Market Outlook

So the month comes to an end. And what an end it was. The Nifty actually went to a new all-time high just above 22,783 actually, and then collapsed back in the last one and a half hours. Last four sessions have been extremely robust in terms of the direction. The Tuesday session has sort of taken a backseat because Wednesday is a trading holiday and people don’t want an extended risk to remain open on such days. And possibly that is why a sell-off happened today also.

Sell-off many times happens whenever a market tries to go to its previous high. You can see it also happened beginning of April when the market opened at or above the previous high. It immediately collapsed but then recovered. And so it can happen many times where double top kind of pattern sellers emerge.

This move from 21,750 to 22,750 and above 1000 point move has come in less than eight sessions. So some profit booking here or there is always par for the course.

Nifty Heatmap

You can see the banks that had run tremendously yesterday had consolidated today not fallen, but just consolidated. You had a big chunk of auto stocks running up- Mahindra and Mahindra are doing extremely well at almost 5% up. You also had some public sector enterprise stocks really go up, you know, especially power and utilities related – Power Grid, REC, all these kinds of companies were doing really well. IT took a huge beating with Infosys, TCS, HCL, Tech all down by more than 1%.

In the Nifty Next 50 heatmap you can see many public setup units giving up some gains. So IRFC, HAL, BEL, IOC gave up ground. But at the same time, you had PFC up 6%, you had REC up 9%. So and some PSBs also PNB and Bank of Baroda that did not perform yesterday are performing today. So very, very mixed bag. Adani Power did very well. Vedanta, Ambuja, cement, SRF, Torrent pharma, Jio finance, Adani Green were mild losers. Trent actually came out with the result, which was five times of profits. But Trent has already discounted so much of these profits already running very hard.

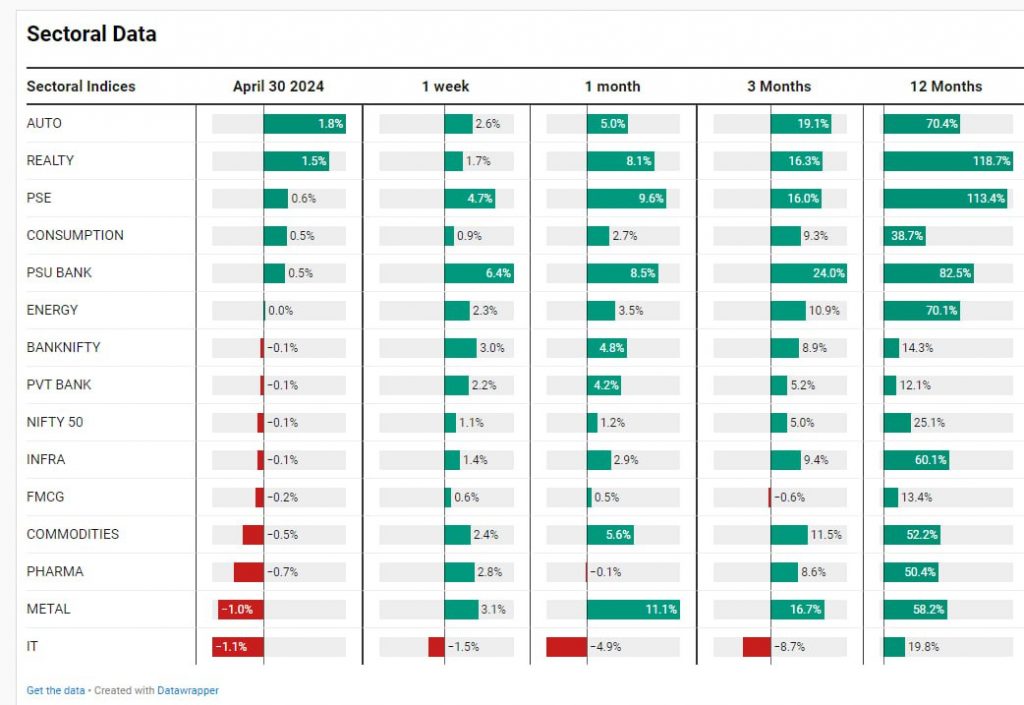

Sectoral Overview

Autos remained the top gainer for the day, 1.8% up, real estate up 1.5%. And you had a lot of other sectors between the zero to half percent or minus half a percent, and metals and IT were the ones that were down. Given all this, I think barring IT, most other sectors have been in the green for the last week and for the last one month, as well as for the last three months. So FMCG and IT, you can say, have been the weak points of the market.

Mid & Small Cap Performance

Mid caps also going to a new high, giving up the day’s gain, but still managing to close at a gap higher than yesterday’s close. So very, very strong there.

Small caps resting last three sessions, there has been no change in the closing price on the small cap 250. So it’s good that it is resting here. Maybe some more. It may come and retest this breakout and then go up. That is a possibility.

Nifty Bank Overview

Nifty bank also, after the sharp move in the last eight sessions, from 46,000 to 50,000, has taken some profit booking, which is always welcome.

Nifty Next 50

Nifty Next 50 also is going, you know, just going straight line up. Last seven, eight sessions, again nearing 65,000. Just see, it was just 50,000 or somewhere near that at the beginning of the calendar year, in fact, 53,000. And we are already at 65,000. So more than 20% gain has come in just four months. So definitely, definitely a lot of gain has come in a very short period.

We must always be mentally prepared for, you know, 510 percent kind of falls in this market. I mean, that is, if you are not prepared mentally, that your portfolio can go down by 20%, especially when the market has done what it has done. I think you are not having the right expectation. Your expectation cannot be that the market will continue to keep going up and it will never fall. You know, trees don’t grow to the skies. They get pruned periodically, and then they grow again.

Nifty Auto Index

At the end of the day, at the end of the month before, out as expected, great numbers. So we will know tomorrow. Tomorrow maybe day after, once the market opens, but a great sort of a closing of the month from March ending

Nifty REALTY

Real estate index reasonably robust, made a new high, and has closed at a new high. So no worries on the real estate index

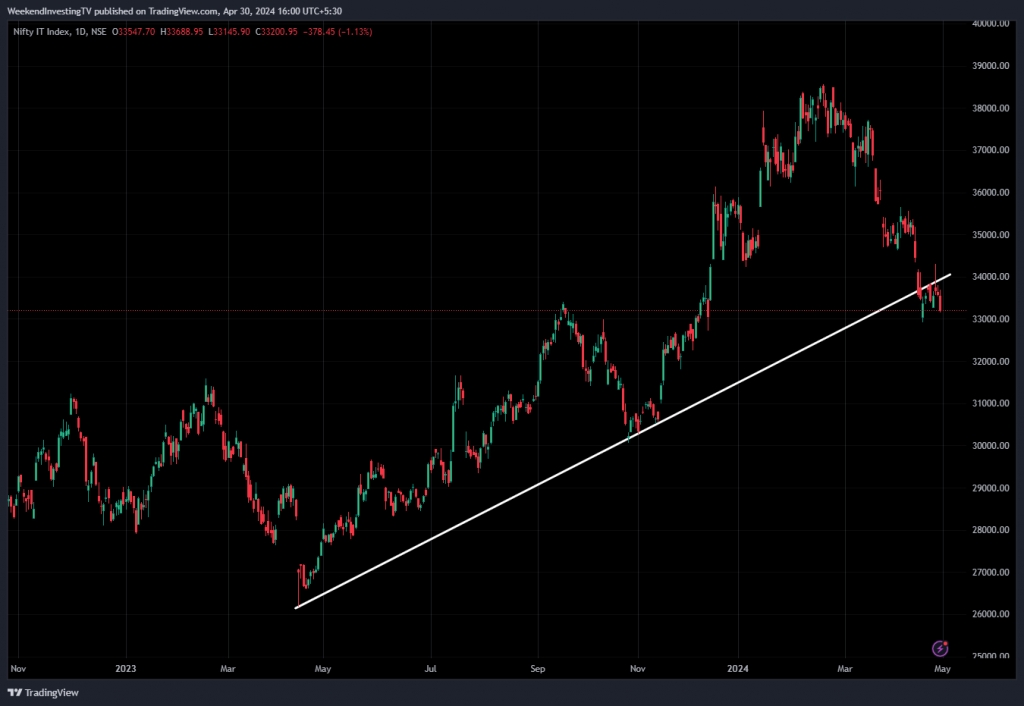

Nifty IT Index

IT index is where really the trend, which was broken earlier this month, has not sustained on the higher side. And in fact, it is sustaining below this trend line. So this is where the weak spot is. The IT index is already down more than 20% or so from the top and still looking weak. So it needs to find some feat here and, you know, maybe get into some consolidation before the next move up comes.

Nifty Metal Index

Metals index is where some pain was there about a percent down. But again, Metals index has run up so much that even if it comes off by another 510 percent, I wouldn’t be surprised.

At the end of the day, at the end of the month before, out as expected, great numbers. So we will know tomorrow. Tomorrow maybe day after, once the market opens, but a great sort of a closing of the month from March ending. So positive cues in the automobile sector also. So overall, I think the market is in very good shape. I think after two rounds of elections, the government is reasonably confident. I don’t think there is any surprise that is at least so far building up in the expectations.

And overall, I think the narrative will very quickly move to US elections post-June, May. And the first couple of weeks of June probably is the only period now, four to six weeks where we will talk about local, you know, outcomes of election and the immediately after the election. The next item on the agenda for action will be the budget, which will probably, I think, will be by June end or July. And then, of course, the action shifts to what the Fed will do before the US elections. Now, there are two schools of thought.

Trump supporters are saying that if Trump comes in and Trump is saying, we will make sure that interest rates go to zero. So one can expect a lot of cuts in the market post-November interest rate cuts. But Biden administration, the way they are going currently, it seems that we are not even close to one or two cuts. So that’s where we are in terms of the outcome.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz