Market Outlook

On April 3, the market experienced a phase of consolidation, with the Nifty forming an inside bar for the third consecutive day, indicating a period of uncertainty and anticipation of a potential breakout.

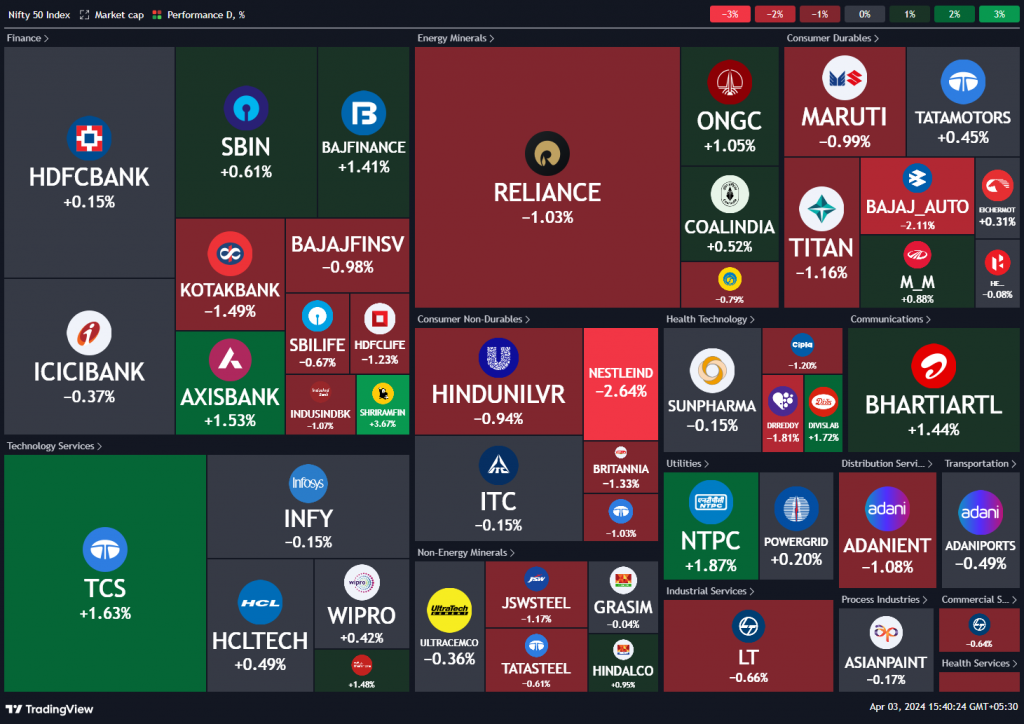

Nifty Heatmap

Despite some red on the heat map, with notable declines in banks like Kotak Bank, ICICI Bank, and Axis Bank, and also in IT stocks like Infosys, TCS, HCL Tech, and Wipro, there were positive movements in the auto sector and sporadic gains across other sectors. The Nifty Next 50, however, showed more positive momentum, with several stocks making notable gains.

Sectoral Overview

Sectorally, public sector banks and enterprises led the day’s gains, indicating a continuation of leadership in these areas. Real estate, despite news of slowing sales, showed resilience in the market. On the downside, FMCG and autos faced some challenges, with FMCG stocks particularly showing weakness amid concerns over margin pressures and volume growth.

Mid & Small Cap Performance

The mid-cap index reached a new high, demonstrating a strong bullish trend, while small caps are rapidly approaching their all-time highs, erasing previous weaknesses

Nifty Bank Overview

Bank Nifty, although stuck in a range, showed gradual improvement

Nifty Next 50

Nifty Next 50 continued its ascent, making new highs and leading the market.

Nifty PSU Index

metals and public sector indexes, show strong bullish trends, signaling robust market segments.

Nifty REALTY Index

Real estate index has taken a downtrend today. I think the breakout above this top has kind of failed for now, but today is just one session.

Nifty IT Index

the IT index presents a concerning picture, with potential for further downside if current support levels break. This trend is in contrast to the overall market optimism and could be influenced by global IT trends and domestic factors like potential tax hikes on companies like Reliance and ONGC.

GOLD / US

Gold is doing exceedingly well from 61,000 levels mid February. It is now at almost 70,000 by first week of April. So six weeks has changed dramatically. 15% kind of gain has come. And gold where we’re expecting 11% in a year, 15% has been delivered in six weeks. So it’s a very, very concentrated returns month. Last one month that has happened. It should consolidate at some point, but right now it is in very, very strong hands.

BRUDE OIL

Crude oil prices nearing $89 and potential impacts if they exceed $90, along with gold’s significant gains in a short period, highlight external market factors that could influence investor sentiment and market trends.

There are two major events, India’s election and then of course, the US elections. We don’t know how and when there will be any hit to the market, if at all. But overall, I mean, the call for growth in the economy from everywhere, from World bank, from all our ratings agency, is very, very fine domestically. So doesn’t seem like there is too much cause for concern right now.