End of the month finally, and this month has been one we want to forget. Nifty has been continuously receding, with FIIs continuously selling. Today was another day where the markets did not hold their ground and succumbed to selling pressure.

Happy Diwali to all patrons of Weekend Investing! We have some ongoing offers during this period. If you’re interested, please use these codes to avail discounts and start your journey with Weekend Investing.

IT stocks have rattled the markets today. Should we be cautious? How have IT stocks performed in the past, and what kind of future do we see? This will be the topic of discussion in the second half of the video. Please read the disclaimer and sign on to the channel if you haven’t done so far.

Where is the market headed?

Market Overview

The markets are continuously bleeding, currently trending downwards. As I’ve mentioned multiple times, this marks the completion of a second head-and-shoulders pattern. The first one is behind us, and we are now witnessing the completion of at least the head. Whether there’s a shoulder here or if we go straight down is uncertain. Today, we closed down half a percent, reaching almost a three-month low. This month has seen consistent declines. We were at about 25,800 on the last day of September and have closed at 24,200.

After 20 odd sessions of losses, we could feel down about the market’s state. However, if we look at the broader context, last Diwali the markets were at 19,500. So, during this Samvat, we’ve seen an increase of nearly 4,700 points, which is a little over 20% on a 19,500 base. A 20% gain in the Nifty, along with other indices showing even larger gains, isn’t a bad outcome over the past year.

It’s important to maintain a larger perspective. If you only focus on recent highs, it may appear sluggish unless you’re viewing it on the day a peak is reached. This is part and parcel of market behavior, so no worries on that front.

Nifty Next 50

Nifty Junior also saw a half-percent decline but remains within the large bar from last Friday, indicating it’s not yet out of that range.

Nifty Mid and Small Cap

he Nifty mid-cap space was down just 0.19%, leaving us without much to interpret. However, Nifty small caps showed a 1.5% gain, indicating they’ve moved out of last Friday’s shadow and are targeting averages moving forward. This suggests that, at least for now, there’s no further selling pressure in Nifty small caps.

The large caps remain under pressure, with FI holdings in that segment around 18%. This presents a potential for further selling, but I hope this trend will ebb soon.

Nifty Bank Overview

Nifty Bank lost some ground today, with the significant candle from Tuesday completely erased. The Bank Nifty is down 0.64%,

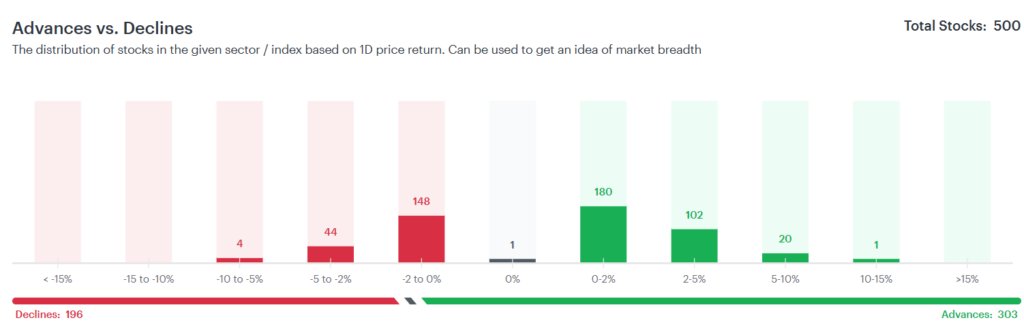

Advanced Declined Ratio Trends

in the advance-decline ratio, there were still 303 advances versus declines.

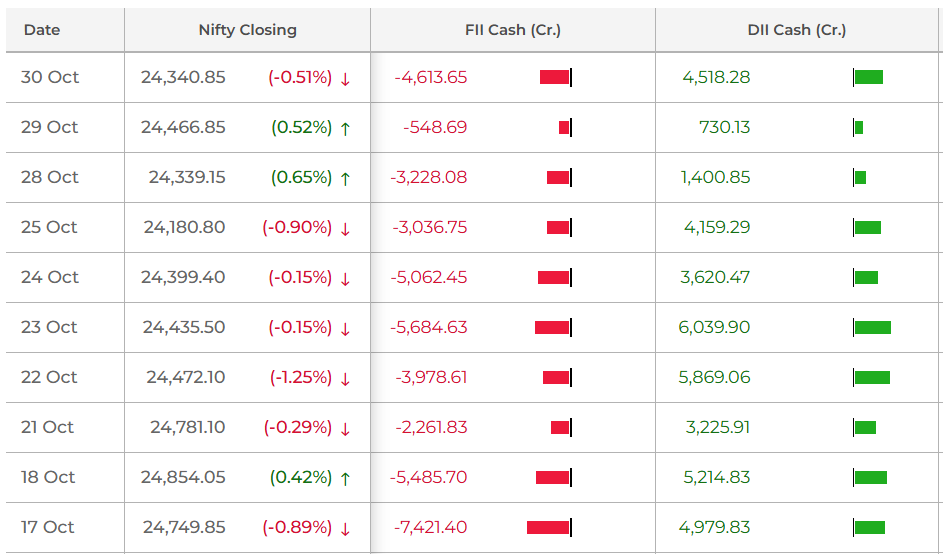

Even though the overall market was down, the CNX 500 is showing a favorable advance-to-decline ratio. On the last trading day, the FII trend indicated 4,600 crores in selling versus 4,500 crores in buying by DIIs, continuing that balance.

Nifty Heatmap

Today, the major heat was in the IT sector. IT stocks were heavily impacted, with Tech Mahindra down 4.5%, Infosys down 2.5%, TCS nearly 3%, and HCL Tech down 4%. ONGC and L&T were among the stocks attempting to stabilize the Nifty, but many others were also down, including ICICI Bank after a brief rally, and Reliance down 0.8%. ITC, Hindustan Unilever, and Nestle also faced declines.

In the Nifty Next 50 space, stocks like Mother Son, Boss Travels, Zomato, Naukri, Vedanta, and Varun Beverages also saw losses. On the upside, some gains were noted in Torrent Pharma, Adani, Tata Power, and Loda, which helped counterbalance the broader move. Overall, it was a mixed day for both the Nifty and Nifty Next 50.

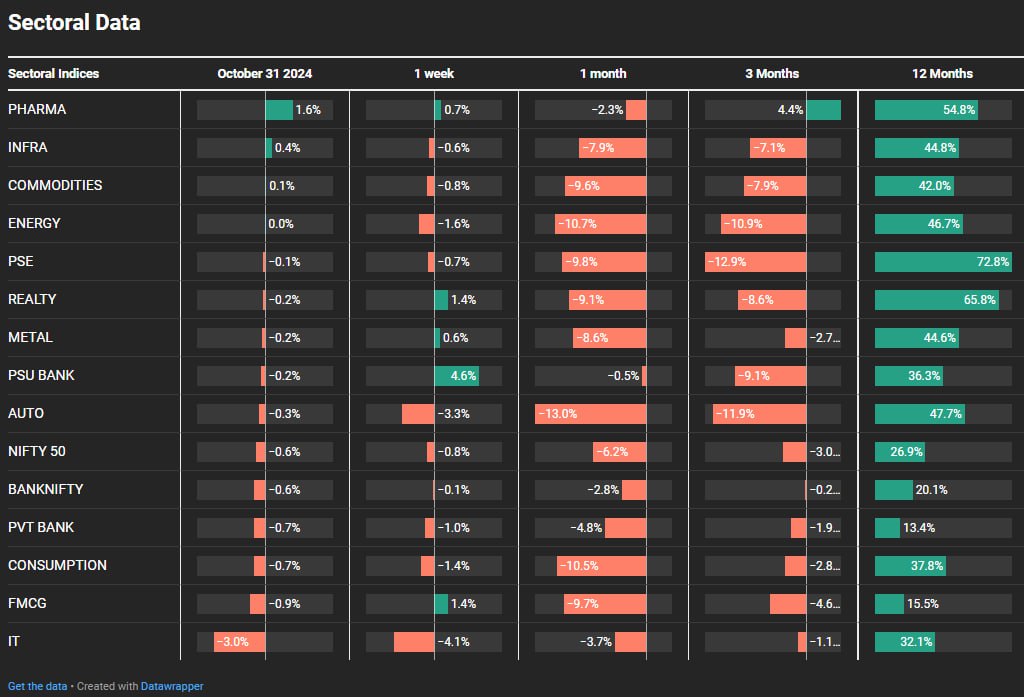

Sectoral Overview

In terms of sectoral moves, only two sectors truly mattered today: IT on the downside (-3%) and pharma on the upside (+1.6%). The performance of other sectors was largely indifferent. For the past week, pharma stocks have now turned green, making it the worst-performing sector for the week at -4.1%. The best-performing sector remains the PSU banks, which clocked a 4.6% increase this week.

Over the last month, all sectors have been in the red, and the same holds for the last three months, except for pharma. It has been a dull three-month period, but history shows that after periods of dullness, brightness follows. We can only hope this phase will pass soon.

Sectors of the Day

Nifty Pharma Index

Today, some pharma stocks showed rapid increases. Cipla was up 9%, JB Chemicals 4.1%, and Granules, Ajanta Pharma, and Torrent Pharma also gained ground. More money is moving towards defensive stocks as the overall market struggles.

Stock of the Day

Rattanindia ENT

The stock of the day was Ratan India Enterprise, which surged nearly 16%, rising from around 62 to 74 rupees. This has formed a flag pattern, suggesting potential breakout momentum.

Story of the Day

The weakness in IT stocks can be linked to the recent earnings reports from Microsoft and Meta Platforms for the September quarter. While the numbers appeared fine initially, deeper analysis indicated that forecasts suggested significant AI investments were insufficient to meet capacity constraints. This mismatch between needs and investments has led to a knee-jerk reaction affecting global IT stocks.

Our IIT index, which had been hovering near all-time highs for months, now looks poised to break down. It retraced back to mid-July levels today. If it recovers sharply within a day or two, it may indicate a false breakdown. However, if it continues to build downward towards 38,000, we could be looking at a clear breakdown.

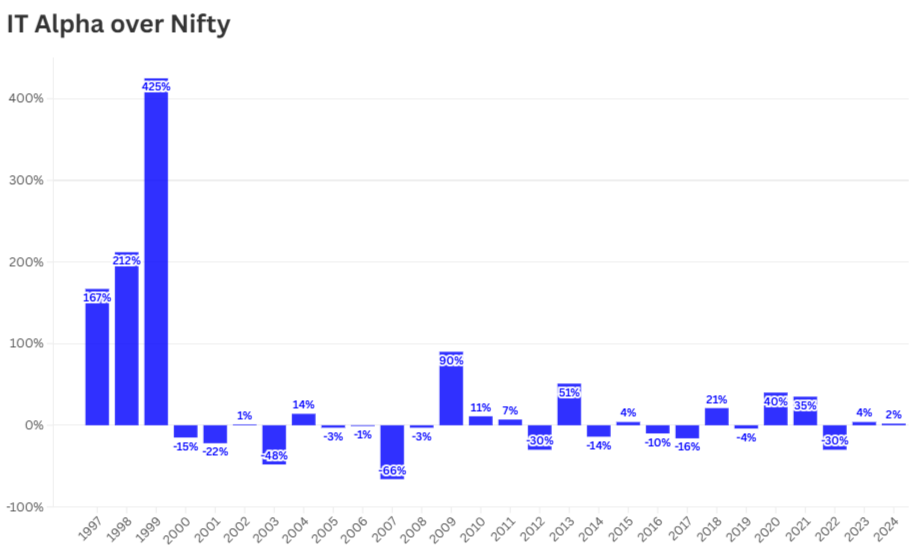

The support level of 41,300 has been broken, undermining the earlier cup-and-handle breakout that many anticipated would propel IT stocks higher. Historically, IT stocks have performed well, especially in strong Nifty uptrends, with notable gains in the pre-2000 era, and significant rallies in 2009, 2013, and more recently in 2020 and 2021.

If we look at long-term charts, the Nifty CNX IT returns have shown a remarkable 9,000% increase over the past 28 years, whereas the Nifty itself has seen gains of around 2,600%.

However, since 2000, the situation has changed, with the Nifty growing approximately 1,300% while the CNX IT managed only 441%. More recently, since COVID, IT stocks have performed relatively well compared to the Nifty.

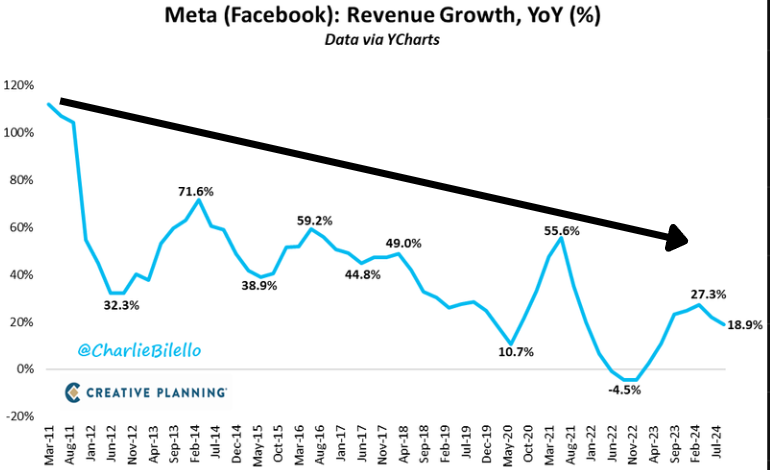

The narrative surrounding Meta has also been choppy. For instance, post-2021, the stock saw a massive fall of 77%, then rebounded to a new top and has since risen 40%. This kind of volatility makes it challenging to navigate the market dynamics, especially with liquidity shifting drastically based on changing narratives.

Currently, there’s a mismatch between revenue growth and stock prices for many companies, particularly in the IT sector. While revenue growth for companies like Meta is declining, stock prices seem to be reacting independently, causing discrepancies in valuations.

Despite the current negative sentiment towards IT stocks, I believe this may not persist for too long. The narrative can shift back to positive very quickly. For instance, revenue growth for Meta has tapered off from mid-40s or 50s CAGR growth to now being in the teens, and the post-COVID period has also brought challenges.

Even within the IT space, it appears that large caps are where most of the damage has occurred, with mid-cap stocks showing relatively less impact. This offers some hope that we may see stabilization in IT stocks over the next week or two, possibly alleviating the current downward pressure.

If you have specific insights or plans regarding IT stocks or if you’re employed in the IT sector with additional perspectives, please share your thoughts in the YouTube comments.