So, the market was completely euphoric in the previous session, with Nifty gaining huge amounts. But today, after 24 hours, the market has come to some sort of realization that nothing changes overnight, and the sellers are back. Nifty has exactly retracted what it gained yesterday. However, other parts of the market are still looking much better than where we were two days back. The Hang Seng market and Chinese markets are also gaining. So, surprisingly, the event has happened, and now the reversals are taking place. What people expected was that with Trump’s victory, there might be a lot of turmoil in the Chinese and Hang Seng markets, but in fact, those two markets are going up right now. It’s very difficult to predict what will happen; most of the time, the news is already baked in, and you only see the reactions post that.

A massive shift is happening from private sector banks (PSBs) to public sector banks (PSUs) in terms of performance and profitability. We’ll look at that and some numbers supporting this story in the second half of the video.

Where is the market headed?

Market Overview

The markets are doing a flip-flop almost on a day-to-day basis. Monday was a down day, Tuesday was an update, and then we had the news, so Wednesday was up. Now, we’re back to where we were on Tuesday and not too far from where we were pre-Diwali. So, four or five sessions have gone by, and almost nine or ten sessions have passed without any real movement. Maybe this is the interim relief before the next move happens, and that next move could be either up or down. I don’t know.

So far, the price action suggests that the up move is very limited, otherwise, we wouldn’t have given up all the gains from yesterday. Some give-up of yesterday’s gain was acceptable, but not the entire thing. The recent lows are very important going forward. There’s also the possibility of a head and shoulders pattern forming again, and if that happens, it could have deep repercussions. Nifty at minus 1.16% can’t really be considered out of the woods; we’re still hanging on by the edge of our seat

Nifty Next 50

Nifty Junior, down 1%, is not looking as bad as Nifty today. It did break out beyond its consolidation, and today is just a pullback. Let’s see where we go next. Overall, we haven’t gone anywhere since June on Nifty Junior. It’s been a sort of time correction, and six months of no gains could be a good time correction. We might get another six months of this, but it can’t last forever.

Nifty Mid and Small Cap

Midcaps are giving up some of the gains from yesterday. The midcap chart was actually what I wanted to see on Nifty as well – euphoric gains yesterday, with some of it being given up today in a profit-taking correction. The intermediate trend remains up for midcaps, though the long-term trend remains down. Midcaps are down 0.5%, and small caps are down 0.62%. However, the interim trend for small caps is still very much up. At 17,900 or nearly 18,000, we are hardly a stone’s throw from an all-time high, so there is no weakness from that point of view in the small-cap market.

Nifty Bank Overview

Bank Nifty continues to languish in a sideways mode. Bank Nifty is at 51,900, down 0.77%. Since mid-June, we haven’t really gone anywhere.

Advanced Declined Ratio Trends

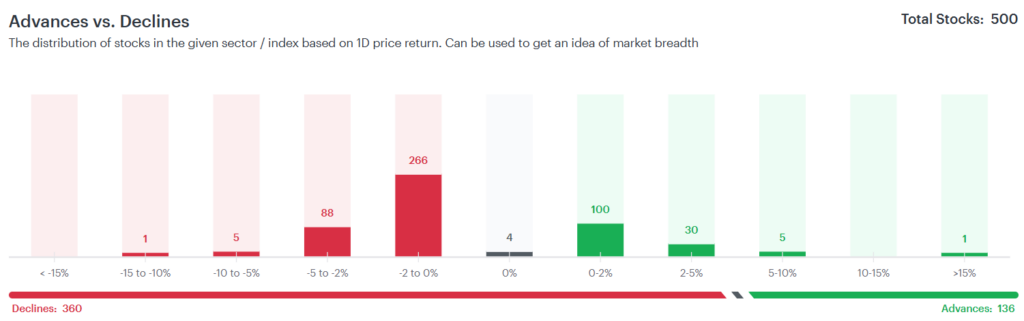

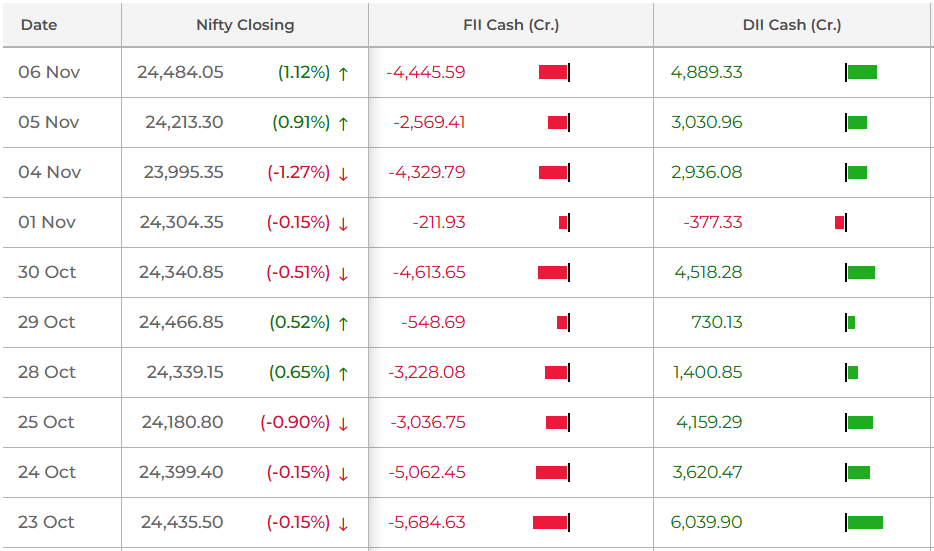

the advanced-decline ratio is almost the reverse of what it was yesterday: 360 declines to 136 advances. FIIs are back on a selling spree, with 4,400 crores of selling on the day when Nifty was up by 1%. This shows that FII buying was not the reason for Nifty’s euphoria. While DIIs had pressed in 4,800 crores of buying, retail investors were also buying big on that day.

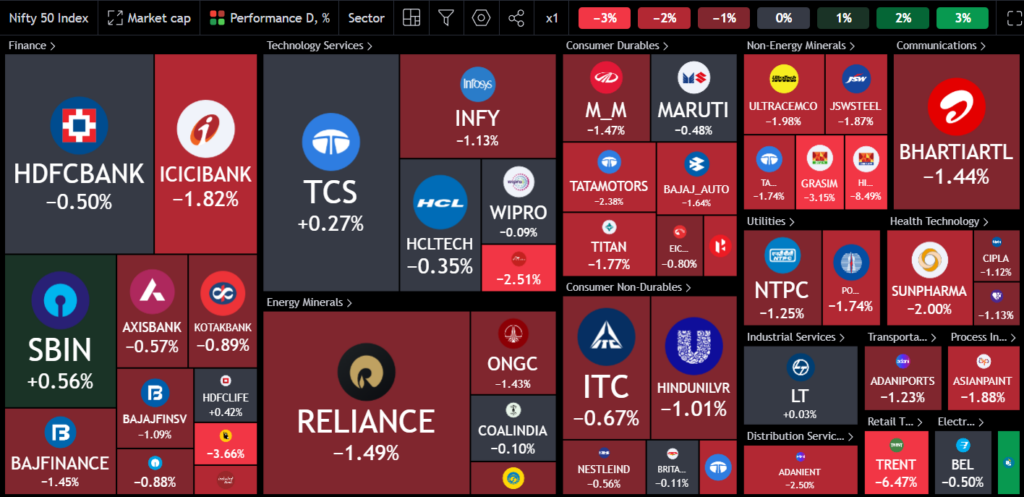

Nifty Heatmap

Today’s heat map is all red, with hardly any green. Banking, mainly private banks, took a hit along with Reliance, ITC, Hindustan Lever, Tata Motors, and Mahindra. Despite great results, Tech Mahindra, Grasim, Hindalco were all clobbered, with Hindalco down 8%. Trent missed expected numbers, dropping by 6%. Some of the big, stable names saw significant declines today, and that contributed to Nifty’s downturn. In the Nifty Next 50 space, Adani stocks and others saw major drops, with Adani Enterprises dropping 10.4%. This was after MSCI’s rejection of its inclusion in the next rebalance, causing the stock to plummet after a lot of upfront buying.

In the broader market, stocks like Adani Green, Adani Power, Vedanta, LTM, ABB, DLF, LIC, and JSW Energy also saw declines, with JSW Energy being one of the few shining through.

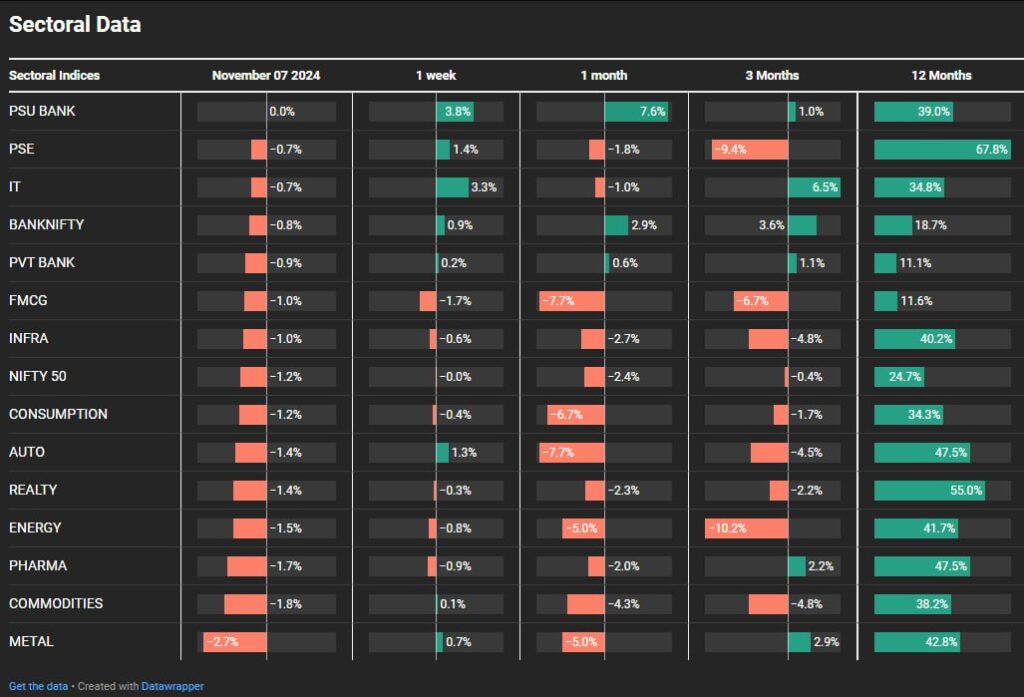

Sectoral Overview

No sector gained ground today. PSU banks were at 0%, which was the saving grace.Metals, which had been doing well recently, collapsed by 2.7%. Commodities dropped 1.8%, and despite Chinese markets starting their upturn, pharma stocks were down 1.7%. Real estate, energy, and auto sectors were all down more than 1.2%. Really, there was no place to hide in today’s session.

Sectors of the Day

Nifty Metal Index

After a few sessions of upswing, metals are again trying to come down, and it looks like they are stuck in a 10-15% range. You can see some big cuts in many of the stocks here.

Stock of the Day

ITI

For Stock Spotlight today, we look at ITI. ITI clocked a 14.8% gain today, rising from a recent 210 to almost 266. Not all public sector enterprise stocks are doing badly. Looking at the lifetime chart of ITI, we can see it ranged for a long period between 20 and 100 rupees, but in the recent run-up, it has moved from 180 rupees to almost 266 rupees.

Story of the Day

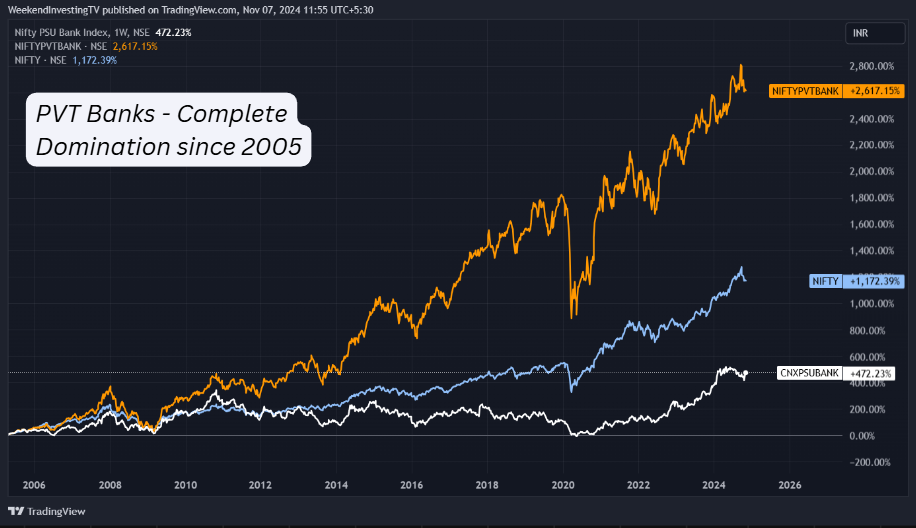

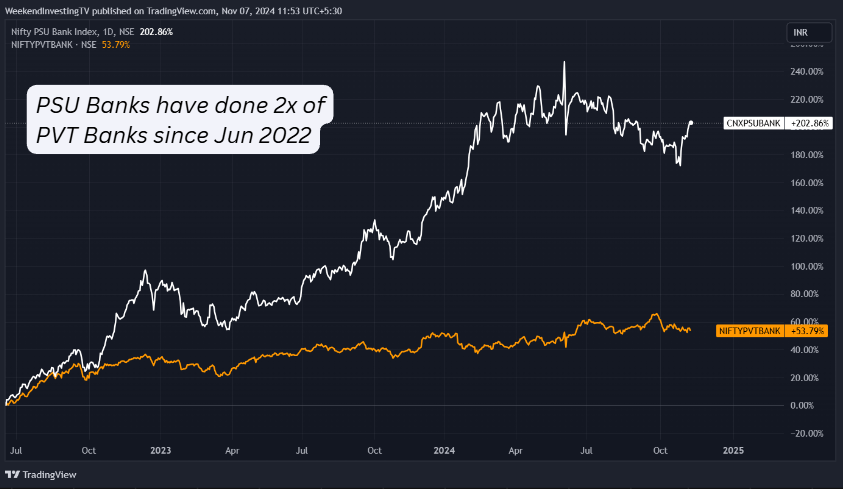

Now, let’s talk about PSU banks versus private banks. Since last year, there has been a shift happening here. The chart shows that the Nifty Private Bank index (golden line) has long outperformed both Nifty and PSU banks. But there has been a cyclical shift in the recent times. In the past two and a half years, PSU banks have performed almost 2x better than private banks. Since June 2022, private banks are up 54%, while PSU banks are up 202%, more than 4x the growth of private banks.

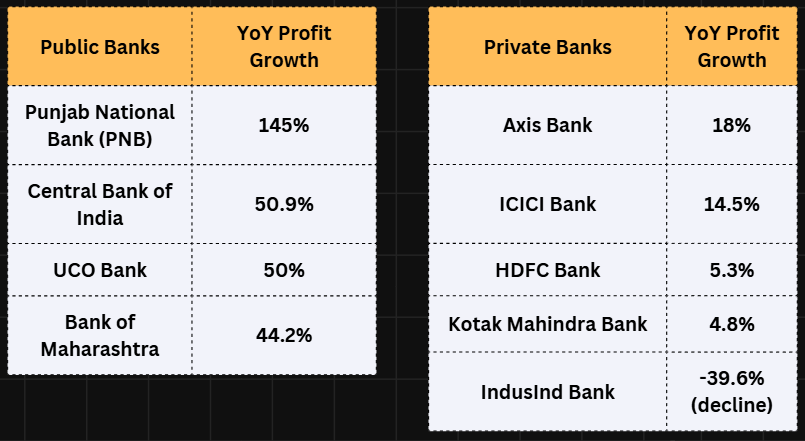

Year-on-year, PSU banks have delivered a 39.3% net profit growth, whereas private banks have only delivered 7.1% profit growth. Specific banks like PNB have come out with blockbuster results, with a 145% profit growth. Other PSU banks like Central Bank, Yuko Bank, and Bank of Maharashtra have shown 50% growth. On the other hand, private banks have shown tepid growth: 4%, 5%, 14% in the case of ICICI, and 18% in Axis Bank, while IndusInd Bank saw a decline of 39%.

Looking at the price performance in the last three years, HDFC Bank has delivered only 9%, IndusInd Bank 8%, Kotak Bank 4%, and only Federal Bank has managed a three-digit return. On the other hand, in the PSU banking space, banks like Indian Bank, Yuko Bank, Central Bank, PNB, and Union Bank have delivered fantastic three-digit returns.

The point to note is that the results from the latest quarter reflect a strong shift that is continuing to happen in the banking sector. PSU banks are leveraging the reforms that the government has pushed, and their profitability is clearly visible in their net profit growth and market share enhancement.

The adaptability of your strategy is key. If you’ve been a weekend investor, you would have noticed that several of these public sector banks entered our strategies much earlier. Right now, they may have even moved out after generating some gains. This flexible approach – not sticking rigidly to private or PSU banks – is crucial. As trends form, you should be able to shift from one to another or to different sectors where alpha is being generated.

Having a “buy and hold” mindset with a fixed bias may not always work. While it works over the long term if the underlying company does well, it’s also a difficult journey. You don’t just want the end results; you want the journey to be smooth and not harrowing. If there are two ways to reach from point A to point B, one being smooth and the other difficult, you would choose the easier one, right? This unbiased approach towards the market ensures that you stay with the winning parts, and that’s how our strategies can outperform the markets in the long term.