Story of the Day

Dixon Technologies

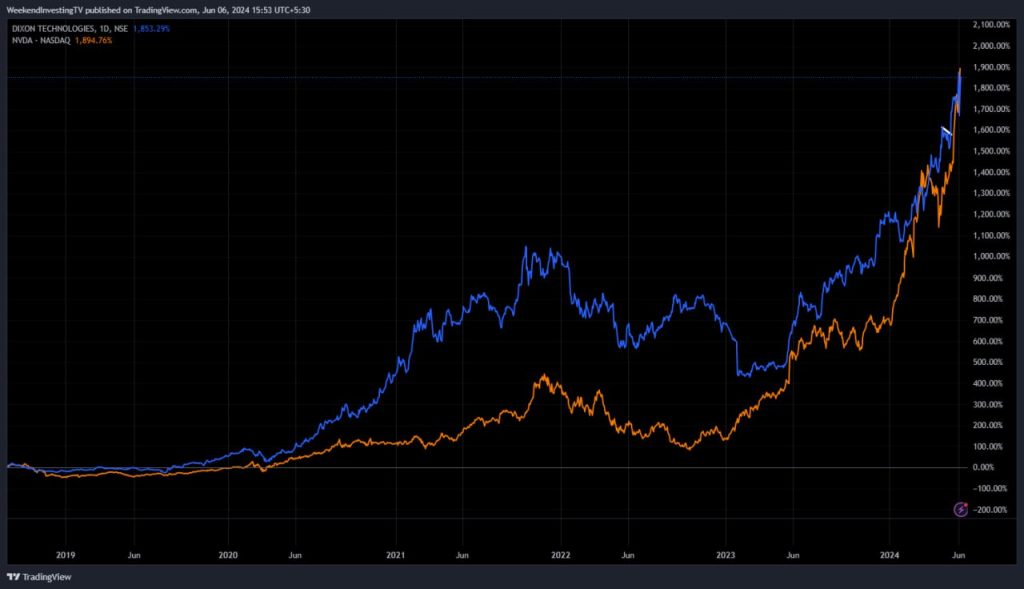

Today’s highlight is Dixon Technologies, often likened to India’s Nvidia. Nvidia, a renowned semiconductor and AI company, has seen an astronomical rise in its stock, growing from a $2 trillion to a $3 trillion market cap in just a few months, surpassing Apple. Nvidia’s market cap gain in the past six to seven months alone is comparable to the entire market cap of Amazon. At $3 trillion, Nvidia’s valuation is more than half of India’s entire market cap, highlighting its unprecedented growth.

Dixon Technologies, an Indian contract manufacturing company, has shown similar impressive growth patterns, albeit on a smaller scale. Dixon has been gaining traction by manufacturing products for various overseas companies, both for domestic distribution and export. Over the last six years, Dixon has experienced a remarkable gain of approximately 1853%, closely mirroring Nvidia’s growth of 1894% over a similar period.

The key takeaway is the importance of identifying and investing in such high-growth stocks amidst market noise. Just as Nvidia has become a standout performer in the global market, Dixon Technologies represents a significant growth opportunity in the Indian market. Investors should stay vigilant for such opportunities, recognizing and capitalizing on stocks with extraordinary growth potential.

VIX

India VIX has experienced a significant decline from its peak of 32 on election day to the current level of 17. This level is consistent with the range seen at the beginning of the year, which was between 14 to 17. A further decrease towards the 12 to 14 range seems likely as market participants resume their regular trading activities and the election-related volatility subsides. This reduction in volatility reflects growing investor confidence and a stabilizing market environment.

Market Overview

The markets seem to be rapidly moving past the election results, with the government formation underway and no major surprises anticipated in the short term. Rumors suggest that core ministries will stay with the BJP, while coalition partners will also receive their share of benefits, ensuring stability. This quick return to normalcy is a positive sign for the markets.

The Nifty is showing strong resilience and seems poised for further gains. Following the sharp sell-off during the second and third hours on election result day, the Nifty has recovered well, which is a highly positive signal. Today’s rise of nearly 0.9% underscores this robust performance. Currently, the Nifty is at 22,850, just about 2% away from its all-time high of 23,300 reached on exit poll day.

The low reached on election result day will act as a critical pivot point for the market going forward. Unless this low is breached, the bears will not have a significant advantage. Even if the Nifty pulls back to around 22,100, it would not indicate a major trend reversal but rather a minor correction within the broader uptrend.

Nifty Next 50

Other benchmark indices are also showing strong recovery, aligning well with pre-election levels. The Nifty Junior index, in particular, has performed well today, mirroring the Nifty’s positive movement and indicating that the broader market sentiment is improving.

Nifty Mid and Small Cap

The mid-cap segment outperformed today, climbing 2.18%. This strong performance suggests that mid-caps could be on track to set new highs in the coming weeks. The resilience and momentum seen in mid-caps signal robust investor confidence in this segment.

The small-cap sector was particularly surprising with an impressive start, showing a significant gap up. In the first hour alone, small caps surged over 3.5%, and notably, they maintained these gains throughout the day. This consolidation without giving up gains is a highly positive sign, indicating that investor sentiment remains strong and there is potential for further upward movement.

Currently, small caps are facing formidable resistance between the 15,800 and 16,000 levels. Today, the market tested this resistance by reaching 15,800 and holding steady. This suggests that a breakthrough could be imminent. If this resistance level is challenged successfully, possibly as soon as next week, it could pave the way for further gains in the small-cap sector.

Nifty Bank Overview

Bank Nifty is showing signs of recovery, inching up and covering most of the losses from the election result day and pre-exit poll day. Today, Bank Nifty gained 0.48%, despite dipping marginally into the red during the day, indicating a resilient market sentiment.

Gold Chart

Gold has shown a significant breakout on a short-term basis, likely driven by renewed tensions on the Russia-Ukraine border. In Indian Rupee (INR) terms, gold prices surged to approximately 73,200, with International London Market (ILM) prices also reaching around 7200-7800. This breakout suggests that gold, after a period of consolidation, is now poised for an upward movement.

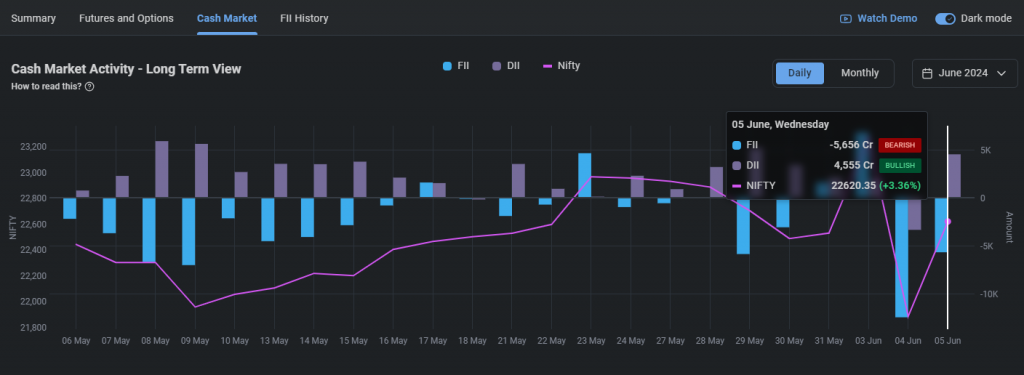

FIIs & DIIs

After the election day debacle, we saw significant sell-offs from FIIs. However, yesterday, despite FIIs selling, DIIs bought almost to the same extent, resulting in a strong pullback. This indicates that FII selling isn’t severely impacting the market. The trend might change if FIIs need to buy back at higher prices, which could provide market support. DIIs, supported by monthly SIP inflows of 20,000 crores, continue to drive the market with consistent liquidity, ensuring resilience and stability. This dynamic suggests that domestic investors are currently a crucial stabilizing force.

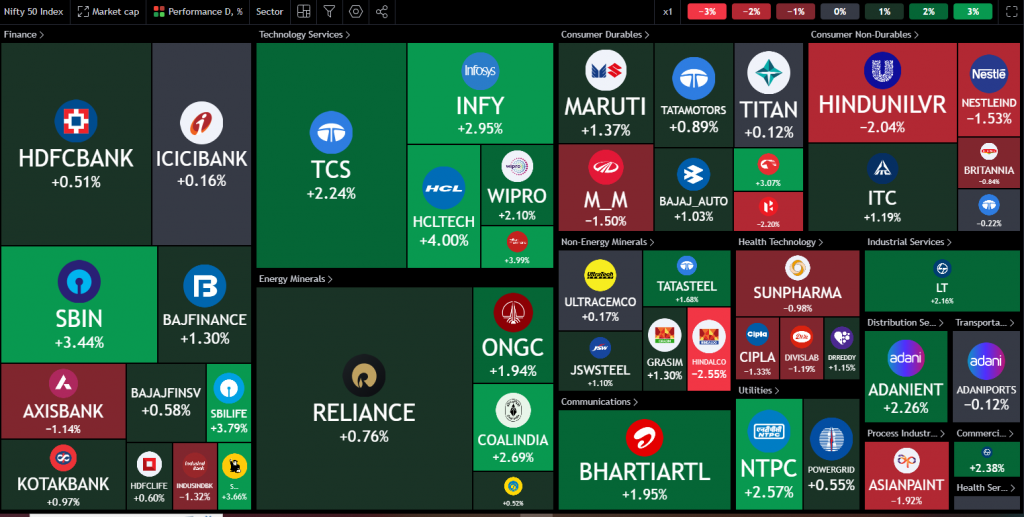

Nifty Heatmap

Today’s heat map reveals strong performance from IT stocks such as Infosys, TCS, and HCL Tech, buoyed by Nasdaq hitting new highs. SBI, which was heavily hit on election day with a 12-14% drop and showed little recovery yesterday, bounced back by 3.4% today. Other stocks like Coal India, ONGC, and NTPC also saw gradual gains. Some Adani stocks experienced modest upticks as well.

In contrast, FMCG stocks, which had surged as defensive bets on election day, are now cooling off. The market is shifting from these defensive plays back into more risk-on sectors like metals, commodities, and autos. This sectoral rotation indicates a renewed appetite for higher-risk investments as market confidence returns.

The Nifty Next 50 chart highlights a significant rebound in public sector banks, public sector enterprises, and defense stocks, which were heavily sold off just two days ago. Stocks such as PFC, REC, IRFC, Bank of Baroda, HAL, BEL, IOC, and IRCTC have surged, with PFC and REC each up 6%. This recovery is driven by renewed confidence that ongoing government programs will likely continue without disruption.

Real estate stocks also showed robust gains. DLF rose by 4% in this index, while other real estate companies like Prestige, Oberoi Realty, and Lodha made new highs. This broad-based recovery is an encouraging sign of market resilience and investor confidence in the continuity of current policies and initiatives.

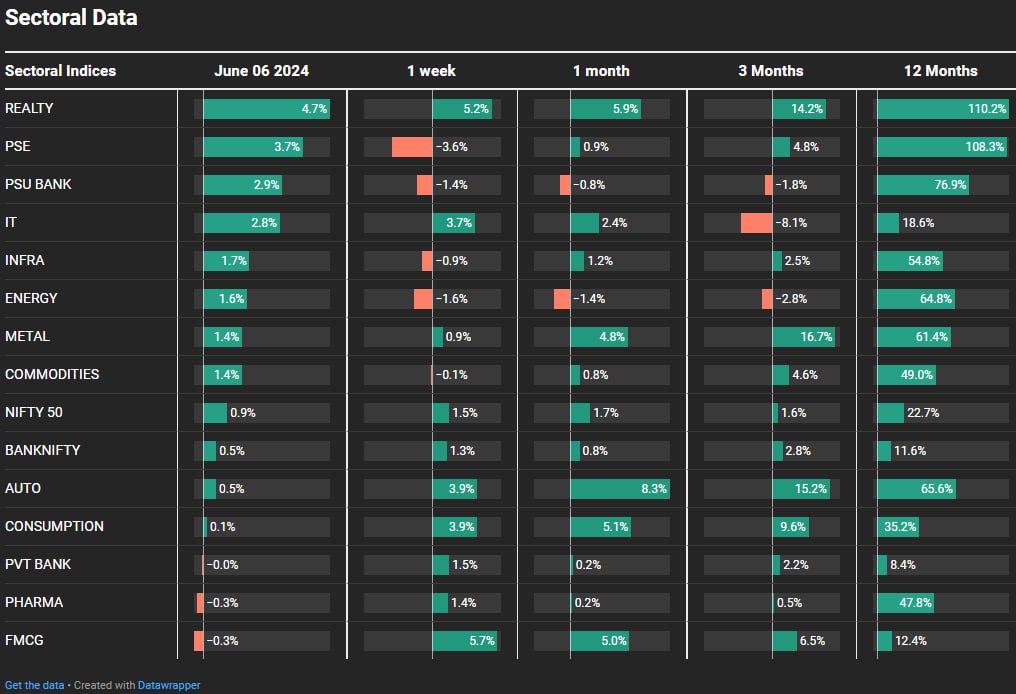

Sectoral Overview

Sectoral trends for the day show significant gains across various segments. Real estate stocks led with a 4.7% increase, followed by public sector enterprise stocks up 3.7%, PSU banks up 2.9%, and IT stocks up 2.8%. Despite some sectors like public sector enterprise stocks, PSU banks, energy, and infrastructure still showing slight losses for the week, most sectors have performed well, including real estate, autos, consumption, FMCG, and IT.

The overall market strength remains intact, and the resilience is notable given that, despite the recent volatility, the Nifty is just 2% away from an all-time high. This indicates that the market has largely dismissed any concerns about weakness, reflecting underlying investor confidence. If the current momentum continues for a few more sessions, even the remaining weak sectors may recover, further solidifying market stability and strength.

Sectors of the Day

Nifty IT Index

IT stocks are experiencing a significant bounce back, supported by strong performance in the Nasdaq. If the Nifty IT index surpasses 34,500, it will be a very bullish signal for the sector.

Nifty PSE Index

Public sector enterprise stocks, despite gaining 3.68%, may require some consolidation before pushing to new highs. The current stability and absence of further declines are positive signs.

Nifty REALTY Index

Real estate stocks have shown a strong rebound, increasing by 4.69% and approaching new highs. This rapid recovery indicates robust investor confidence in the sector.

Stocks of the Day

Amara Raja Energy

Another notable story is Amara Raja Energy Mobility. This stock, which had been trading within a large range over the past eight to nine years, is now breaking out and making new highs even on weaker days. This demonstrates the underlying strength of the stock. The significant move towards the electrification of vehicles positions Amara Raja Energy Mobility to potentially benefit greatly. It would be prudent to keep this company on your watch list for potential investment opportunities based on any emerging setups.

Exide

Another company in the same industry, Exide Industries, has also been performing exceptionally well. Towards the end of 2023, Exide Industries broke out of a long-standing range, as evidenced by the weekly chart. This breakout, which occurred after many years, was followed by a retest of the breakout level. Since then, the stock has been on an impressive upward trajectory, effectively doubling in value since the breakout. This strong performance, even amid broader market weakness, is a clear indication of the stock’s robust momentum and potential for continued growth.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz