Market Outlook

Nifty showcased a remarkable performance today, making a strong close for the financial year with a notable moment when it briefly touched 22,500. Despite facing selling pressure towards the end, closing with substantial gains highlighted a robust finish. This trading action around the 22,200 resistance point, which we’ve previously identified as significant, underscores the ongoing challenges and potential for future growth as we move into FY 2025.

The market’s optimism is palpable, with expectations high for the upcoming year, especially with the elections around the corner. This year’s turnaround from the previous year’s FPI sell-off to a substantial buy-in this year adds to the positive outlook for the Indian markets.

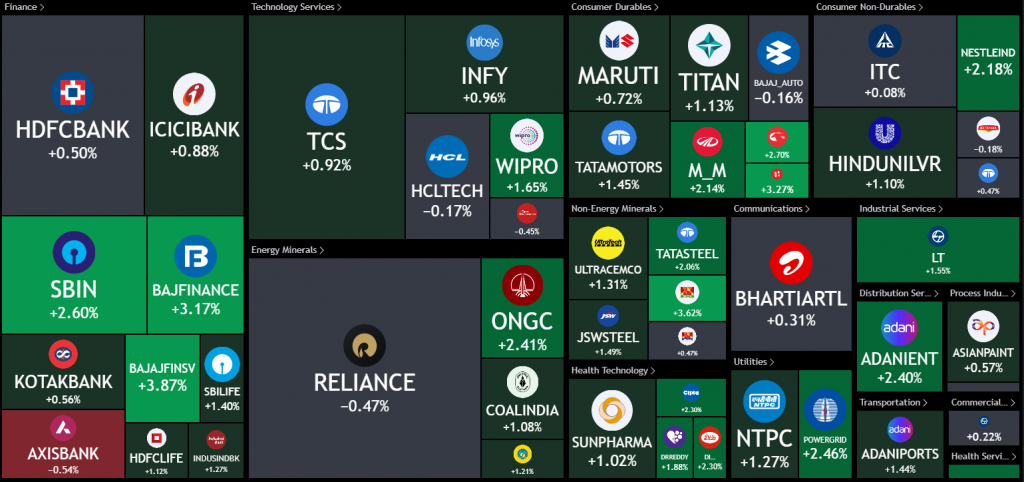

Nifty Heatmap

The heatmap was predominantly green, showcasing broad market gains except for a few sectors like IT, which faced downward pressure possibly due to global market influences like Accenture’s performance in the US. Notably, heavyweights such as Reliance and HDFC Bank played a significant role in Nifty’s climb, despite Reliance experiencing a slight decline today. Banking and IT sectors exhibited mixed performances, with notable gains in SBI, Bajaj Finance, and Bajaj Finserv, while IT stocks like Wipro, TCS, and Infosys saw gains, countering their recent slump.

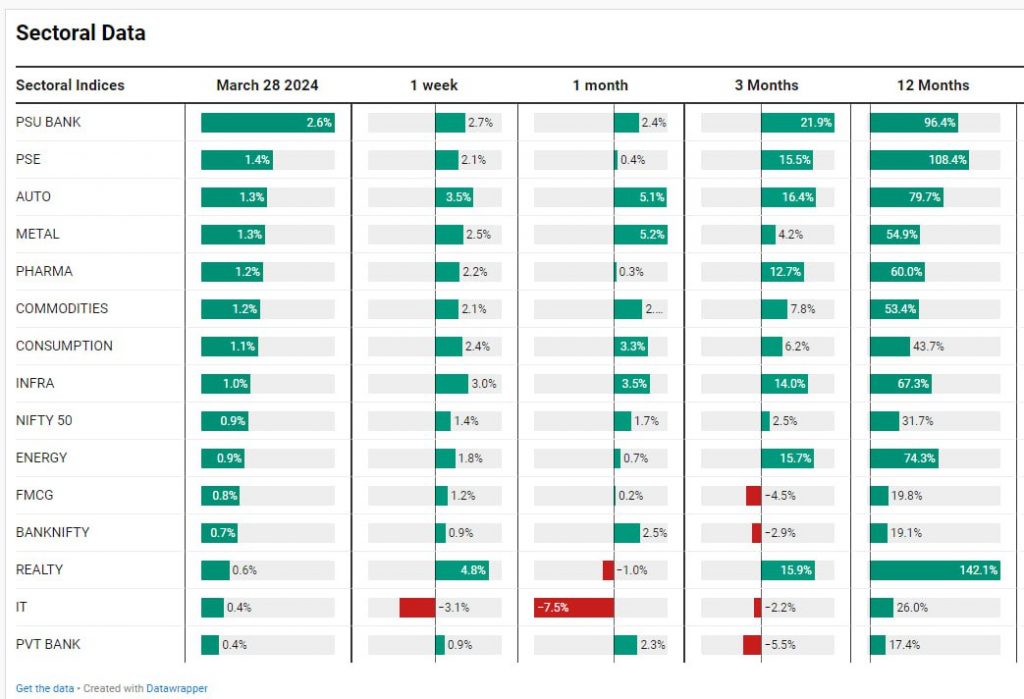

Sectoral Overview

The sectoral performance was led by PSU Banks, PSEs, Autos, and Metals, all registering over 1.3% gains, with PSU Banks topping the charts with a 2.6% increase. This performance not only reflects the day’s positive momentum but also underscores the sectors that have dominated FY24. However, the Real Estate sector, despite being the year’s standout performer, had a relatively modest day.

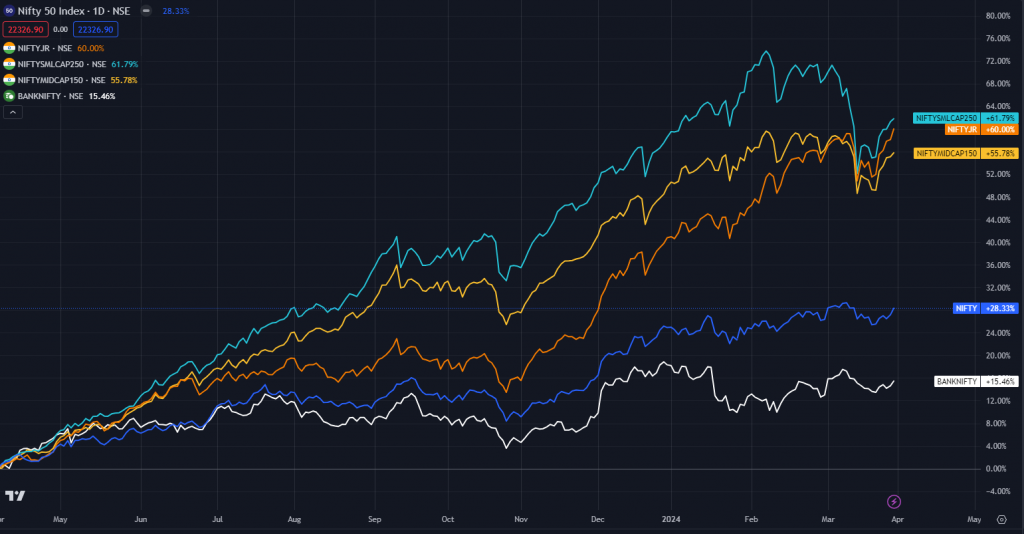

Mid & Small Cap Performance

Midcaps and Smallcaps showed restraint, with midcaps encountering resistance around the 18,000 mark, suggesting a need for momentum to break past this level for continued growth. Smallcaps faced similar challenges, indicating that key resistance points must be overcome to sustain an uptrend.

Nifty Bank Overview

Nifty Bank concluded the year on a positive note, with a 0.7% gain, hinting at a potential breakout from its recent range-bound movement.

Nifty Junior

This, coupled with Nifty Next 50’s proximity to its all-time high despite a slight pullback, paints an optimistic picture for the indices as we step into FY25.

FY2024 Closing Remarks

FY24’s closing session encapsulated the year’s dynamics—highlighting the sectors that have flourished and those with room for improvement. As we transition into the new financial year, the market’s readiness to embrace new opportunities and navigate challenges remains evident. The diverse sectoral performance, from the soaring Real Estate to the lagging Media sector, illustrates the complex landscape investors navigated through FY24. As we bid farewell to this financial year, the excitement for what FY25 holds is palpable, promising new avenues for growth and investment.