Market Outlook

It was indeed a day filled with notable events, particularly in the realm of the Nifty index.

Nifty managed to break out once again, overcoming two prior failed attempts to breach the 22,500 mark. This breakthrough was notably robust, driven by a strong performance in the banking sector. As I’ve often emphasized in the past, when banks lead either a rally or a decline, it tends to be more sustainable.

Nifty Heatmap

A glance at the Nifty heat map revealed gains in both private and public sector banks. State Bank of India surged by more than 3%, while ICICI Bank saw an impressive nearly 5% increase. However, Kotak Bank remained muted due to restrictions, while HDFC Bank faced its own challenges. Notably, ICICI Bank shone brightly post its recent earnings announcement, boasting a market cap of almost eight lakh crores.

In addition to banking, cement companies such as Ultra Semco and Grasim performed well, alongside NTPC and various PSUs. Conversely, HCL Tech faced a downturn post-results, while DLF and insurance companies like SBI Life and LIC experienced losses.

Notable losers also included Dmart, Bharat Electronics, Zomato, IOC, Naukri, Vedanta, and Tata Power. Bank of Baroda, PNB, and Canara Bank saw modest gains, while PFC and IRFC in the PSU space made solid advances.

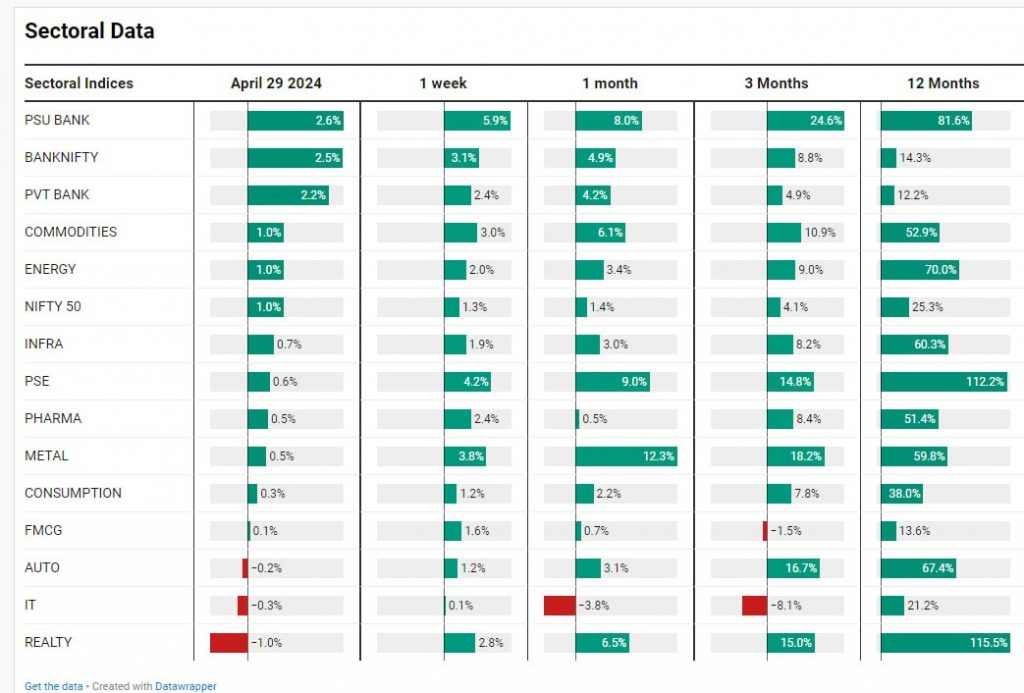

Sectoral Overview

Both PSU and private banks experienced upward movements of over 2%, while commodity and energy stocks saw a 1% increase. The Nifty index itself closed 1% higher, indicating a substantial market shift.

Interestingly, FMCG remained stagnant following Hindustan Lever’s disappointing rural pickup in its recent results. The automotive sector also showed signs of stagnation, emerging as the worst performer over the past month.

Real estate, though still strong, saw a slight decline.

Mid & Small Cap Performance

While mid-cap stocks continued their upward trajectory for the sixth consecutive day. Small caps, on the other hand, experienced a day of consolidation after a gap-up opening.

Nifty Bank Overview

This breakout in the market has been building momentum over the last six sessions, particularly evident in Nifty Bank’s strong upward movement, resulting in a new all-time high.

Nifty Next 50

The Nifty Next 50 also managed to achieve a new all-time high, albeit with a more subdued performance.

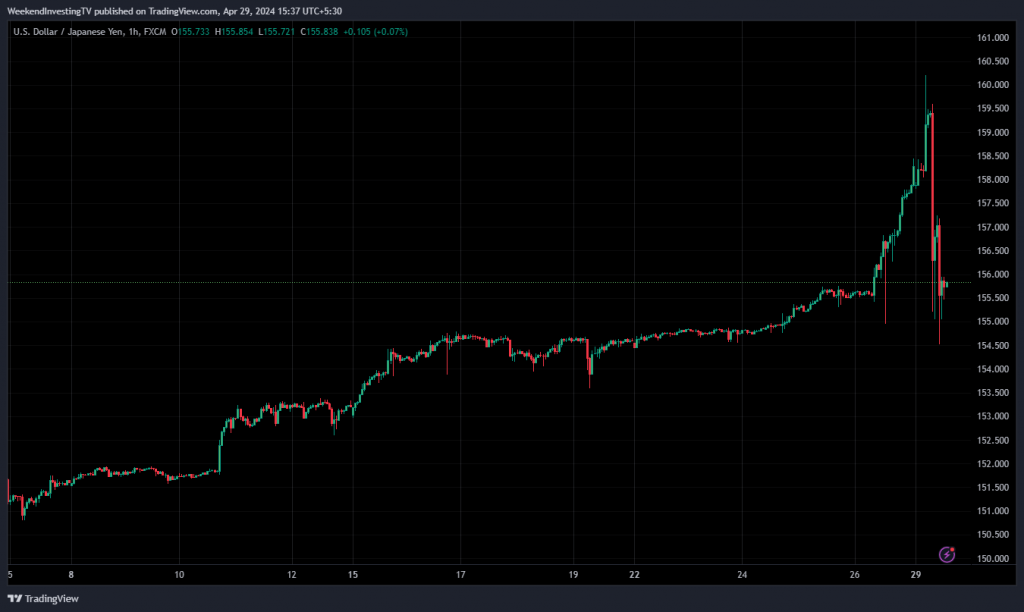

Uncertainty in Global Markets

In the past two sessions, an intriguing development unfolded concerning the US dollar and the Japanese yen. Typically overlooked, recent months have witnessed a rapid decline in the Japanese yen’s value, plummeting from 130 to 160 against the US dollar. Analysts attribute this sharp decline to significant intervention by the Bank of Japan aimed at curbing the currency’s fall.

In currency markets, interventions to halt depreciation often prove challenging. Despite central bank efforts, currencies tend to continue their downward trajectory. The repercussions of such movements are far-reaching, with other currencies like the US dollar, Chinese yuan, and Indian rupee likely to be affected. The interconnected nature of currency markets means that once depreciation begins, it can lead to widespread volatility.

Adding to the complexity is the uncertainty surrounding the upcoming US elections and differing monetary policy stances. The potential outcomes of these events could have significant implications for global interest rates, further impacting currency markets worldwide.

As markets navigate these developments, the resilience observed suggests that while challenges exist, there is no immediate cause for alarm. However, continued vigilance and adaptability remain crucial as we monitor the evolving landscape of global finance.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz