India VIX Index

The story of the day is the rising India VIX. If you understand the relationship between VIX and markets, you’ll know that up to about 20, there’s no issue, and no volatility is expected. Between 20 to 25, there is traditionally some concern about upcoming volatility. Beyond 30, it becomes extremely dangerous, indicating a very volatile market. Currently, we are around 24, not in the danger zone yet, but VIX typically rises before elections. VIX measures the expected volatility, and options prices are increasing. Those buying options at such high VIX levels risk losing a lot unless the market moves in their direction. Elections are a significant event, and many bets are placed globally, adding to market sensitivity.

Market Outlook

Now, let’s look at the Nifty. On the hourly chart, I’ve superimposed a supertrend indicator. Toward the end of the day, it entered a sell mode on the last candle. This might be a false breakdown, which we’ll know more about tomorrow. The market has shown some resistance since it broke 22,800, consolidating near that breakout. Ideally, it will retest 22,800 and bounce back, which would be a best-case scenario.

Nifty Heatmap

The Nifty heat map shows reliance and other energy stocks losing ground. ITC, Maruti, Tata Motors, Bharti, NTPC, and Power Grid also saw declines, while Pharma and Steel, along with some two-wheelers and life insurance companies, posted gains.

The Nifty Next 50 heat map was more red, indicating more pressure on mid and small caps. Adani stocks, DLF, public sector enterprise stocks, and others showed significant losses, while McDowell’s, Berger Paints, REC Cement, and ICICI Prudential were among the gainers.

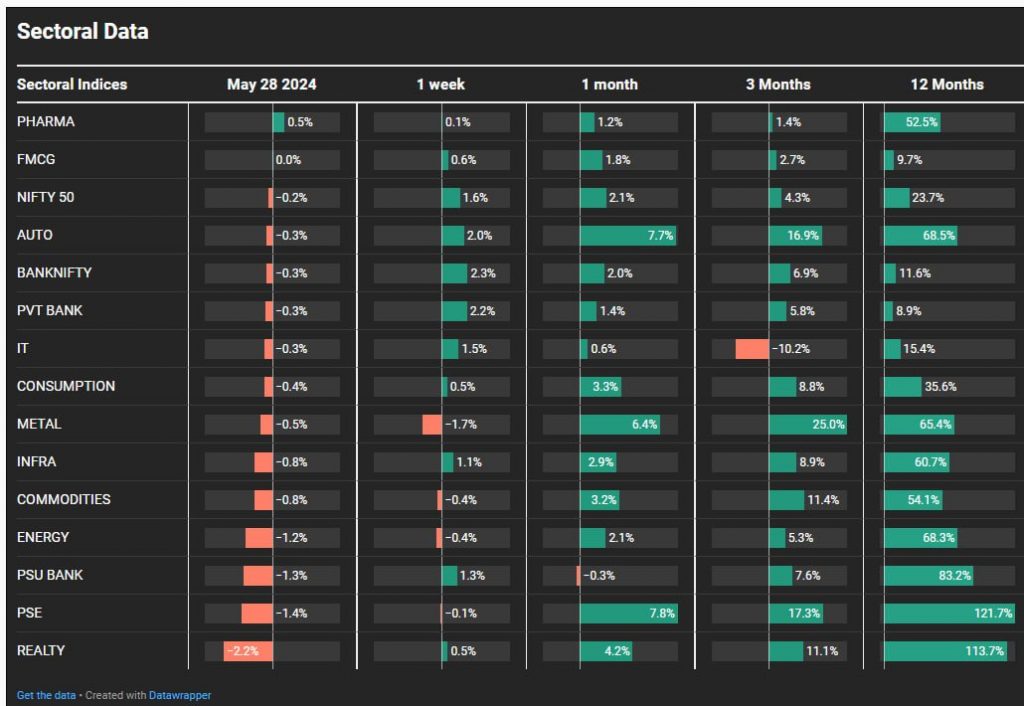

Sectoral Overview

Sectoral data shows almost all sectors in the red, with real estate leading the downtrend at 2.2%. This sector had been gaining over the last month, three months, and twelve months. Metals, energy, and commodities also saw declines. Despite today’s 0.5% pharma gain, the sector hasn’t gone anywhere in the past week. Autos, banks, and private banking gained some ground in the last month, while autos, metals, and public sector enterprise stocks have performed well in the last three months.

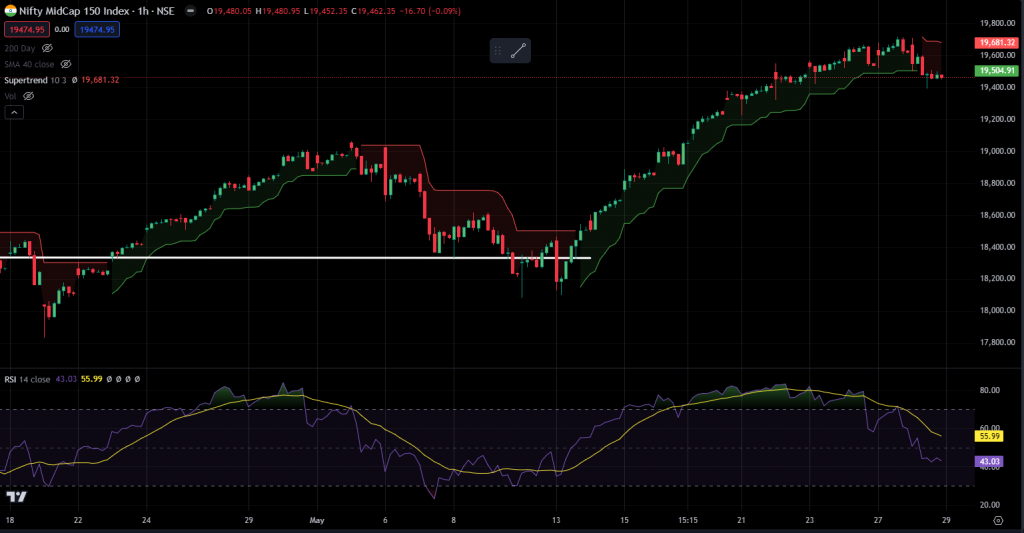

Nifty Mid and Small Cap

The mid caps have fallen through in the short term, and the RSI has been declining since the 21st, showing divergence. The small caps couldn’t surpass the 15,900 mark and also broke down today, indicating a consolidation phase. However, this doesn’t indicate a long-term trend change, just a short-term consolidation.

Nifty Bank Overview

Nifty Bank Index remains robust, holding up well despite some pullback.

Nifty Next 50

Examining various indices, the Nifty Next 50 is also in a short-term sell mode but remains strong in the long term.

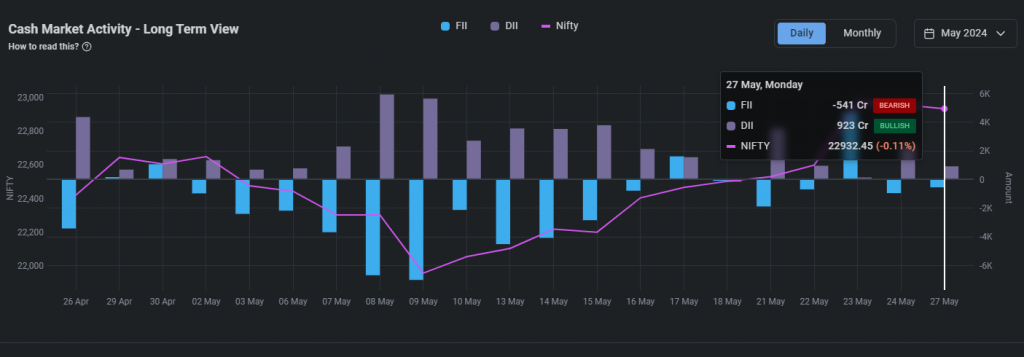

FIIs & DIIs

FIIs and DIIs are showing interesting activity. On a daily basis, FIIs sold 541 crores while DIIs bought 923 crores. Since May 21, FII sales have decreased, with a notable buy on May 23, followed by some profit-taking. DIIs have been consistently buying during this period.

Sectors of the Day

Nifty PSE Index

Nifty Public Sector Enterprise stocks have also surged since November, nearly doubling in six months. This significant move may suggest a price correction or reversion to the mean.

Nifty RELATY Index

Nifty Real Estate has risen dramatically since November, with the 200 DMA far behind the price action. A trendline support is about 4-5% below current levels, suggesting some cooling off.

Stocks of the Day

Hero Moto Corp

Today’s outstanding story is Hero Moto. Despite a weak day, Hero Moto, which broke out at the beginning of May, continues to perform well, indicating inherent strength. Any falls in this stock should be seen as buying opportunities, with a short-term stop near 4950.

TVS Motors

Similarly, TVS Motors, another strong performer in the two-wheeler category, has shown resilience and is likely to challenge previous highs soon. The relative strength in these two stocks is notable despite the day’s decline.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz