Story of the Day

Today was a highly anticipated day due to the outcome of the elections, which had built up a lot of expectations. Some expectations were met, while others were not, resulting in really volatile markets. Yesterday saw a huge bump up, and there was an expectation that this would continue. However, today, the markets cracked because the ruling party’s expected numbers were not met.

The story of the day is, of course, the election results, which fell short of expectations, leading to market adjustments. On Monday, we saw a huge gap up, with markets closing at around 23,200. On Tuesday, we saw a crackdown to as low as 21,200 or nearabouts before recovering to close at 21,884. This fluctuation has pushed us back virtually to the same point where we were at the start of the year. The entire calendar year gains have once again been washed out. This has happened several times this year—first in March, then April, then May, and now again in June.

Portfolios started in February, March, and April are currently at even, while those started more recently are in the red. However, objectively speaking, no major gain has been lost yet. We are still sitting near 22,000, which is a fine level for the Nifty given the current market situation. Many folks sitting on cash likely came into the market when it cracked today, and a lot of shorts would have been covered. Although we don’t have the stats for the net shorts at the end of the day, it seems like stability may return somewhere in this ballpark. Today’s low becomes very crucial because it is also support from the past.

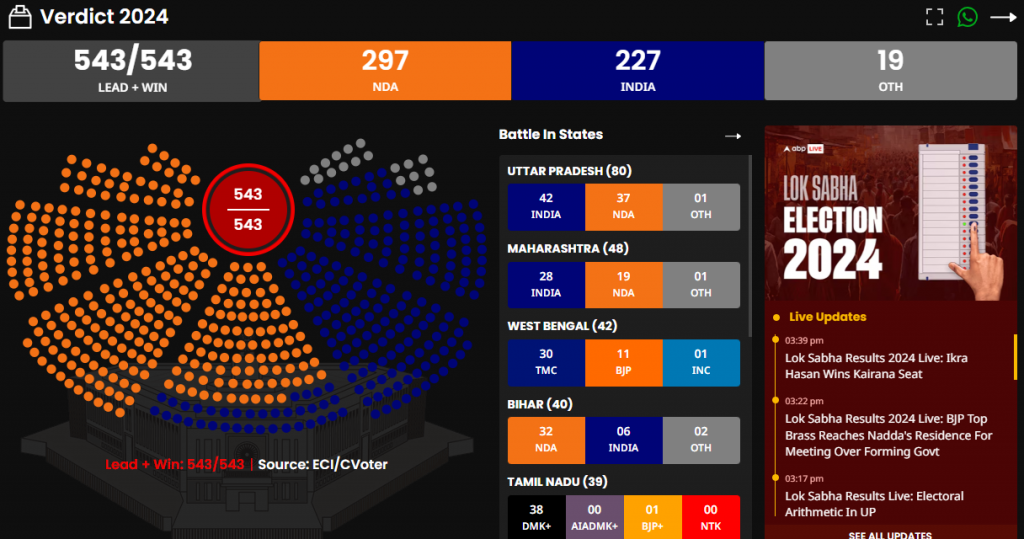

The 21,200 level now becomes the Lakshman Rekha. If this is breached, we could see much further declines. This is the verdict as of 04:00 p.m., and here is a screenshot from ABP Live. A lot of folks were heated about why we did not get 350, 370, or 400 seats, and some key states did not perform as expected. Nevertheless, there is a comfortable majority of 272 seats and above, with 19 others likely to support the NDA.

So, the continuation of governance is not in question. Let’s be very clear about that. If this were to be the final tally, and there is still about an hour or two to go, the continuation is not a question. The only question is whether the market can support the current levels regardless of this change. Were we too much into an expectation mode before the election, which got thrashed down, or were we in a range for many months pre-election? It seems we were pretty much in this 21,800 to 22,000 range, going up and down, up and down. So, there isn’t really anything to lose from here, in my sense.

In the worst-case scenario, if the numbers change by the end of the day and come closer to 272, and there is nervousness in the market, we might see another 5-10% decline at worst. But I don’t think we have anything much more to go. The focus will now immediately shift to earnings, the upcoming budget, and how ministries are allocated.

In the very short term, there were huge whiplashes. On Monday, shorts were crucified, and on Tuesday, today, longs were crucified. Short-term players have had their lives hijacked in these last two days. Hopefully, the support that has come through will be where the Nifty may consolidate. Right now, in the very short term, it is still in a downtrend. Other benchmarks also crashed quite remarkably intraday.

Nifty Next 50

Nifty Junior saw a dramatic fall from 71,000 to nearly 61,000, marking a 14-15% decline, before recovering somewhat to where it was at the start of May.

Nifty Mid and Small Cap

The Mid Cap index experienced a sharper fall, taking it back to levels seen in mid-April. The Small Cap index, which had not been making new highs recently, closed exactly at its support point, indicating a 14,800 to 16,000 range. A break below this range could weaken the small caps further.

Nifty Bank Overview

The Nifty Bank Index, which saw a breakout yesterday, collapsed today, closing lower within its previous major pivot at around 47,000. This suggests a directionless situation may prevail for some time.

Gold Chart

Gold saw a minor bump up due to INR dropping from 83 to 83.50, though its overall range remains between 72,600 and 71,000.

FIIs & DIIs

Monday’s session saw both FIIs and DIIs buying heavily, nearly 8,000-9,000 crores in the cash market. However, today might have been a sell-on-news reaction, with the market reassessing the new political landscape.

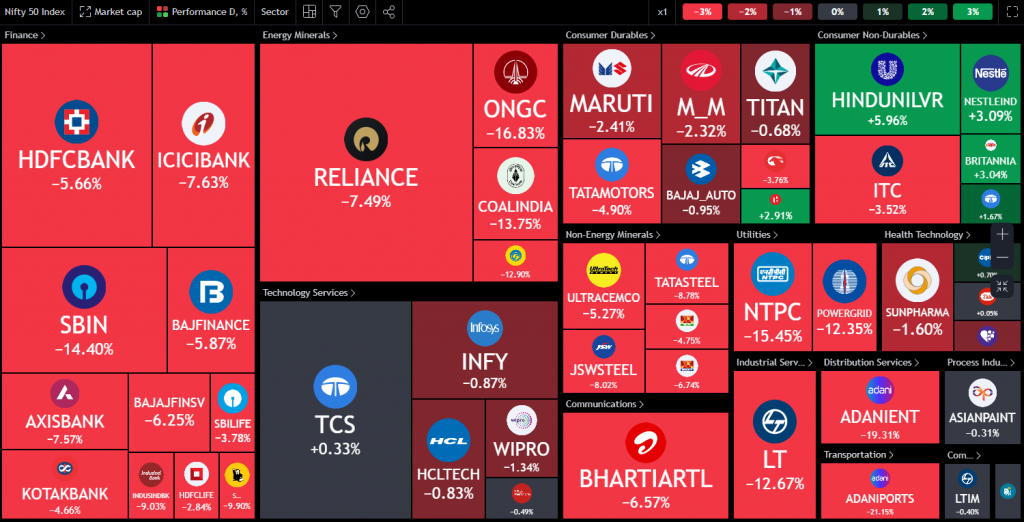

Nifty Heatmap

Heat maps predominantly showed red, except for FMCG stocks, indicating defensive buying as investors moved away from risk-on trades. Major declines were seen in Reliance (-7.5%), State Bank of India (-14.4%), HDFC Bank (-5.5%), and ICICI Bank (-7.6%). Other significant drops included NTPC and Power Grid, both in double digits, and Axis Bank (-7.5%). Adani stocks and other public sector enterprises like REC and PFC saw substantial losses, with some dropping 25%. Major names like DLF, ABB, Tata Power, and Vedanta also experienced steep declines.

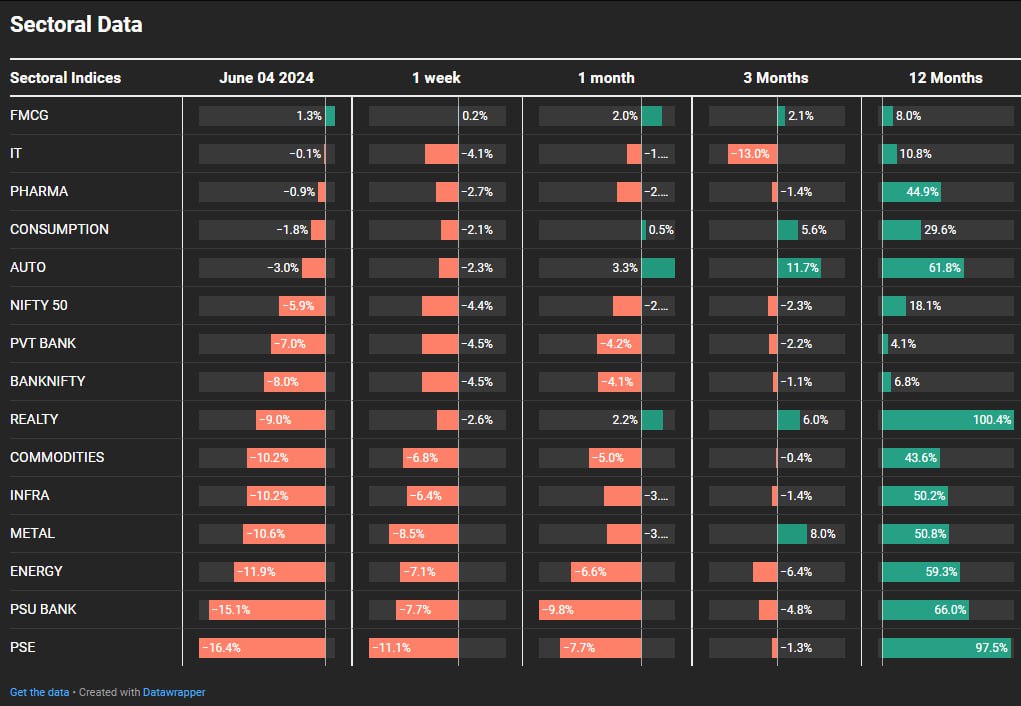

Sectoral Overview

Sectoral trends showed dramatic moves, with PSU banks, public sector enterprises, energy, and metals down 10-16%. Real estate was down 9%, Bank Nifty down 8%, and the broader Nifty 50 down 5.9%. Autos were down 3%, while IT, pharma, and FMCG were spared, being seen as defensive sectors.

Sectors of the Day

Nifty PSU Bank Index

In terms of the PSU Bank index, we have been brought back to mid-February levels, effectively canceling out any gains made during that period. We should get support at this level, as we’ve seen support here a couple of times before, and that’s where the market stopped today. However, we don’t know what will come next. If FIIs (Foreign Institutional Investors) really press the sell button, we could go lower, but that will only be seen in the coming days.

Nifty PSE Index

Similarly, public sector enterprise stocks have returned to where they were in February. The gains from the last three to four months, especially those since March, have been erased. The FMCG index experienced a sharp decline but recovered very smartly during the day. It took support and closed above its range. This suggests that FMCG stocks are not willing to go down any further from these current levels, as indicated by the index’s behavior.

VIX

The VIX, which had calmed down to 19, surged back up to 32 before closing at 27, indicating increased volatility.

USD/INR

Similarly, USD/INR moved from 83 to 83.60, nearing an all-time high. Any further market declines could push it even higher.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz