Market Outlook

In today’s Weekend Investing daily update for May 6th, the market experienced some jitters, particularly after Friday’s downturn. Despite expectations for a rebound, the market remained subdued. The Finance Minister’s clarification on the capital gains tax rumor did little to boost confidence, leading to a modest uptick followed by a downward trend throughout the day.

A major factor contributing to the market’s lackluster performance was the sell-off in public sector enterprise stocks, fueled by news of a less favorable project finance regime. Notably, stocks like PFC and REC suffered losses.

Nifty Heatmap

The Nifty heat map revealed significant declines in banking and PSBs, with BPCL, Coal India, L&T, Power Grid and NTPC among the losers. Titan’s 7% post-results decline added to the market’s woes, reflecting overall muted corporate performance.

So it seems like no results are really coming much beyond expectation. Either they are just meeting expectations or they are below expectations. So markets kind of priced to the maximum for now and it will take some really good news or more lot of liquidity to move the market up.

Despite some bright spots like Kotak Bank and Hindustan Unilever posting gains along with Britannia at 6% move up, overall market sentiment remained subdued. Reliance lost 1%

The Nifty Next 50 index fared worse, with REC and PFC leading the losses at 7 and 8% respectively. Bank of Baroda, Kendra Bank, HAL, IOC, IRCTC, all the public sector enterprise, LIC losing ground. Adani stocks faced pressure due to non-disclosure notices issued by SEBI.

On the positive side, DLF moving up on news of new project Privana being launched and several thousand crores of advance money is likely to come in soon. Chola Finance also moved up 2%. Siemens and ABB in the capital goods moved up very smartly at three and 4%. But rest of the market was very very dull and not much really to cheer about.

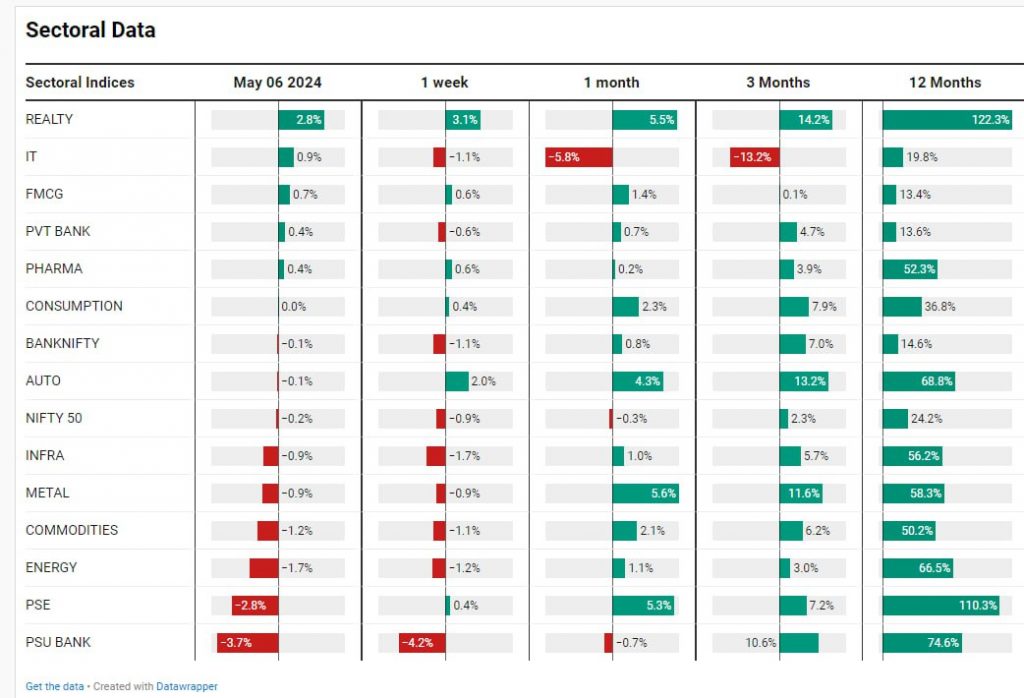

Sectoral Overview

Real estate was the only place in green really along with some moves in it and FMCG real estate making 2.8% gains today. SU banks, public sector enterprise stocks, energy and commodities losing the most along with metals. So you had this entire pack especially in metals and public sector enterprise that have been doing very well last one month. They have been the top performers getting hit quite a bit nifty. Not so badly hit actually. Kotak and levers supporting Nifty in a big way right here.

Mid & Small Cap Performance

Mid-caps were down, but it’s not seen as alarming after a spectacular nine-day run. While the market experienced a lull, there wasn’t significant damage on the charts. It was similar for the Small Caps as well. So after this breakout at 15,415-15,500, we’ve retraced, you know, 3400 points from the top, which is pretty much par for the course. So no major damage done on the charts. It’s just lethargic sort of moves.

The trigger for an upward move is not apparent yet, with FIIs continuing to sell. However, the long-term trend suggests a gradual shift toward domestic institutions driving the market. That over the last few years, the roles of FIIs and the domestic institutions have really reversed. So the kind of money that some five lakh crores have been moved out by FIIs and ten lakh crores have been moved into in by DIIs. So gradually the market is going to be lesser and lesser controlled by overseas flows.

Nifty Bank Overview

Nifty bank index also very much in line with Friday. Nifty bank was the least hit amongst all the major indices. It is still sort of flagging after this nice move up and taking support at the breakout. It could well move up from here.

Nifty Next 50

Nifty next 50 also second day down, but no major issue as such after a run like this.

Power Finance Corp

Power Finance Corporation was a major loser today. But if you see the chart, two days of gains that were there were lost. We’ve been at 424, 440 for the last three, four months. So if panic bottom today maybe at 415 and it recovered to nearly 440. There were reports later that this new dictate that has come around is not going to impact the margins at Power Finance Corporation or recovery.

Nifty REALTY Index

Nifty Real estate index extremely good, making a new high almost 1000 points now. So in light of poor market conditions today, this having moved up and this having been the leader of the market in the last year, year and a half is very, very promising. I think leadership should not give up on days of weakness and that’s exactly what has happened.

Nifty PSE Index

Public sector enterprise stocks also has only given up few days of gains. So no major damage here as well.

Nifty PSU Bank Index

In terms of public sector banks, this range that was broken out has sort of broken back so this was, in hindsight, you can say it was a false breakout. And now we’ll have to work again towards finding some consolidation and breaking out at some point later.

So a bit dull day, a bit of a not so positive session. There will always be weeks or months which will not be to the best of our liking. And that’s what the market is the few weeks and months will be good. Some weeks and months will be more of wait and watch. So keep adding to your portfolios.

If you are gradually bringing in your money, don’t worry about the market levels as such. if you are a long term investor, the whole thesis always remains is that people back off whenever market starts to fall or has fallen. People don’t invest at that point of time. And once the stocks start to run again, we are easily anchored to the lowest price that we have seen, and that causes our inability to invest more at that point when stocks have started to run.

If you have a system where the strategy itself will be a self healing strategy, it will take care of losers. Even if you invest today and it goes down and will take care of itself and six months later, you may be fine. You can’t expect that there be no red on your screen, that whenever you buy you have to go up and whenever you sell, the stock has to come down. That that will never happen, actually. So given the fact that you have the historical perspective that my strategy will be self healing or self corrective in nature, you can rest assured, you know, feel confident that over a longer period of time, this will sort out.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz