There was a small bounce in the market today. There was an expectation of a downside this morning, and indeed the market opened lower, particularly in the small and mid-cap sectors. However, the Nifty recovered first, followed by Nifty Junior, mid-caps, and then small caps, all of which ended up in the green.

This relief rally, if we may call it that, seems to have been triggered by the narrative that the war may be coming to an end. Additionally, this week leads up to Diwali, and perhaps people are squaring up their short positions from the last two weeks. It is still not clear what the expiry day will be this week; the Nifty calendar lists Diwali as 1st November, whereas many are suggesting it may actually occur on the 31st. This could mean that the holiday gets moved up by one day, potentially causing the expiry to shift from Thursday to Wednesday. All of this remains flexible, as we haven’t heard from the exchange yet.

This week is likely to be light in terms of trading activity. I don’t expect much action, especially on the downside, given that a significant correction occurred over the last two weeks. While there may be more to come, for now, it seems like a bounce is happening. Crude oil has collapsed by 6 to 7% just over the last day, which is generally good news for India going forward. As I mentioned in one of my tweets, it’s high time the government considers slashing rates at the pump to help stimulate the sluggish economy. This could be one of the easier measures the government can undertake.

So, will the markets throw a surprise party this week? If you’ve been waiting for lower levels, what will you do if the market doesn’t reach your target? We will discuss all this in the second half of the video.

Where is the market headed?

Market Overview

The market’s jump was extremely benign. It’s hard to argue that the increase was anything material—just 0.65% by close. Around 2 PM, we did hit almost a two-day high but did not close above it. My rule of thumb for a high probability turn is that a stock, sector, or index should close above the previous two-day high, which hasn’t happened yet. Therefore, we remain in some sort of flux. There’s still a possibility for further declines, or the market may try to catch up in this light week.

This is considered a support zone, with levels around 23, 924,000 serving as crucial support. Having come off pretty steeply, some bounce is likely, but further declines could also follow if that’s the trend.

Nifty Next 50

The Nifty Next 50 shows a similar pattern, with a 0.45% bounce, but again, nothing too substantial. The bottom we are seeing is significant and could act as a key point going forward. A break here could also create a small head-and-shoulders pattern.

Nifty Mid and Small Cap

In the mid-cap space, the bounce was more pronounced at 0.64%, but it remains far from the moving average. Small caps, being higher beta, were up 1.15%, indicating some support. There was a gap in the market at the beginning of August that has been filled and supported over the last two sessions, making these two bottoms important going forward. Overall, the market structure is still tentative and downward; it is too early to declare an upward trend.

Nifty Bank Overview

Bank Nifty actually surpassed yesterday’s high at one point but succumbed to profit-taking. Some banks have released decent numbers; I noticed PNB and Bank of Baroda, although I haven’t reviewed those numbers in depth. It seems like we are in a consolidation phase rather than a free fall, with Bank Nifty up 0.9%.

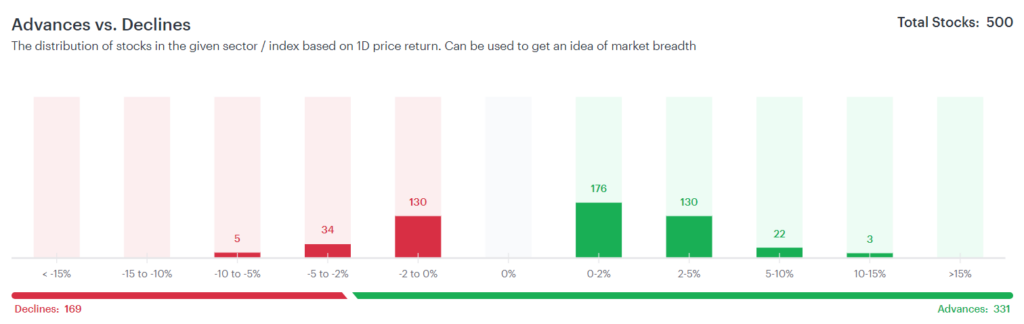

Advanced Declined Ratio Trends

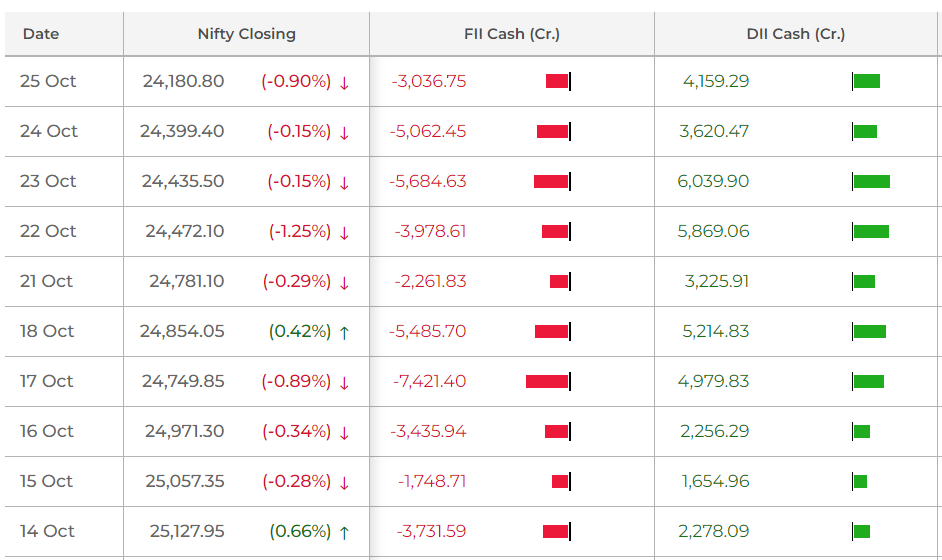

In the advanced decline of CNX 500, the bias leaned towards advances: 331 advances compared to 269 declines, which is a positive indicator. Regarding FII trends from 25th October, FII continued to sell at 3,000 crores, while DIIs bought at 4,000 crores. Their buying and selling seem to be evenly poised.

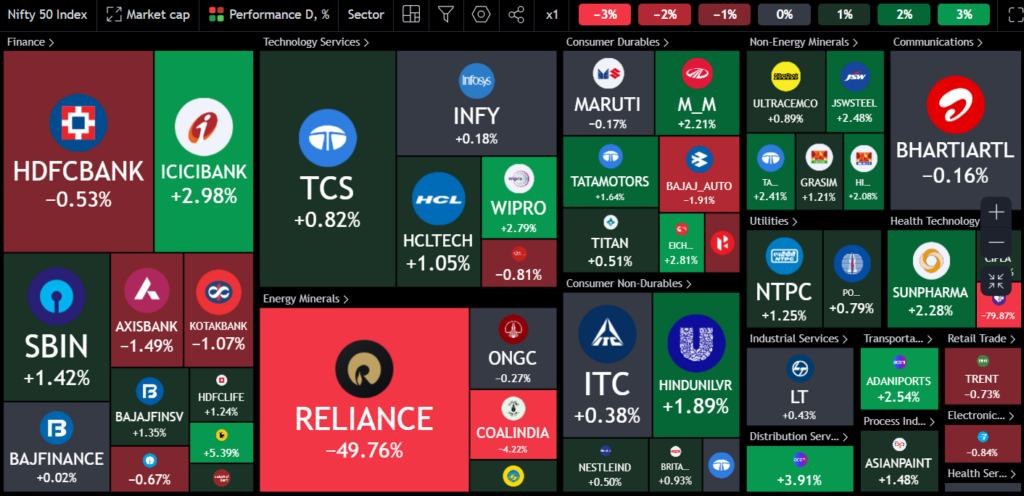

Nifty Heatmap

The heat map for today had not been adjusted by TradingView yet. However, Reliance hasn’t dropped by more than a quarter percent. ICSI Bank, following its spectacular results, is up 3%. Wipro is also up nearly 3%. Mahindra and Mahindra bounced, along with Aisher Motors and Tata Motors. In consumer goods, we saw a bounce in Hindustan Unilever, while GSW Steel, Tata Steel, Hindalco, Sun Pharma, and Adani Ports all performed well.

On the flip side, Coal India was down sharply post-results by 4%. Bajaj Auto continues to reel down by 1.9%, along with Kotak Bank and Access Bank. In the Nifty Next 50 space, we see fantastic gains from Vedanta, REC, PFC, and IRFC, with all railway stocks up. PNB is up 3%, while BHEL has seen a 6% increase, although some accounting changes may have impacted their profits.

Geo Finance is up 1.7%, and DLF announced a mega project selling 100 crore apartments, which resulted in a 5.9% rise. Other stocks like Dabar, Ambuja Cement, and JSPL are also up. Conversely, Indigo nosedived nearly 11% but recovered to a decline of 8% post-results, while Torrent Pharma, ABB, and Chola Finance were down, along with several others.

So we see a mixed bag today. Mostly, the bounces occurred in oversold stocks.

Sectoral Overview

The PSU banks had a significant bounce, up 3.8%, which is substantial for any sector. Metals also rebounded sharply by 2.5%, with real estate up 1.4% and pharma up 1.3%. Notably, no sector was in the red, which is an important aspect of today’s trading.

Sectors of the Day

Nifty PSU Bank Index

The PSU banks had a significant bounce, up 3.8%, which is substantial for any sector.

Stock of the Day

Indian Bank

Among notable movements, Indian Bank jumped 10.6%. Despite this surge, it remains stagnant since February 2024, but there is potential for it to reach previous highs given its exceptional results. The stock has performed very well since the COVID bottom, rising from 40 rupees to 551 now.

Story of the Day

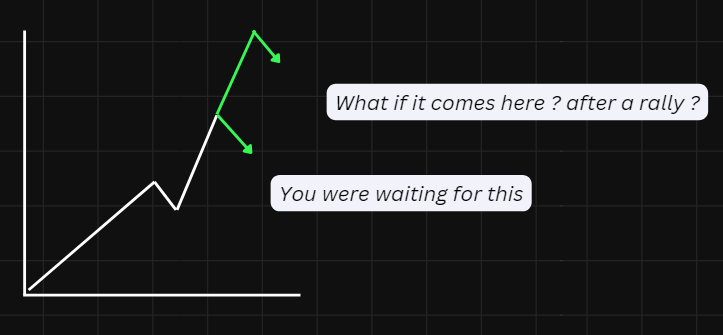

Now, let’s circle back to the topic of whether the markets will throw a surprise party. Have you been waiting for lower levels? Will you get them, or will the market surprise you? Often, when the market is weak, we hear narratives about waiting for specific levels, like below the 200 DMA or some other indicators, which can lead to a fixation that may not serve us well.

For instance, many were waiting for the index to dip below the 200 DMA to buy. However, after the election outcome, it came close but never closed below it, resulting in missed opportunities as the market rallied by 15-20%. If you were waiting for that 200 DMA, you’ve been waiting for over a year, and the 200 DMA has since risen substantially.

What may happen next is uncertain. The market might come down again, or it could rise another 30% before it meets the 200 DMA. Holding onto such a narrative can be risky. Another common approach is to wait for a specific percentage correction, such as 10%. But after the COVID rally, when the market corrected 18%, those who were waiting for further dips might have missed substantial gains.

In many cases, fixating on specific market conditions can lead to missed opportunities. You should avoid waiting for an exact bottom to form. Usually, when a bottom is reached, the fear factor is so high that it becomes challenging to make buying decisions. Right now, the market is down by about 7-8%, and while most strategies are experiencing similar declines, it’s not dire.

You must recognize that if you are waiting for specific levels, the market might not present those opportunities. The essential lesson is to develop strategies that allow for regular investment, regardless of market conditions. If your goal is to build wealth over the long term, deploying funds consistently will outweigh the benefits of waiting for a precise dip.