Market Outlook

It seems like the adage “sell in May and go away” is working well this year, as the markets have been down for a few consecutive days now. The hourly chart illustrates the market’s collapse from the opening, followed by a mild recovery towards the end of the day. While the market is still above major support zones, there is a head and shoulders pattern formation indicating a target of 22,000, suggesting a possible slip of another 300 points before reaching that target.

The recent dull sessions are mostly attributed to foreign selling, which is somewhat surprising. One possible reason could be the sudden focus on China and Hong Kong markets, which have been rapidly rising, prompting some allocation shifts. However, domestic flows remain unaffected, as indicated by the

Nifty Heatmap

Nifty heat map showing a movement towards defensive sectors like FMCG and IT stocks, which were up, while others like energy, consumer durables, banking, and infrastructure stocks faced significant losses.

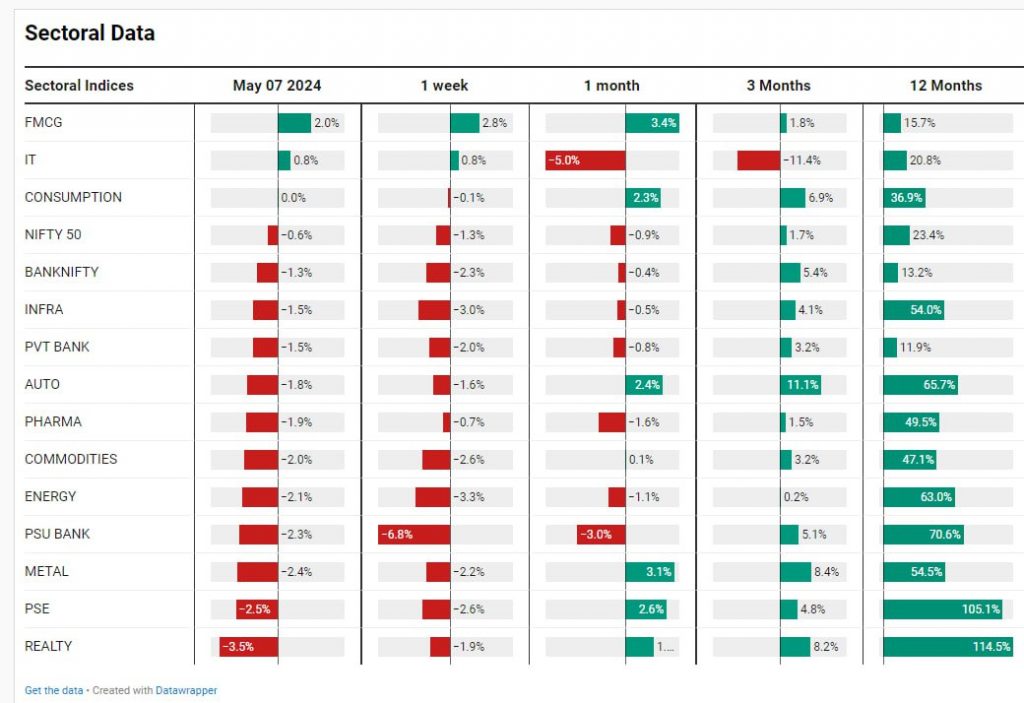

The Nifty Next 50 index experienced more red than the Nifty, given its faster upward movement. The sectoral map mirrored this trend, with real estate losing 3.5% and most other sectors losing around 2% to 1.5%.

Sectoral Overview

PSU banks were hit the hardest this week, down almost 7%. FMCG and metals also showed contrasting performances, with FMCG gaining and metals losing, possibly due to knee-jerk reactions or fund liquidations.

With volatility expected until June 4th, as news related to elections unfolds, the market may continue its current trend. However, the overall market sentiment remains positive, supported by stable currency indicators and the ongoing results season, which, while not exceptional, hasn’t fallen below expectations. The market is awaiting further clarity on political narratives and foreign fund movements, with potential upside only if significant foreign funds start flowing in.

Mid & Small Cap Performance

Mid-caps retraced back to breakout points, with small caps giving up their breakout levels.

Nifty Bank Overview

The Nifty Bank index also gave up its recent gains, necessitating consolidation before a potential upward move. Despite recent declines, the overall market outlook remains optimistic, with some correction seen as healthy consolidation after a significant rally since November.

Nifty Next 50

Nifty Next 50 down for three days. There are no complaints. If I see the context, it has gone up substantially, and a few days of correction will not hurt us so badly.

Some of the FMCG counters are doing very well. So there’s a very nice sort of counterbalance that happens in the market whenever other high beta stocks are falling. Money liquidity rotates into defensive stocks very, very quickly.

Dabur

Dabur moving up

Godrej

Godrej was soaring

Marico

Marico was up nearly 10%. So there is support from different sectors that is available once the market start to tank.

Nifty Metal Index

Metals also losing significant gains. Most of the gains of the last month are gone here. But again, metals have run up quite a bit. So some gains have been lost here.

Nifty FMCG Index

FMCG, as an index, has broken out of this consolidation. Maybe it will come back and retest and then go up, but it does look like a nice couple of months of consolidation is done and the market in FMCG wants to move up.

Nifty REALTY Index

Real estate was a surprise today after a very strong move yesterday. There was a complete collapse in this index, although if I see it has only given up the last few weeks of gain and no, I mean it’s not really even made any lower low as such.

But a very strong down day pretty much on the back of the sell on news on the DLF project. I think market may have been expecting that on this news of the project that DLF will fly, but sellers had different ideas about it.

Concluding Thoughts

So a good day, a good week in terms of, you know, weak hands getting shaken off and some correction happening finally. I think maybe by middle of this month we should get some consolidated bottom, mid, mid term bottom, and then maybe we start to go up again. That’s the, that’s the hope right now. We’ve had a significant rally since November. So almost six months into this rally, a couple of months of consolidation will not really, you know, disturb the overall long term rally. So this is part and parcel of the game. Please accept it and continue to invest. Don’t break any of your sips or whatever plan you had for your investing because of these few days. Smart investors always buy on dips, and this dip is no different from that.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz