Market Overview

It was indeed a blockbuster day for private banking, with HDFC Bank leading the market higher. The Nifty continued its upward trend, closing at 24,286, up 0.67%, largely supported by the strong performance of HDFC Bank and other private banks. This marks almost seven to eight consecutive sessions of gains, baffling many observers.

Nifty Next 50

In addition, Nifty Junior surged by 1.08%, closing at a new all-time high, signaling renewed momentum in smaller cap stocks.

Nifty Mid and Small Cap

The Nifty Midcap index also achieved a new all-time high, rising by 0.78%. This indicates a broader market participation beyond just private banks, as small caps also saw gains of 0.9%, nearing the 17,500 mark. This performance has left many sellers and short-sellers in disbelief, particularly those with significant put positions.

Nifty Bank Overview

In addition to the midcaps and small caps, the Bank Nifty surged by 1.77%, reaching a new high by the end of the day. This reinforces the overall bullish sentiment across the market, with virtually all indices hitting new highs.

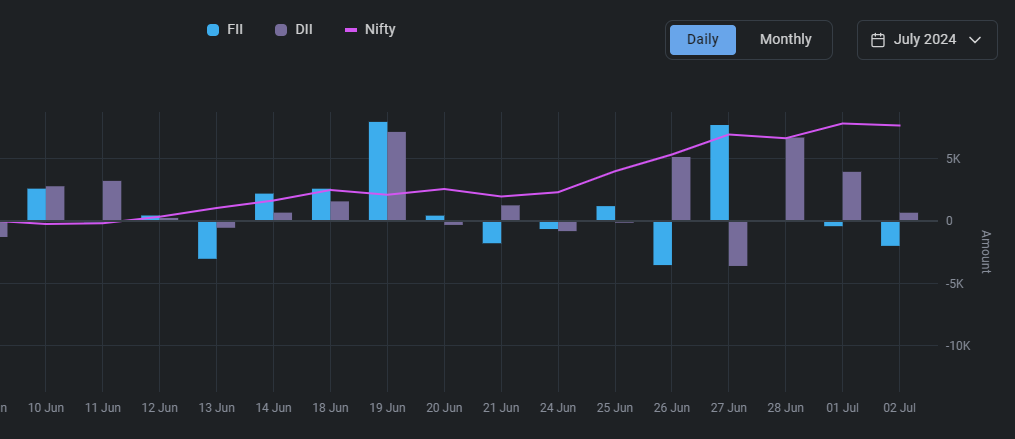

FIIS and DIIS

The FIIs (Foreign Institutional Investors) continued to show reluctance, with net selling amounting to 2000 crores yesterday. In contrast, DIIs (Domestic Institutional Investors) demonstrated more positive sentiment, with decent buying totaling 648 crore. This highlights a trend where local investors, including domestic institutions and retail investors, are increasingly driving fund flows in the market.

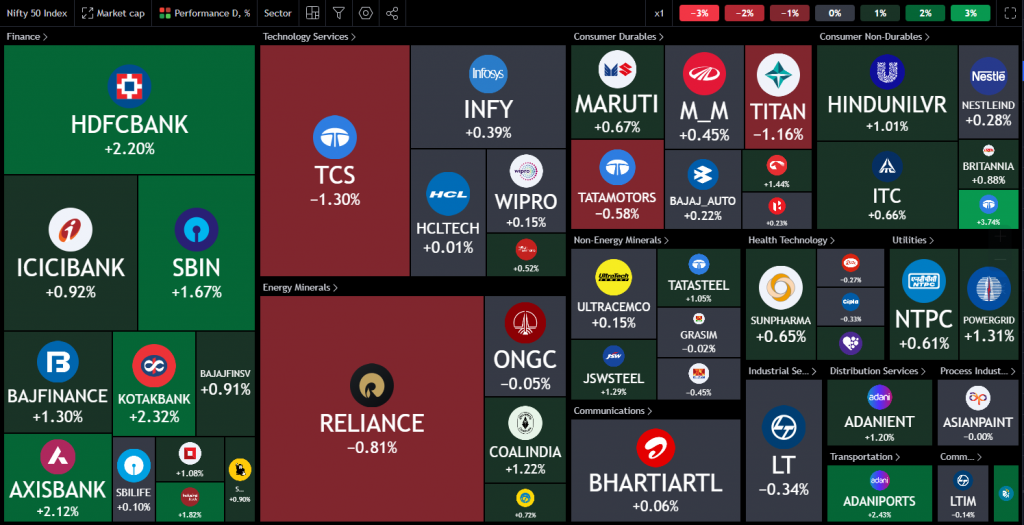

Nifty Heatmap

HDFC Bank led the charge with a 2.2% increase, supported by other banks like ICICI Bank, Axis Bank, Kotak Mahindra Bank, and State Bank of India. Meanwhile, ITC, Britannia, Tata Consumer, and other FMCG stocks also saw positive movements, contributing to the market’s upbeat mood.

Within the Nifty Next 50 segment, stocks like ReC and PFC made substantial gains, prompting new brokerage reports to forecast even higher targets for these companies. This surge was not limited to specific sectors, as insurance companies, Havells, HAL, public enterprises, and Varun Beverages all saw upward movements.

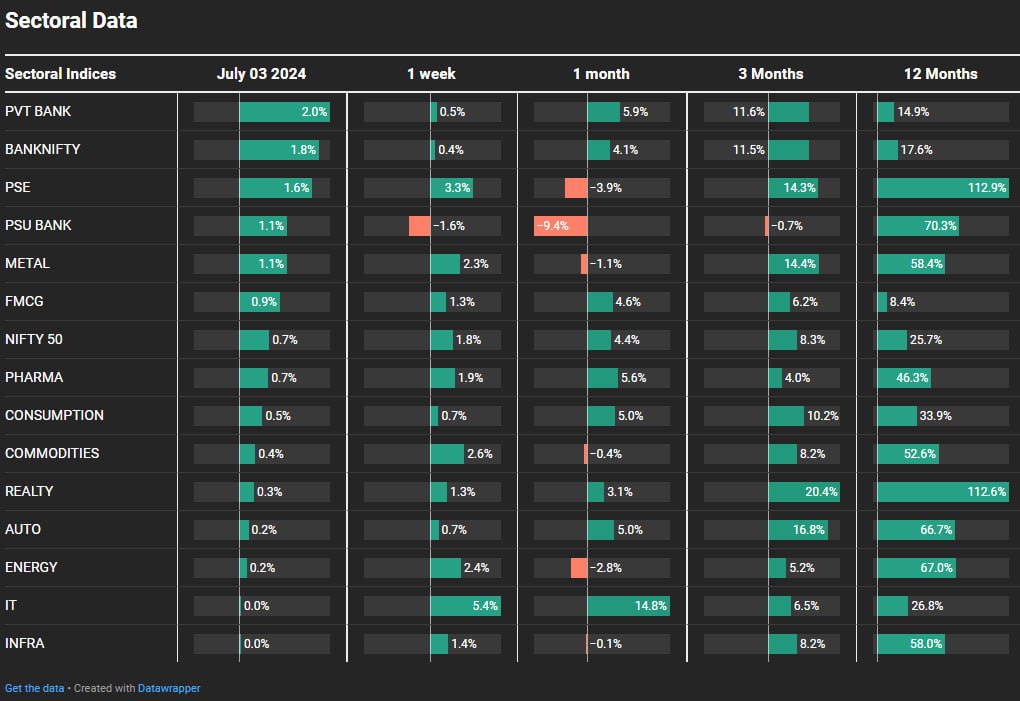

Sectoral Overview

Today’s market saw a robust performance across various sectors:

Private banking led the charge with a 2% gain, marking a strong continuation of the breakout that began in June. Public sector enterprises followed suit with a 1.6% increase, alongside PSU banks, which saw an unusual but positive uptick of 1%. Metals and FMCG sectors also showed resilience, each gaining around 1%. Real estate, auto, energy, and cement sectors also eked out gains, contributing to an overall bullish sentiment across the market.

Specifically, HDFC Bank stood out with a notable 3% increase. This surge was partly driven by recent speculation regarding foreign institutional investor (FII) interest triggered by potential adjustments in HDFC Bank’s foreign ownership below 55%. This speculation, fueled by reports from Novama, suggested that such adjustments could lead to significant inflows of $3.2 to $4 billion into the bank.

Sectors of the Day

Nifty Private Banking Index

Private banks, as I have been mentioning, this breakout that happened earlier in June is continuing.

So there is continuation on this front. There has been two minor corrections and closing at a new high. So the rally is very much on here.

Stock of the Day

Castrol India

Gold Chart

Gold also started to move today after many days up 0.7%.

Story of the Day

The recent uptick in HDFC Bank’s stock price, driven by speculation surrounding potential FII inflows if foreign ownership falls below 55%, has stirred significant market interest. Here are the key points to consider:

The surge in HDFC Bank’s stock followed a report from Novama indicating that reducing foreign ownership below 55% could attract substantial FII investments, estimated between $3.2 to $4 billion.

Investors reacted swiftly to this speculation, leading to a rush to buy HDFC Bank shares, pushing the stock price up by approximately 3%.

Despite the optimism, uncertainty looms regarding the timing and certainty of these potential inflows. The specifics of MSCI’s assessment and the foreign ownership threshold remain unclear, which could contribute to volatility in HDFC Bank’s stock in the coming weeks.

From a technical perspective, HDFC Bank has broken out to new all-time highs, typically indicating positive momentum. Investors interested in short-term gains may consider entering with a clear exit plan in case anticipated FII flows do not materialize as expected.

Over recent years, HDFC Bank has trailed behind some peers in terms of stock performance. While the current rally presents short-term trading opportunities, its ability to sustain momentum and outperform peers in the long run remains uncertain.

For investors, it’s essential to balance short-term trading strategies with long-term investment goals. Monitoring market developments closely and having a well-defined investment strategy will be crucial amid potential volatility.