Market Outlook

it’s quite a surprising day for most market people. The market just started to sell off from the word go and did not stop till about 02:00 in the afternoon and after which it retraced a little bit, but the damage was done.So this entire last few days, the thesis that we are about to break out of this top has been filled.

The Nifty was the worst hit amongst all indices. It has also now created a huge bearish engulfing candle. So it seems like Nifty is in no hurry right now to go up. Now we have to wait for, you know, maybe some consolidation and another attempt potentially maybe now near the election results or leading to the election results.

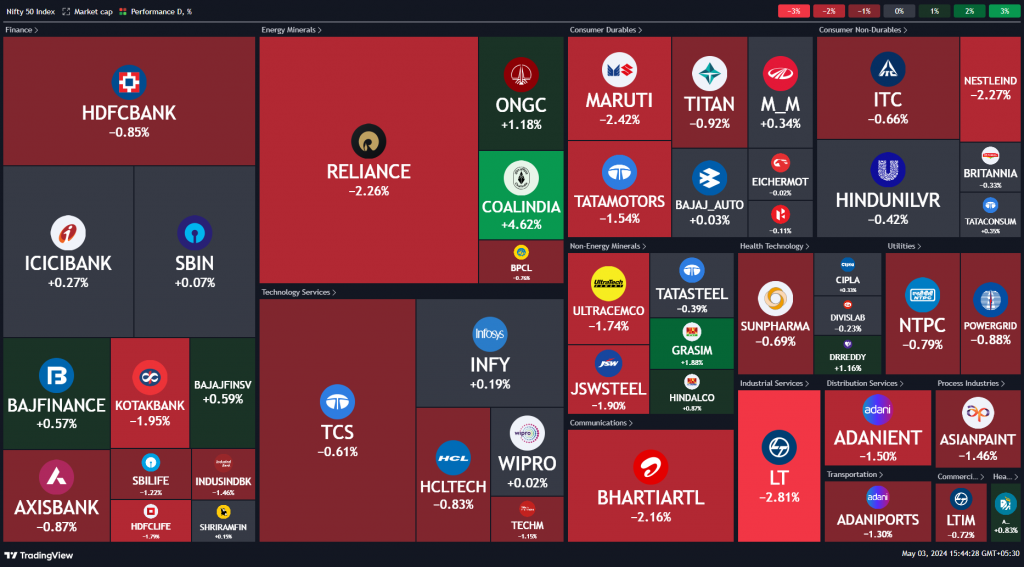

Nifty Heatmap

Nifty heat map was all red so nothing was spared. Whether it was autos, energies, banking system, L&T, steel stocks, FMCG, everything was beaten down there.

In Nifty next 50 heat map. There were some green spots. So public sector enterprise stocks like PFC, BHEL, continued to go up. You had DLF, LIC, PNB, Trent which have been very strong recently, SRF, HAL IOC losing ground. You had Godrej CP, Bajaj Holding, Siri Cement, and Torrent Pharma moving up a bit.

So Nifty next 50 was still a mixed bag, but Nifty was a total gone case today. It was down more than one and a quarter percent at one point of time.

Sectoral Overview

Public sector enterprise as you can see, only sector which managed to eke in the green along with pharma a little bit, metals remaining robust and remaining strong at zero. But you had infra stocks taking the brand today along with real estate, IT, autos and banking stock. So certainly, certainly FYI have pushed on the sell accelerator and the domestic buying is unable to sort of counter that as of now.

So this, this is maybe nervousness before the later parts of the election rounds or this is a result of the FOMC meet eventually. People are understanding that we are neither in a situation where interest rates will get cut on a sustainable basis, nor are we in a situation that interest rates can go up because the economy will get crushed. So again, the central bankers are stuck in a logjam. Some are calling it as an era of stagflation where the world basically stagnates while you allow inflation to run a little high so that the debts can be, you know, sort of if you allow the inflation to keep running high for five years, seven years, the outstanding debts will appear smaller at that point of time. So the seventies playbook is what most people are alluding to that in the seventies also, we had a similar situation globally and it’s essentially higher inflation, high interest rates were the solutions to that.

Mid & Small Cap Performance

Mid caps, however, I would think manage the day better. They lost some ground today, but did not go below the previous two days candle at close. So I think this is quite a reasonable sort of correction so far after this gigantic thousand point run. Small caps, also very limited down move today. So again, I would welcome this kind of a move and even maybe down to 15 400 to retest this breakout. But this is no problem at all.

Nifty Bank Overview

Nifty bank came back and retested this breakout point and has retraced a little bit above that. Hopefully we can build on top of this and not drop below the support point.

Nifty Next 50

Nifty next 50 was in fact fatal, hardly giving up any gains from yesterday’s close. And it has been the best performing index so far.

Nifty PSE Index

Public sector enterprise stocks surprising everybody on a daily basis. Even today, the public sector enterprise stocks were not in the red. Yes, they did give up some of the gains of the day, but still managing to close above yesterday’s close.

Nifty REALTY Index

Reality index gave up a percent, but ingestion zone, no real damage has actually been done.

Nifty Infra Index

Infrastructure was the one which has been, you know, demolished last four days of gains have got demolished today. So a sharp correction here. But again, it is a rising tops, rising bottom scenario. So no damage done in the longer-term structure of infrastructure index. So the market is in decent shape. Two steps forward, one step back. That is the nature of the market. One has to accept some down days.

In fact, I’ve done some content piece on this which will probably come next week where we haven’t had even a 10% correction in a long time now. So to expect that, you know, trees will go to the, will grow to the skies and we will never have any corrections. Is living in complete, you know, dream world in markets don’t work like that. 10% is the bare minimum. 20% is something that starts to get a bit serious. So 10-20% is that sweet spot that if you are able to get that kind of correction, one should be ready to deploy more money and that will come at some point or the other.

One should not have this expectation that a 10-20% drop will not come. It will surely come. When it will come is anybody’s guess. It will probably come at the time when nobody is expecting it, and that’s when it will happen. But you can’t plan for it. You can’t. People have been waiting since 2016 to get it, get to get the market to a reasonable valuation. But the market has a mind of its own, and the prior valuation perspectives of 20, 10-12, 13-14 have been demolished. I mean, the market never goes back to twelve price earnings now. So all these models have failed now, essentially, because the key model to follow is a liquidity model.

If the market is able to attract liquidity, markets will go up. If the liquidity goes out, the market will go down, regardless of any story that is built around the market. So that is what the momentum tracks and the momentum strategies follow. So, look for, you know, opportunities to get in and ride the wave till the wave is on.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz