How are the Markets Looking ?

The overall market has been incredibly strong, with Nifty showing signs of resilience. Although it closed flat, it started the day on a much higher note and remains comfortably above the congestion zone that was previously identified.Despite some pullbacks in particular stocks and sectors, the market at large remains in good shape.

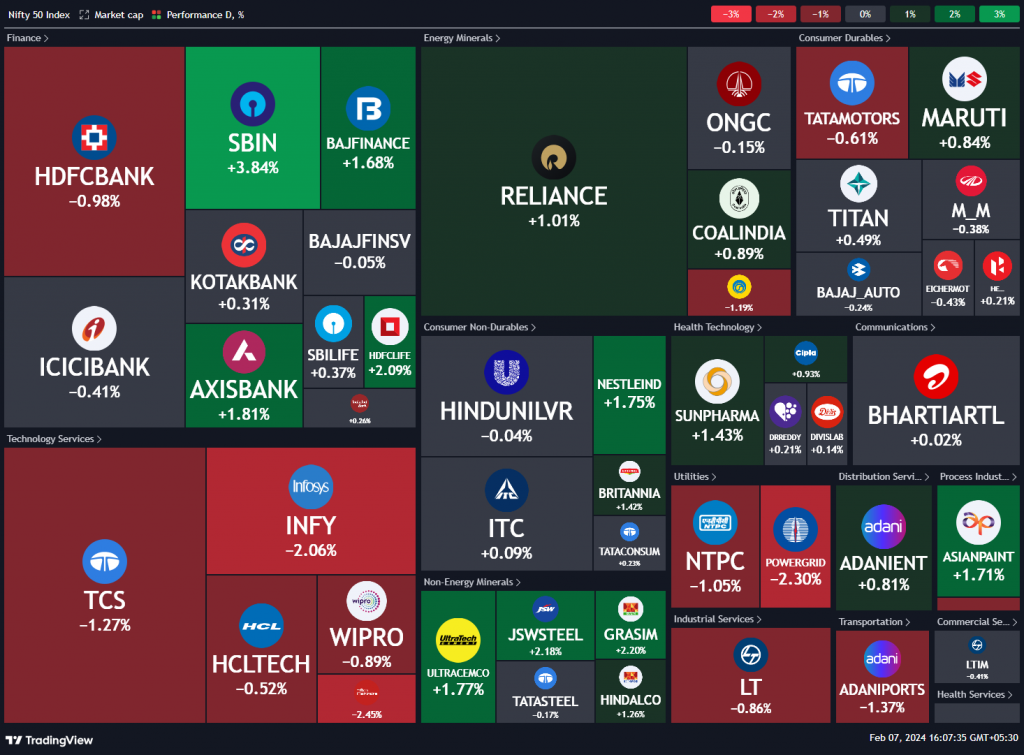

Nifty Heatmap

The Nifty heat map reveals a reasonably positive picture, with stocks across various industries driving the market. Power stocks experienced a slight decline, but steel and FMCG performed well. Notably, public sector banking, led by State Bank of India (SBI) showing a 4% increase, contributed significantly to this positive momentum. Other gainers within the finance and private banking space include Axis Bank and HDFC Life. On the other hand, HDFC Bank witnessed a 1% decrease, as it continues grappling with a recovery after a significant drop.

Sectoral Overview

In fact, smaller banks, both in private and public sector banks are zooming. UCO Bank, IOB, and other PSU banks have witnessed a 2.9% single day move and a significant 15.5% increase over one month, culminating in a 73% rise over the past twelve months. Real estate is also making notable strides, up by 1.8% today. This indicates that when a sector is in motion over a year, its rally tends to persist, marked by occasional stops and corrections but also continued momentum.

This trend is evident in public sector enterprise stocks, banking stocks, and real estate stocks, which have seen almost 114% and 115% growth over the last twelve months, respectively. Previously overlooked by investors, the under-ownership and lack of focus on these sectors have led many to miss out on these significant gains. Consumption stocks have risen by 1%, with commodities, energy, and metals seeing half a percent to 1% increases. However, IT stands out with a deep red, experiencing a -1.3% downturn.

Mid & Small Cap Performance

Mid-cap and small-cap companies have been thriving, further solidifying their strength in the market. Mid-caps hit a new high of 18,200 and are displaying a strong chart pattern that continues to climb on a weekly and daily basis. Small-caps have also had an impressive run, maintaining most of the gap and closing at 15,400. These performances reflect a dream run that investors seldom witness. It’s important to recognize and appreciate the rarity of such bull runs and take advantage of the opportunities they present.

Nifty Bank Overview

While the overall market performance has been robust, Nifty Bank has experienced some stagnation. Despite the positive movement of PSU banks, the weightages of private banks are contributing to the Nifty Bank’s inability to make significant progress.

Nifty PSU Bank

PSU Banks looking at a new high and the establishment of higher highs and higher lows are indicative of a healthy market.

Nifty IT

Nifty IT is down for the day but remains on an upward trend. The recent strong moves has caused the correction there.

Past Earnings do not dictate future

Case Study: State Bank of India

It is crucial to understand that the stock market is forward-looking and that past earnings do not always dictate future performance. A prime example of this is the recent trajectory of State Bank of India. After disappointing results, the stock experienced a sharp correction. However, in just two days, it rebounded and reached an all-time high. This demonstrates the stock’s resilience and strength, despite what the past earnings would have suggested. It serves as a reminder to investors that relying solely on historical performance is not an accurate indicator of a stock’s future potential.

Looking solely at past results to forecast the future is akin to driving while solely looking at the rear-view mirror, rather than looking ahead through the windshield. To succeed in the market, it is essential to focus on the future, anticipate trends, and consider factors beyond just historical data.

If you have any questions, please write to support@weekendinvesting.com