Story of the Day

The election is behind us, and the government is set to stake a claim for continuation on 8 June, which is the planned date for the ceremony. There are many ifs and buts in the minds of folks regarding whether the coalition partners will demand concessions that might be acceptable or unacceptable to the markets. So far, there has been no such talk, and the coalition has shown support.

The Nifty roaring back to the pre-election level is the news of the day. If you observe the Nifty movement, we were at around 22,500 on the Friday before the exit polls. We saw a significant gap up on Monday, closing higher with expectations that the exit polls were correct. However, they weren’t. On the day of the election results, there was panic in the market due to high expectations not being met. After some recovery, today, despite a shaky first hour, the market continued to build up and closed slightly higher than the pre-election level.

From an index point of view, if someone had been sleeping for these two days, they would not notice any change. The Nifty is where it was two days ago and was also there two months ago. We haven’t done much since the start of the year, being around 21,800 then and 22,600 now. So, we’ve essentially stagnated in the last five-plus months. While this isn’t great news, it also means the market has consolidated at this level, accepting it over a five-month period.

Market Overview

Looking at the metrics from a value perspective, Nifty’s valuation is in the same ballpark as the last two years, indicating stability.

Another insight from today’s move was the flash crash of the VIX, which subsequently culminated at a lower point. India VIX is now down to 19, a level we’ve been at for the last three weeks. The volatility index only spiked during the build-up to the election day, the exit poll, and the election result day. Now, it has reverted to levels seen around 13 May and could potentially stabilize further as this event and its repercussions settle down.

As the saying goes, after a big earthquake, there are often smaller aftershocks. We might experience some more volatility in the coming days, but largely, it seems the storm is over unless there are new developments on the political front, such as disputes over government formation or claims by the opposition about having the numbers to prevent it. As of now, it appears that stability is returning.

Where is the Nifty headed? It’s very difficult to say at this point because the Nifty is exactly where it was in the months before the election. The aftereffects of this significant move have to settle in. For this week, it would be prudent to take very cautious short-term moves or trades if necessary. There is still considerable potential for volatility. We may retest the recent lows, or we might break out from the current levels. If we break out above 22,700, it would strongly suggest that the short-term downtrend is over.

Nifty Next 50

Nifty Next 50, which had fallen sharply, has not fully recovered to pre-election levels but is not far off.

Nifty Mid and Small Cap

Mid caps recovered very well, and they are now pretty much where they were at the pre-election level. Small caps, which had not made a new high and were unable to make a new high, are just hanging in there. They haven’t fully recovered to the pre-election results levels but are definitely trying to establish some support around the 14,800 level. During the last two days, there have been several attempts to break down below this level, but these attempts have failed so far. This suggests that small caps might experience a short-term downtrend moving forward.

Nifty Bank Overview

Bank Nifty has rebounded smartly, returning to pre-election day results levels. Despite the State Bank not recovering as strongly as expected, private banks have surged significantly. This shift indicates a movement from public sector banks and public sector enterprises into other sectors. This trend will be elaborated on later in this video.

Gold Chart

Gold is flat. This entire movement of USDINR from 80.05 to 83.6 and back has not impacted the gold price much, which remains stable. This stability in gold is a good sign amidst the currency fluctuations.

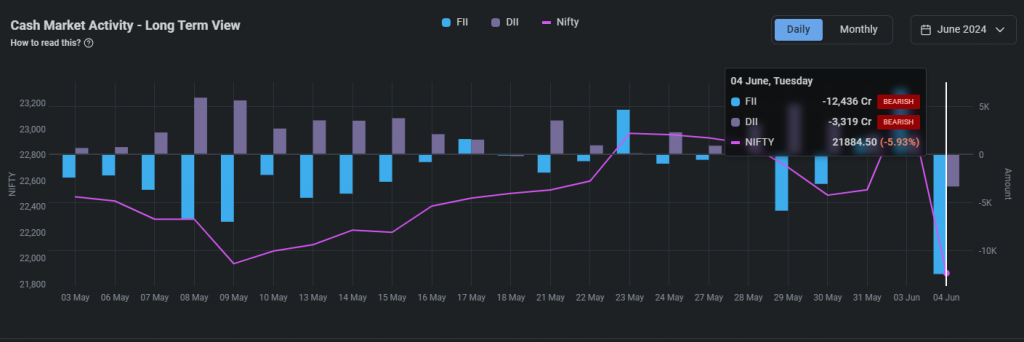

FIIs & DIIs

Yesterday, on the election result day, there was a significant sell-off. FIIs sold over 15,700 crores worth of assets, indicating a considerable shedding of positions. It’s challenging to determine whether they are still hedging their positions or if longs are being cut. DIIs, on the other hand, have shown selling activity of this nature after a long time. For the past month, DIIs have not been selling.

From this perspective, today’s upward movement is crucial to understand the actions of FIIs and DIIs. This will become clearer by the evening when more data is available on their activities.

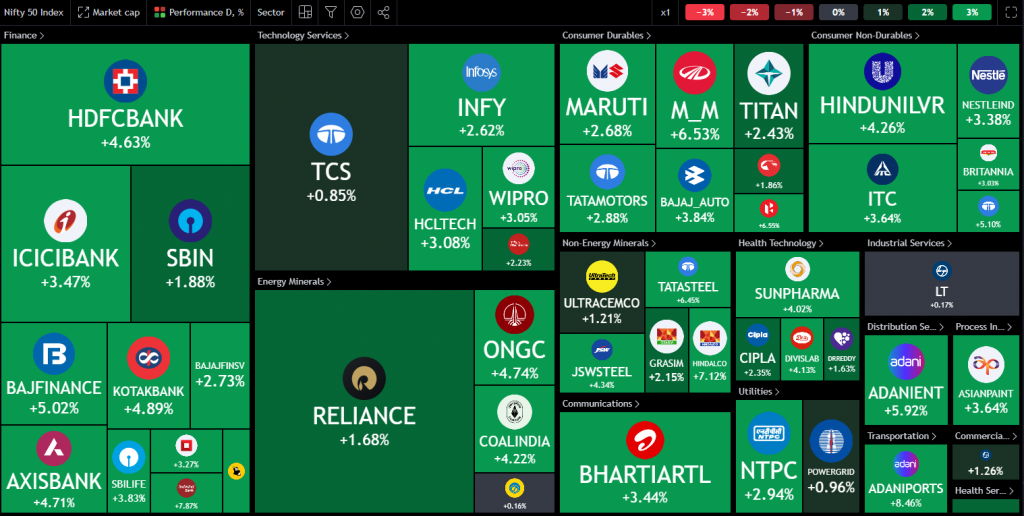

Nifty Heatmap

The heat maps are currently showing a lot of green, indicating a bounce-back. However, it’s important to remember that they were stark red yesterday, so today’s green bounce might look more significant than it is. The troubles in the market may not be completely over, although there’s a chance they could be.

State Bank of India (SBI), for instance, despite being down by 12% previously, only rose by 1.8% yesterday, indicating minimal recovery. Reliance Industries also dropped more than 7% but only rose by 1.6%, showing virtually no recovery. Significant moves happened in the FMCG sector from the start of the day. Stocks like Hindustan Unilever, Nestle, ITC, Britannia, and Tata Consumer performed well. In private banking, banks such as HDFC Bank, ICICI Bank, Axis Bank, and IndusInd Bank moved up smartly. Auto stocks, including companies like Mahindra & Mahindra, Bajaj Auto, and Maruti, did extremely well. Adani stocks, such as Adani Ports and Adani Enterprises, also performed well.

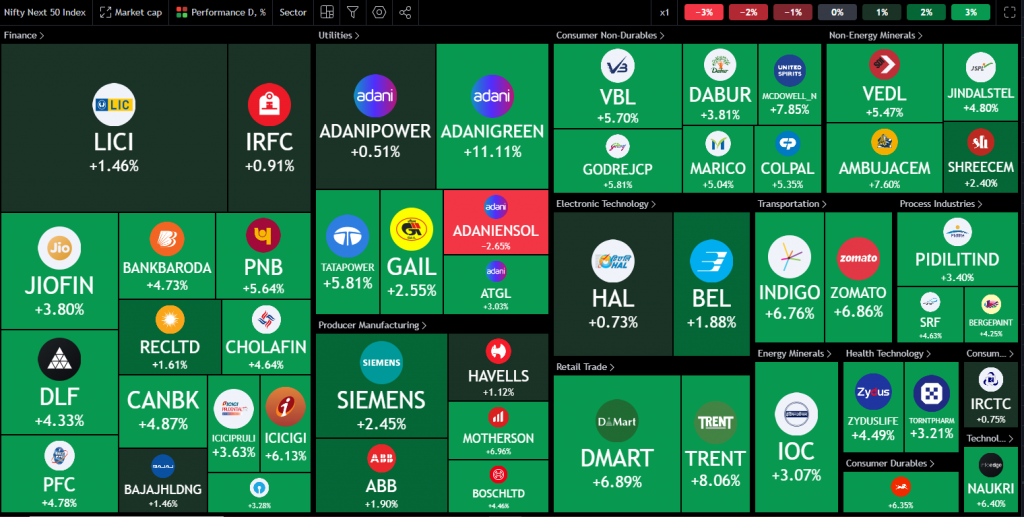

On the other hand, public sector units like NTPC and Power Grid, which fell by around 10-12%, saw only a marginal comeback. REC showed no recovery after collapsing more than 20%, while PFC had some recovery but was still down. Retail trade and consumption stocks, such as D-Mart, Trent, Pidilite, and Berger Paints, rose smartly. In the cement sector, Ambuja Cement and Shree Cement performed well. Adani Green was up 11%, while Adani Power remained virtually flat after a significant fall. Industrial stocks like Siemens, ABB, Motherson Sumi, and Bosch did extremely well.

The market has shown some signs of recovery, but the context of the previous sharp declines is crucial. For the recovery to be meaningful and reassuring for traders and investors, these stocks will need to overcome their previous highs. The shift from public sector units to other sectors like FMCG, private banking, and certain industrial and auto stocks suggests a strategic realignment by investors. The market may experience some slow-down moves again, as sustained recovery requires overcoming resistance at previous highs.

Sectoral Overview

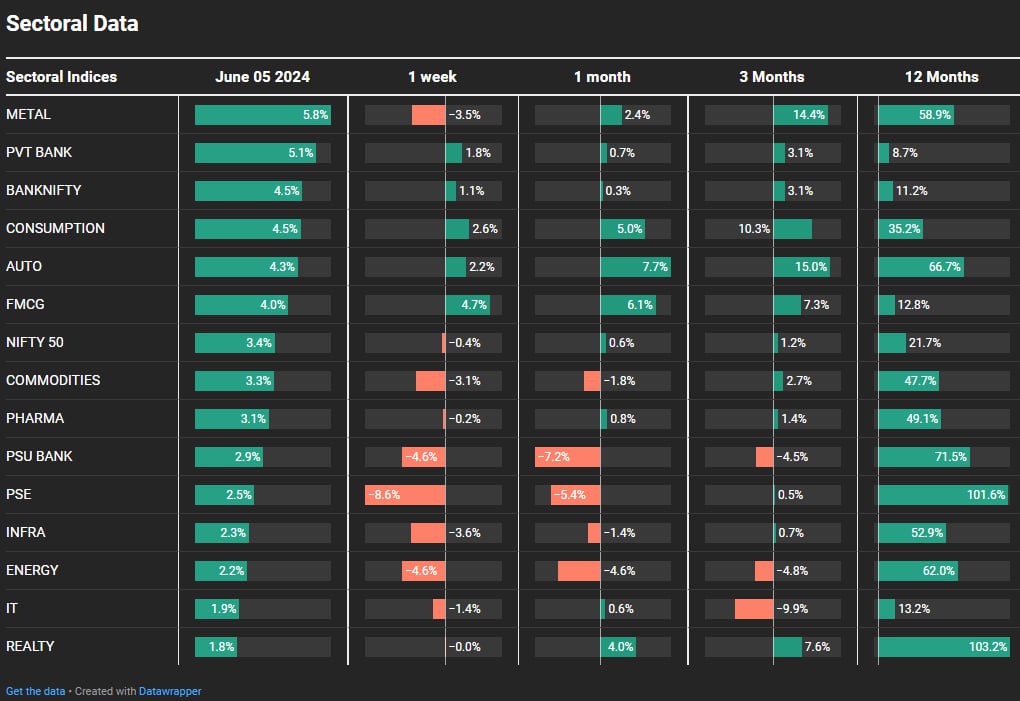

In terms of sectoral trends, metal stocks took the lead with a 5.8% gain for the day, although they are still down 3.5% for the week. Private banking showed a strong performance with a 5.1% gain. Consumption, auto, and FMCG stocks also performed well. However, the pharma sector, despite a 3% gain, only managed to return to its weekly levels. PSU banks gained 3% but remain down 4.6% for the week. Public sector enterprises saw a 2.5% gain but are still down 8.6% for the week.

The muted recovery in public sector enterprises and PSU banks is likely due to their substantial gains over the past year and the perception that a slightly weaker government might struggle to push through reforms. Real estate stocks were up 1.8%, and IT stocks rose by 1.9%. Energy stocks only recovered about one-third of their recent losses, indicating this remains a problem area. If these sectors do not perform well over time, they will likely be removed from many portfolios, with stronger sectors taking their place.

Sectors of the Day

Nifty Auto Index

The Nifty Auto Index was a significant surprise, moving from a low of 22,000 to surpassing 24,200 and closing at a new all-time high. This sector has recovered the best among the leading sectors, hitting a new high alongside FMCG. While FMCG’s rally is driven by a shift from aggressive to defensive stocks, autos have been consistently strong and continue to show further gains, indicating a very favorable position for the auto sector.

Nifty Metal Index

Metal index also coming back very, very smartly you can see that it is hardly now 5% below its all time high and very, very smart recovery on a two day basis.

Nifty FMCG Index

FMCG stocks have shown a sharp move over the past two days, with the index moving from 53,000 to 58,500, nearly a 15% gain. This indicates that FMCG may have formed a medium-term bottom, presenting potential trading opportunities on dips. The metal index has also recovered smartly and is now just 5% below its all-time high.

Stocks of the Day

Heritage Foods

Heritage Foods has been notable, largely due to its perceived association with the Chandrababu Naidu group. The stock hit an upper circuit, reflecting optimistic expectations for companies linked to Naidu’s domain and domicile. Investors anticipate favorable outcomes for these companies, contributing to the positive movement of Heritage Foods.

Similarly, Aditya Birla Fashion showed remarkable recovery, rebounding from 250 to 305, achieving a new all-time high close. This resilience in the face of recent volatility indicates that it has surpassed all previous resistance levels, marking it as a new leadership stock.

Such stocks, hitting new all-time highs after turbulent periods, demonstrate significant strength. While Heritage Foods and Aditya Birla Fashion are mid-cap and small-cap stocks, the same principle applies to large-cap names. Any stock that now exceeds its exit poll day high is indicative of substantial strength relative to its peers. This insight is crucial for understanding current market dynamics and identifying robust investment opportunities.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz