Market Overview

Today is a significant day as it marks the point where the impact of the election results is now considered history. The market has resumed its previous path, indicating that the entire event of the elections is behind us. If there had been any nervousness, we would not have seen the markets climb back to previous highs or make new high closes. PSU and PSE banks, which were dependent on a strong government, have rallied back despite continuous selling by FIIs.

FIIs have been selling for a while, but domestic players have been buying more than what FIIs are selling. The flow of money from domestic investors is substantial, with SIPs crossing 20,000 crores per month last month, compared to six or 7000 crores four years ago. This tripling of funds into the markets is noteworthy. While this may change in the future, SIPs typically do not break down easily unless there is a significant market shock. The SIPs did not break even during the market lull in 2021-2022.

There has been significant buying on dip days, indicating a lot of money on the sidelines. At Weekend Investing, we saw our highest number of new subscribers on a dip day. People are smart and optimistic for the future, buying the dips. The weekly candle pattern is unprecedented, showing strong market resilience, trapping shorts, and indicating lots of money was sitting outside. Many overseas institutions without a foothold in India were looking to get in after the elections, causing a churn in portfolios.

Overall, this week has been very good for the market, showcasing its strength. Unless the market breaks the 21,200 range, there are no significant problems, and we are 2,000 points above that range. Overbought conditions and corrections may occur, but the market trajectory could have changed if 30-40 more seats had gone against the ruling parties. Not having to go through another election is a lucky break for existing investors.

Nifty remains very strong, gaining more than 2% today, with a strong closing despite not breaking a new intraday high. The current support would land at 22,800 if there were a retest of the bounce. The market’s strength this week is a good indicator of its resilience and optimistic future.

Nifty Next 50

Nifty Next 50 gaining 1.4% so we are now very close to prior to election highs.

Nifty Mid and Small Cap

Mid caps are closing near all-time highs, up by 1.4%. There’s notable sectoral churn happening, which I’ll delve into shortly. Small caps, however, bring the most positive news today, rising by 2.25%. More significantly, they have broken above a long-standing resistance level held since April. If this breakthrough holds, it will become a robust support point, ranging between 15,800 to 16,000. This is excellent news for small caps in general, indicating potential for further growth and stability in this segment of the market.

Nifty Bank Overview

The Bank Nifty is also gradually building up, though it hasn’t reached all-time highs yet. It is very close to the 50,000 mark, which serves as a psychological resistance. Large round numbers like these often act as psychological barriers, and it typically takes time for the market to break through them.

Gold Chart

Gold experienced a significant drop today, falling by 1.7%. This decline saw prices tumble from around Rs 73,600 to Rs 72,200, bringing it back into a previously established zone. On a short-term basis, particularly when viewed hourly, gold is currently extremely oversold.

he oversold condition on an hourly chart suggests that the recent sell-off may have been excessive, potentially setting the stage for a short-term rebound as traders may start buying at lower prices.

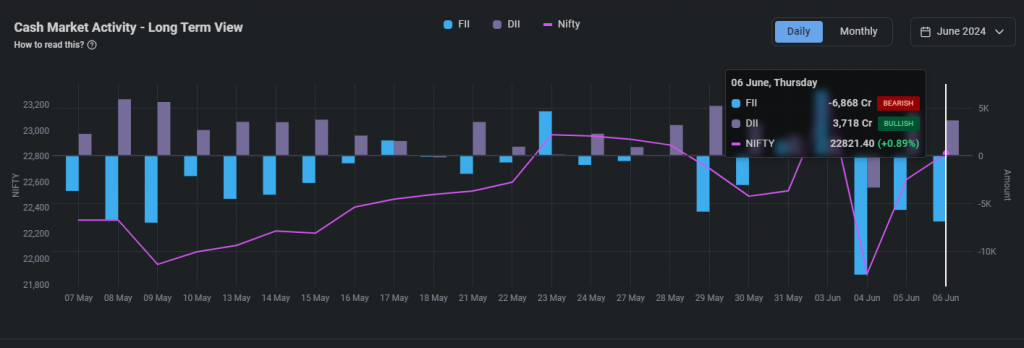

FIIs & DIIs

Sometimes foreign institutional investors (FIIs), as I mentioned, continue to sell. Yesterday, FIIs sold ₹6,868 crores, while domestic institutional investors (DIIs) bought ₹3,700 crores, yet the market was up. The previous day, FIIs sold nearly ₹5,000 crores, and still, the market was up. This indicates that the market movements are not in sync with FII sales. The correlation between FII selling and market decline seems to have been broken. However, if FIIs continue to sell nearly ₹6,000 to ₹7,000 crores, or about $0.8 billion a day, at some point, it could cap the market. The percentage of FII holding in India is decreasing rapidly, which I will show in upcoming sessions. Soon, there might come a point where some FIIs may decide to increase their stake, potentially starting a new buying phase for the FII segment.

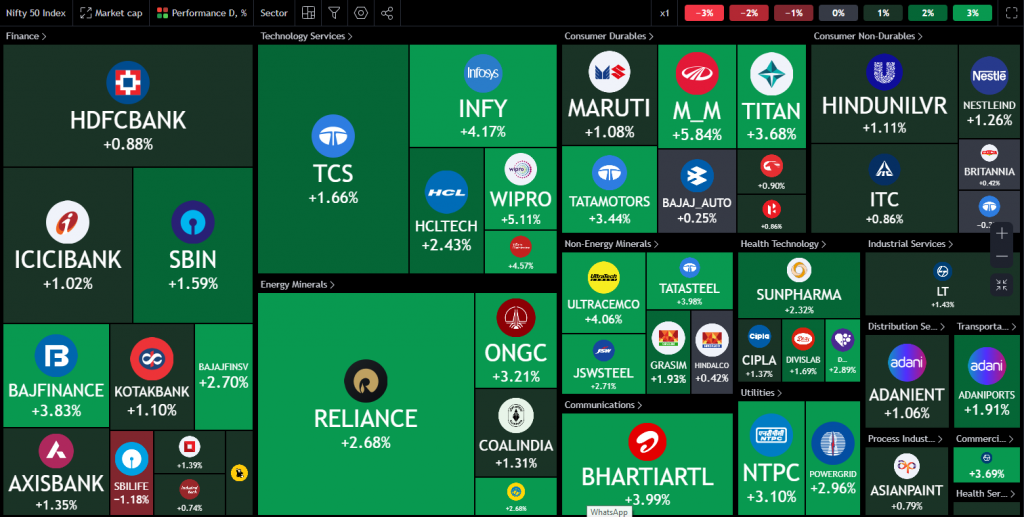

Nifty Heatmap

Today’s heat map is very green across the board. Reliance is up two and a half percent. IT stocks have shown remarkable resilience, with Nasdaq hitting new highs. Companies like Infosys, TCS, and Wipro are all performing well. In the auto sector, Tata Motors and Mahindra & Mahindra are especially strong. Steel and cement sectors are doing well, along with infrastructure and power. Communications, particularly Bharti Airtel, are also seeing positive movement. Banks are not advancing as rapidly as other sectors but remain in the green territory.

The FMCG sector was a bit muted today, which is expected when risk-on sectors are moving. Within the Nifty Next 50, the trend is also primarily green. Power stocks have risen, as have public sector enterprise stocks and commodities. FMCG, real estate, and finance companies are all showing gains. Retail trade is also up, contributing to the overall positive outlook in the market.

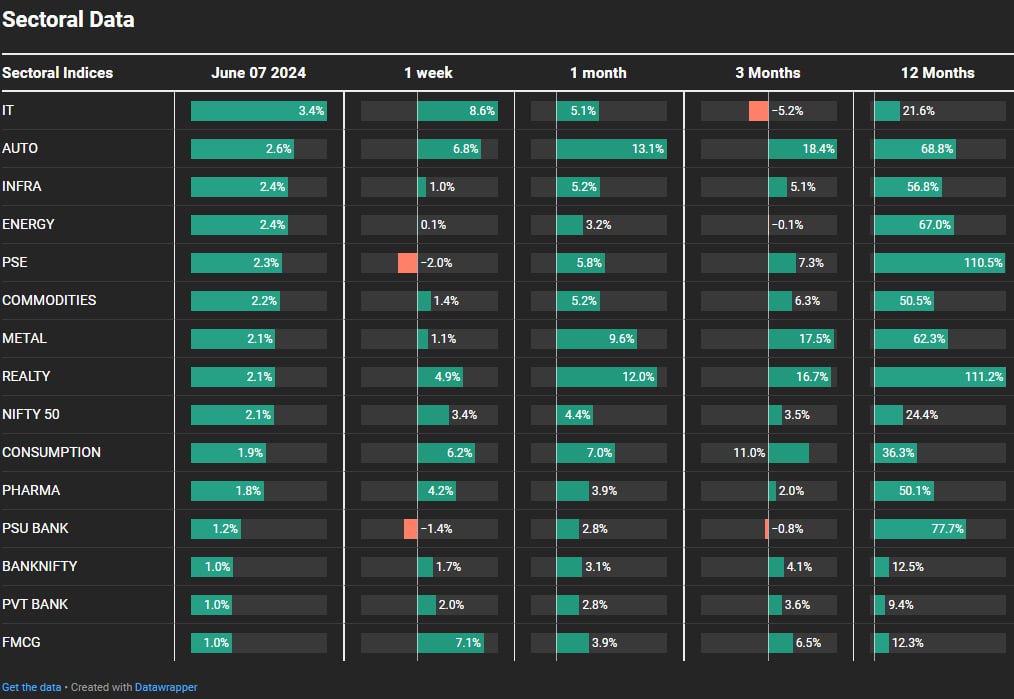

Sectoral Overview

There’s no red on the screen here, so all the sectors are in the green today. Even FMCG has moved up 1%, and incidentally, for the last one week, FMCG is now the second best performing sector. IT stocks have made a remarkable change, up 8.6% this week. You can see that sector rotation is taking place, with IT and autos leading at 8.6% and 6.8% respectively for the week gone by. Along with FMCG, consumption stocks are also up 6.2%. All sectors are up 2% or more, including consumption, pharma, PSU banks, and private banks, which are up a little less than 2% overall. The entire chart is largely green, which is always a good sign.

Sectors of the Day

Nifty IT Index

The IT index, as mentioned, has broken out, showing an extremely good move. The sharpness of the move is evident as it came close to 31,000, and today’s close is nearly 35,000, gaining more than 15-16% in just three and a half sessions. This remarkable move has pushed IT stocks up by 3.3%.

Nifty Auto Index

The auto index is also performing exceptionally well, reaching a new high with the CNX Auto index crossing 5000, up 2.56%. Many stocks within the auto space have moved up. Some stocks, however, are showing relative weakness compared to the market.

Stocks of the Day

Nifty REALTY Index

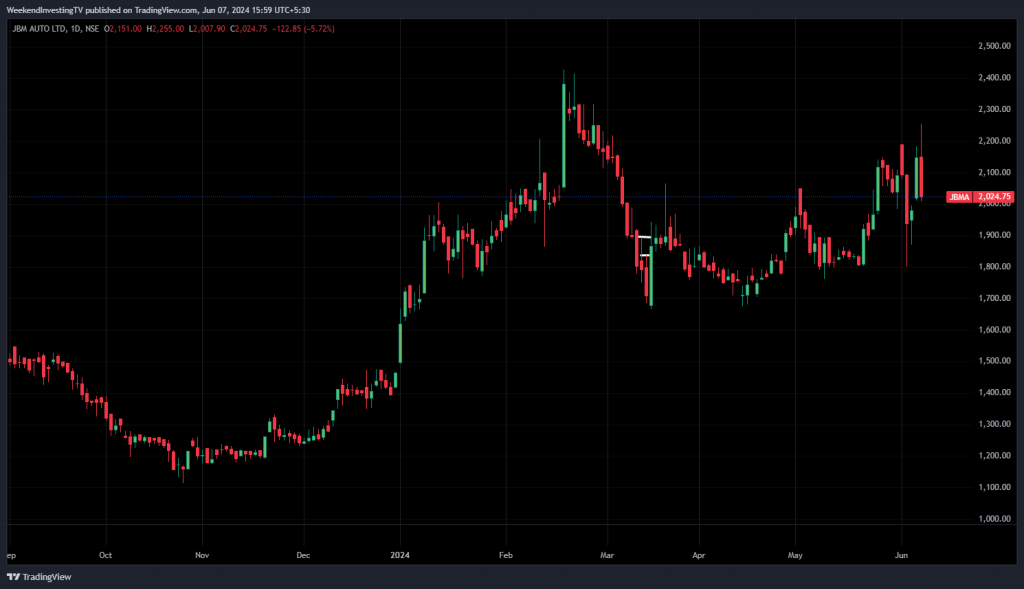

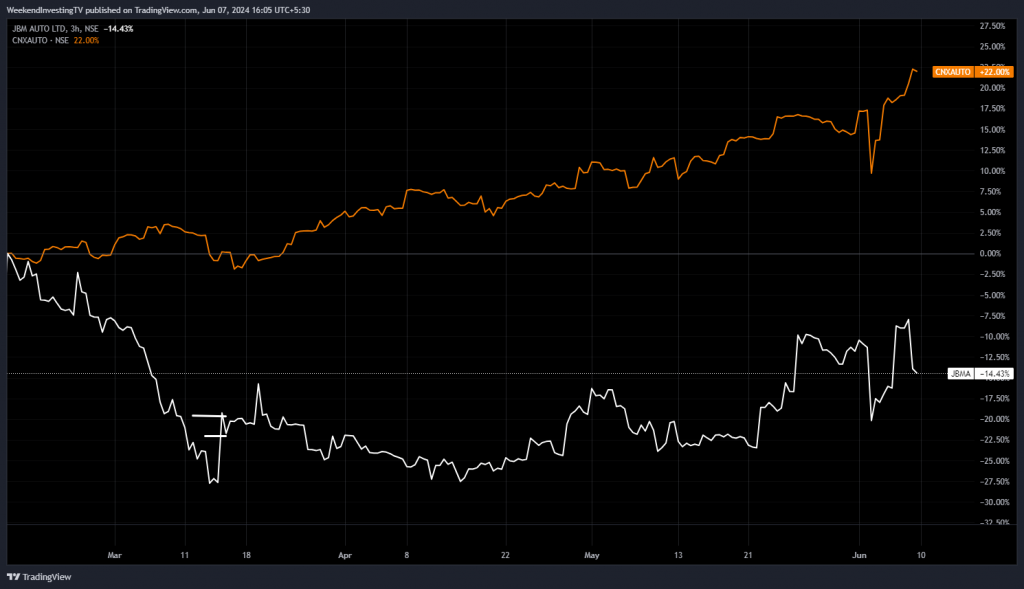

Despite the general bullish trend in the market, JBM Auto experienced a significant drop of 5.5% to 6% today. This decline is notable given that many of its peers in the auto sector saw gains. It’s important to watch for strength in a weak market and weakness in a strong market to identify which stocks are performing well and which are struggling. In the absence of any specific news driving this decline, the drop in JBM Auto while the market was otherwise performing well suggests there may be underlying issues.

The stock has been diverging since February 2024, declining by 15% while the overall auto sector has seen a 22% increase. This divergence highlights a potential red flag. Historically, JBM Auto had a strong run-up over the previous two years, and it was included in several of our portfolios. Some portfolios may still hold this stock, but its recent performance indicates it might be losing momentum.

Nifty REALTY Index

JP Associates is another notable example of a stock struggling amidst a generally bullish market. The stock has been hitting lower circuits recently, and its political affiliations might have played a role in this downturn. After a substantial rally from just a few rupees to Rs 27 earlier this year, JP Associates has been on a steady decline since February, despite the broader market’s upward trend.

This pattern suggests a distribution phase, where the stock is being offloaded to retail investors. Such a trend often indicates that those who accumulated the stock at lower prices are now selling off, potentially ahead of anticipated negative developments or due to diminished future prospects.

JP Associates has had a volatile history. It once traded as high as Rs 300-400 before plummeting to Rs 1. It then staged a dramatic recovery to Rs 27, only to start dropping again rapidly, currently trading around Rs 10.9. This sharp decline after a significant run-up is a red flag, indicating potential underlying issues that could have broader implications for its investors.

VIX

The India VIX index has come down to 17 levels and is stabilizing here, close to where it was before the election results. Gold has seen a significant drop today, down 1.7%, falling from around Rs 73,600 to Rs 72,000, returning to the previous zone. On an hourly basis, gold is extremely oversold due to the sell-off in the US dollar gold market, reflecting in the Indian market.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz