Story of the Day

Many weekend investors likely saw one of their biggest portfolio gains in the last five years. The momentum has been remarkable, with portfolios ballooning in size, and today’s 3-6% gains on already large holdings have been spectacular. It’s a great day for momentum investors, while those against the momentum might be struggling.

Story of the Day: Strong Market Move After Exit Polls

Today’s big story is the confident market move following strong exit polls. Many people were cautious about these polls, but the numbers were impressive. My observations, based on on-ground realities, suggest significant positive changes that have occurred under the current government, such as widespread infrastructure improvements. Performance speaks for itself, and despite any anti-incumbency sentiment, it seems difficult to ignore the tangible benefits many people have experienced.

The exit polls were phenomenal, predicting a strong lead for the current government. Historically, final results have been about 10% more favorable than exit polls suggest. Most polls are predicting around 360 seats, and we could see closer to 400, which would propel the markets even higher, potentially by another 4-5%.

Market Outlook

Today, Nifty was up 3.2%, Nifty Bank gained 4.35%, and Sensex rose by 3.5%. Despite a significant gap up at the open, the market held its ground, indicating robust strength. On the Nifty, the short-term trend has reversed. Despite overbought conditions, the market can stay overbought for a while, suggesting further gains are possible.

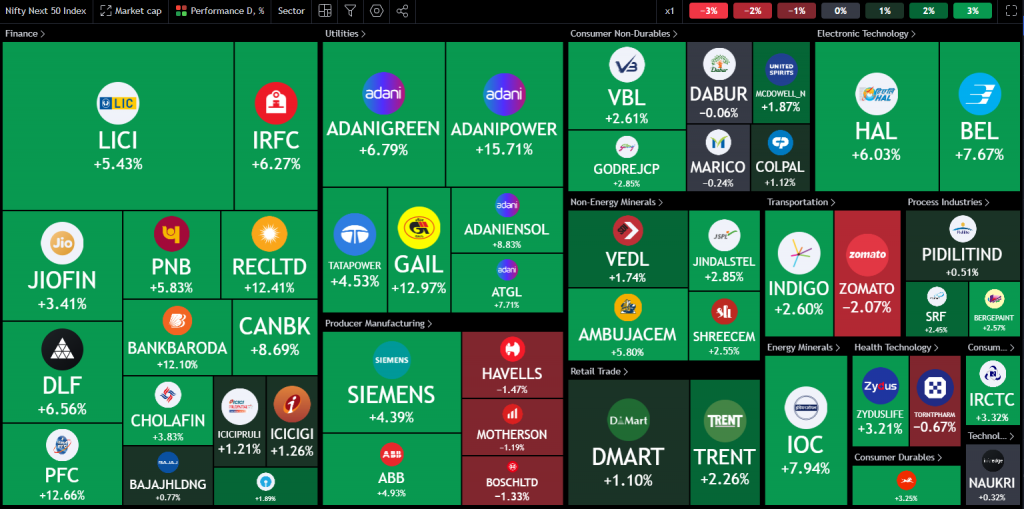

Nifty Next 50

Nifty Next 50 gapped up, sold off, but recovered to close near new highs.

Nifty Mid and Small Cap

Mid caps saw a good gap up and maintained gains throughout the day. Small caps are facing resistance since April 25th, indicating rotation out of small caps into mid and large caps.

Nifty Bank Overview

The Bank Nifty saw a strong move to new highs, leading the charge.

Gold Chart

Gold prices are subdued, with the strengthening INR impacting Indian gold prices.

FIIs & DIIs

FIIs bought 1600 crores yesterday, with today’s figure expected to be highly bullish.

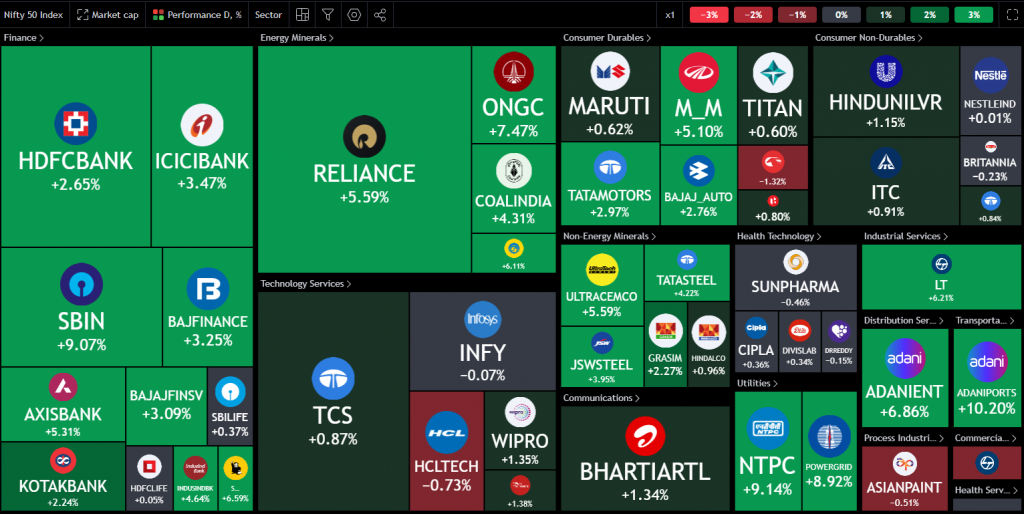

Nifty Heatmap

In the heat maps, top performers included Reliance, up 5.5%, L&T up 6.2%, NTPC and Power Grid nearly 9%, Adani stocks with Adani Enterprises up 7%, Adani Ports up 10%, Adani Power up 15%, and banks like SBI up 9%. In the Nifty Next 50, Adani Power rose 15%, Adani Greens 7%, PFC and REC both 12%, and HAL, BEL 6-7%. Sectoral trends showed PSU banks up 8.4%, public sector enterprise stocks up 7.8%, energy up 6.8%, real estate up 6%, and infrastructure up 5.5%. Defensive sectors like IT, pharma, FMCG, and consumption saw little to no movement.

Sectoral Overview

At every level in the last one year, people have said PSU banks, both public sector enterprise, they won’t go up. They won’t go up. It is exactly when you have put your own barriers. You are doing a disservice to your portfolio by not allowing it to run. Yes, whenever they will start to fall, you get out. But they are not falling.

Why you want to, you know, give up that strong momentum? This may be the move of this of the decade.

Why would you want to miss that, right? Another sector may start at some other time. We will go to that sector when it starts.

Sectoral trends PSU banks 8.4% for the day is mind boggling stuff. Public sector enterprise stocks 7.8% for the day. Energy stocks 6.8% real estate 6% infrastructure 5.5%. All sectors in green. But it pharma, FMCG consumption virtually no move. I would say these are defensives and right today it was not the day to play defense. It was a day to attack. And that’s what the bulls did. You know, all the risk on trades were taken and you can see where this has led.

Sectors of the Day

Nifty PSE Index

The public sector enterprise stocks 136% up in twelve months on stocks which people did not touch with a barge coal for ten years. This is the magic of momentum and how winners will take the entire cake away.

Nifty PSU Index

Nifty PSU banking index. You can see a huge breakout gap up and breakout here. You can see the channel breakout and staying above and closing at the highest point.

Stocks of the Day

Adani Enterprises

Very strong moves were observed, particularly with Adani Enterprises breaking out significantly. All Adani stocks showed impressive gains, reflecting a highly positive sentiment. This momentum was evident throughout the day, and everything seemed really upbeat.

However, it would be naive to expect that there won’t be any corrections at all. It’s important to capitalize on the market while it is in your favor. When a downturn begins, we’ll assess and decide on the necessary steps at that time. But there’s no need to fear the market’s heights. Don’t develop a case of market vertigo. After all, we might see another 5% gain tomorrow.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz