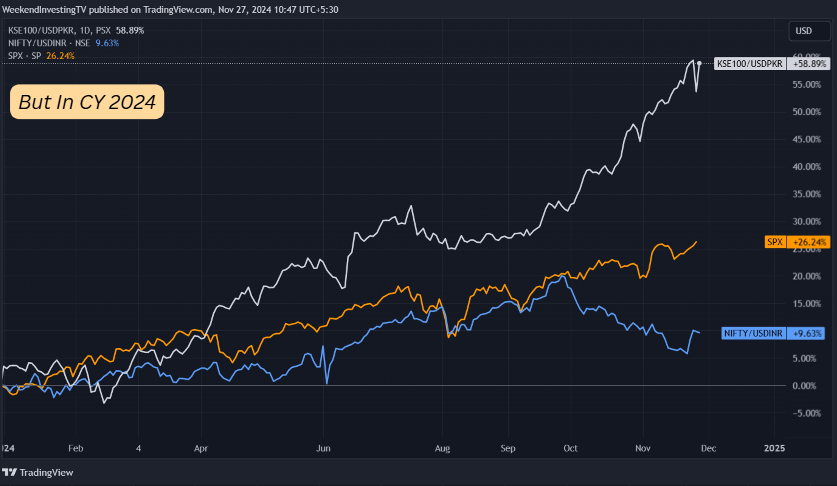

Looking at the KSE 100 index in the last 10 years, it has only gained 14.7%, while the Nifty in USD terms has grown by 107% and the S&P 500 by 191%. So, in the last decade, Pakistan’s market has lagged significantly. However, in 2024, the KSE 100 index has surged 60% in dollar terms, while the S&P is up 26% and the Nifty is up only 9%. This remarkable surge has been fueled by several factors, including a $7 billion loan from the IMF, which has injected confidence into the market. Additionally, general elections have been successfully conducted, inflation has dropped from 38% to 7.2% within a year and a half, and there are signs of structural reforms taking place.

Domestic investors have driven this growth, as foreign portfolio investors have pulled out. The market cap to GDP ratio is extremely low, standing at only 11%, compared to India’s market cap to GDP ratio of around 140%. The low PE ratio of 4.6 indicates that the market is undervalued, and there is room for further upside. However, Pakistan’s political volatility, reliance on imports, and dependence on external financing could pose risks to the market’s future performance.

So, can Pakistan continue to perform well? What are your views? Please share your thoughts in the comments below. While we are not recommending investing in Pakistan, there are lessons we can draw from this surge, such as the importance of where the money flows, the role of domestic investors, and the concept of good prices for bad markets.

WeekendInvesting launches – PortfolioMomentum Report

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com