Story of the Day

The big news today is that S&P has upgraded India’s outlook to positive from stable. While this hasn’t had an immediate impact, it’s great news for the future. A rating upgrade usually means changes in large fund allocations. For example, if India is currently 4% of an emerging market fund, an upgrade can increase this allocation, bringing more funds to India regardless of the market’s current state. This upgrade is particularly significant coming before the election, signaling confidence in India’s future.

Market Outlook

Regarding Nifty, it remains on a weak wicket in the short term. Yesterday’s last-hour signal of a short continued today. It retested the 22,800 level but closed at 22,700. While this isn’t a major loss, the market remains nervous ahead of the elections, which can cause irrational moves. Expect volatility in the coming days, potentially peaking around June 4. The RSI on hourly charts is near oversold levels, suggesting that buying may emerge soon if the medium to long-term trend remains intact.

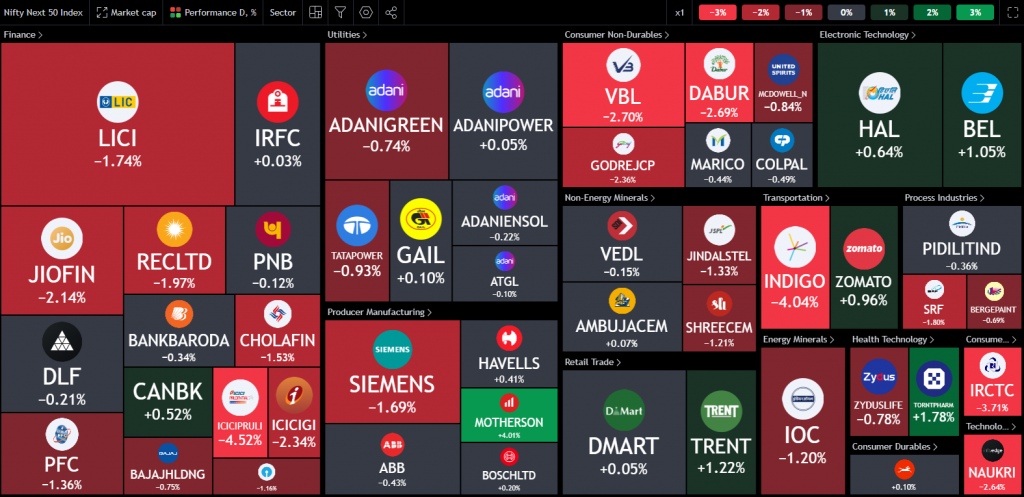

Nifty Heatmap

The heat maps show that Nifty was broadly red, with significant losses in banking, energy, and IT stocks. Pharma, FMCG, and power showed minor gains. In the Nifty Next 50, the damage was broad but minimal, with notable gains in Madharsan Sumi, Sun Pharma, Torrent Pharma, HAL, and BEL.

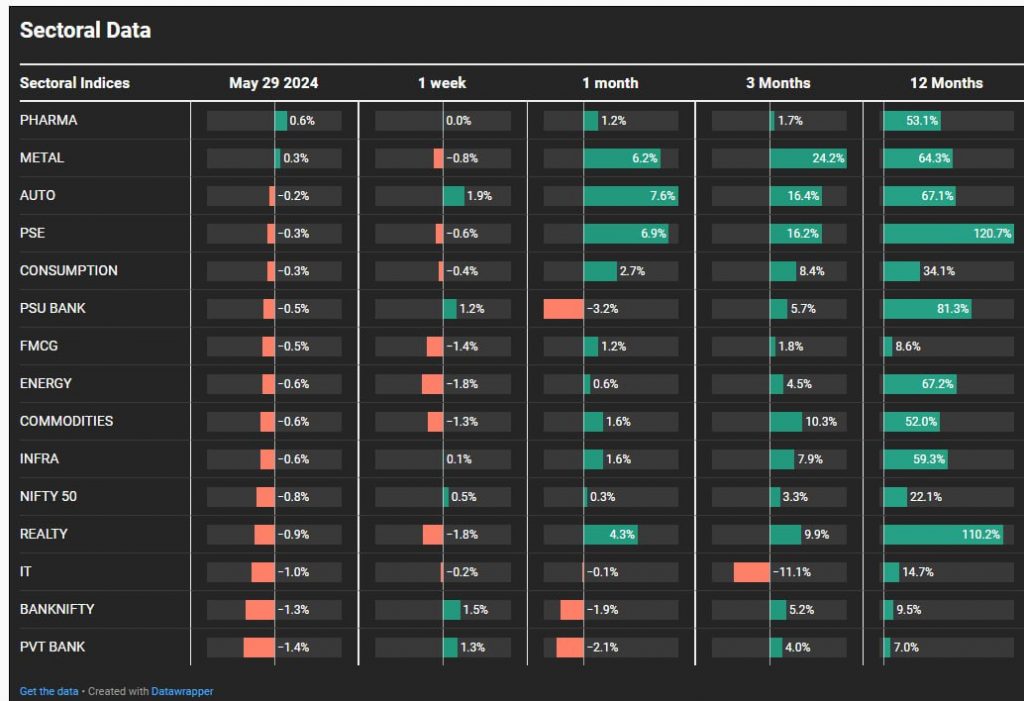

Sectoral Overview

In sectoral trends, pharma was up 0.6%, metals were up 0.3%, while private banking was down 1.4% and real estate down 0.9%.

Nifty Mid and Small Cap

Mid caps were virtually flat today, experiencing a mild downtrend after breaking the short-term uptrend. Small caps were slightly positive, remaining flat towards the end of the day.

Nifty Bank Overview

The Nifty Bank index led the market down with significant losses, suggesting potential continued downside.

Nifty Next 50

Looking at other indices, the Nifty Next 50 has seen a slight correction after a steep rise over the last ten days, with the RSI nearing oversold regions.

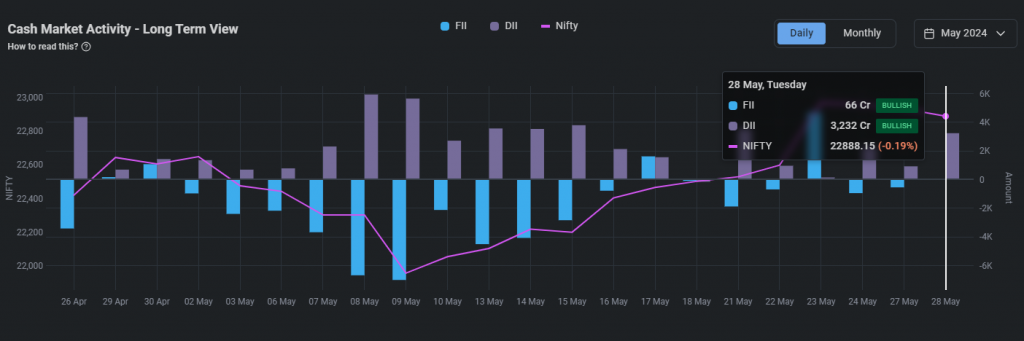

FIIs & DIIs

On 28 May, DIIs bought 3200 crores, while FIIs bought 66 crores. Recently, FII sales have been negligible, with some small buying emerging. This might be due to FIIs building cash position longs in anticipation of a potential market upswing following the election results.

Sectors of the Day

Nifty Pharma Index

The Nifty Pharma index has consolidated for three months after a rise from November to March. It’s now at the top of this range, indicating a potential breakout, especially if there’s a risk-off event in the broader market.

Stocks of the Day

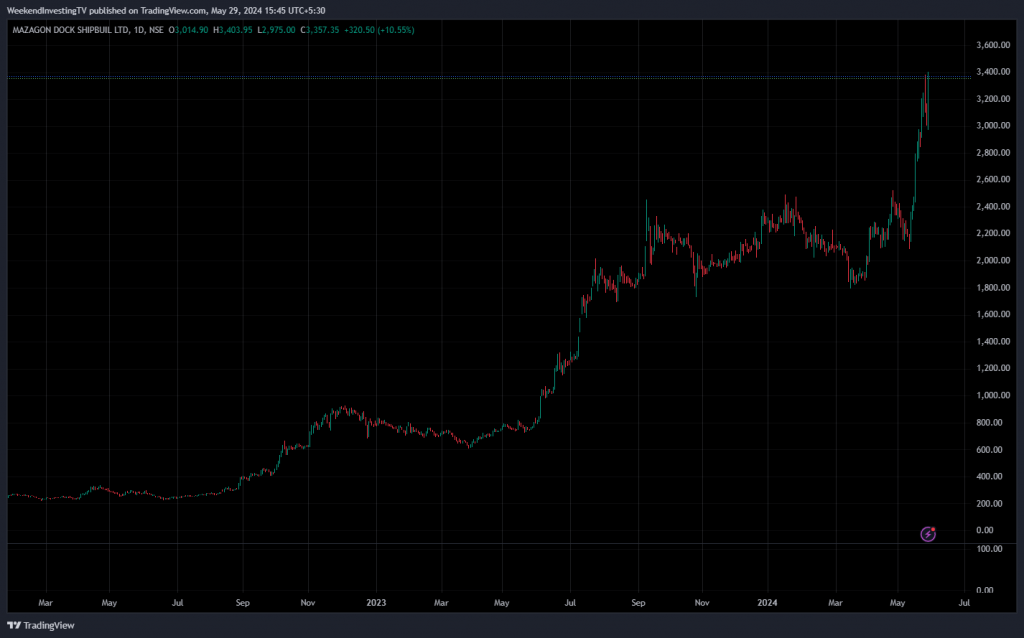

Mazagon Dock

Mazagon Dock is the stock of the day. This stock has risen from Rs 200 to Rs 3400 over the past couple of years. It consolidated between 1800 and 2200 for six to seven months before surging 70% recently. Strong results have driven this recent rise. Holding on to strong stocks through consolidation phases can yield significant gains when the next leg up begins.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz