Market Outlook

The Nifty index showcased a robust performance by making a new high after five days of consolidation, a clear indicator of the market’s positive momentum. This breakout above the previous high signals a strong trend, with higher lows and higher highs forming, painting a bullish picture for the market.

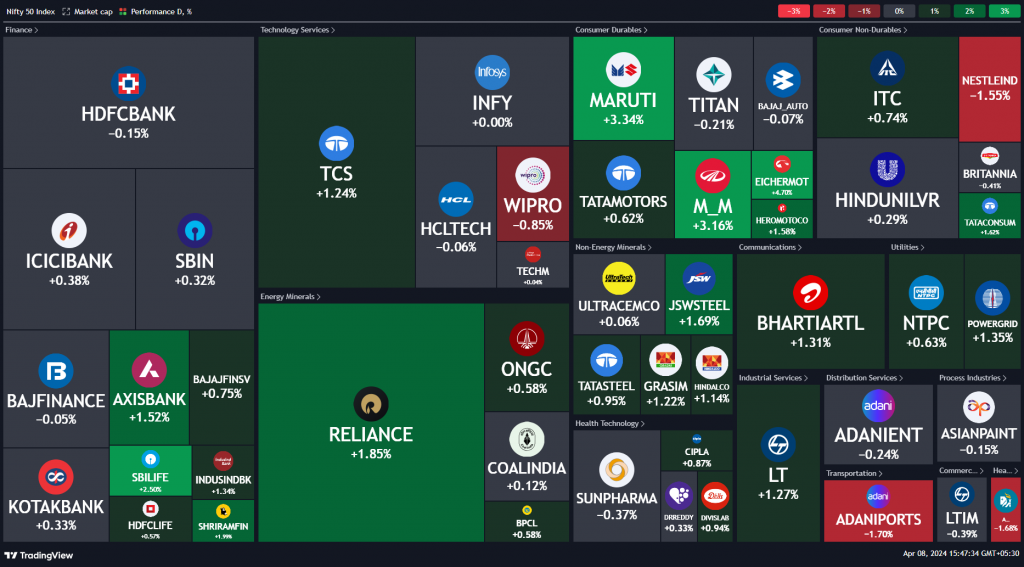

Nifty Heatmap

The market’s heat map presented a varied landscape. Large-cap stocks, especially, leaned towards green, showcasing growth. Notably, Reliance Industries surged almost 2%, while auto giants Maruti and Mahindra & Mahindra also posted significant gains, with Eicher Motors leading the pack with a 4.7% increase. Despite these gains, Nestle faced a downturn, shedding one and a half percent. JSW steel and Tata consumers were up nicely. Axis Bank, State bank of India Life Insurance and ICICI bank also gaining.

The Nifty Next 50 heat map, in contrast, revealed more red, indicating a slight retreat for stocks that had previously shown strong performance. However, real estate stood out positively, with DLF marking a 1.7% uptick. The auto sector emerged as a strong performer, recording a notable 2.2% increase despite contrasting reports of sluggish demand on the ground.

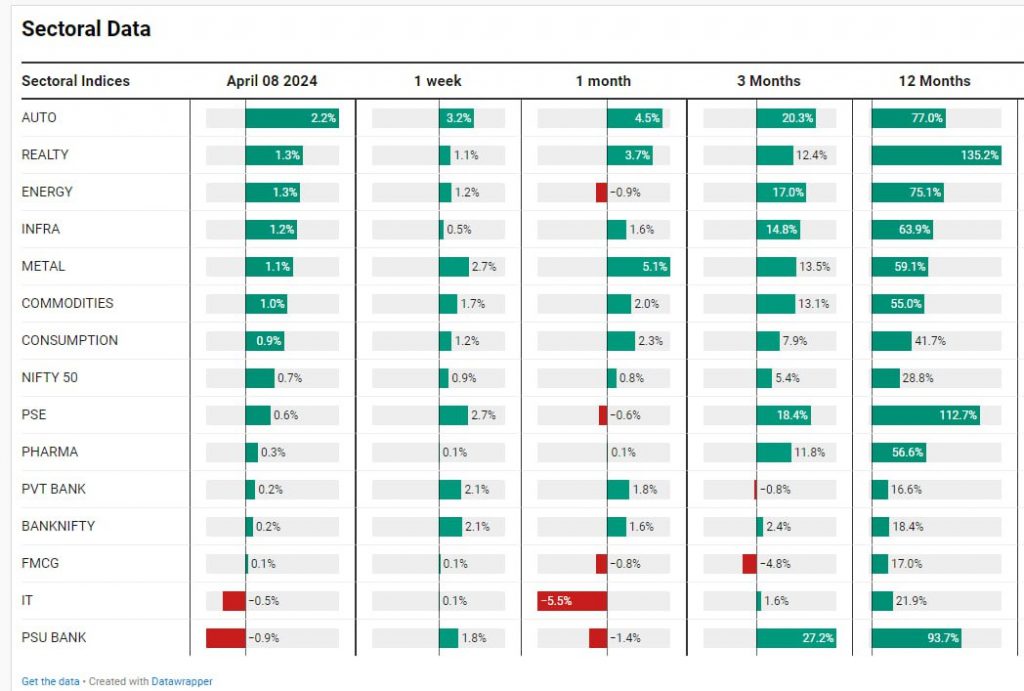

Sectoral Overview

The day’s trading painted a diverse picture across sectors. Real estate continued its impressive rally, marking a 1.3% increase for the week and an astonishing 135% growth over the last twelve months. The private banking and FMCG sectors also saw gains, albeit at a more moderate pace.

Conversely, the IT sector and PSU banks lagged, reflecting the ongoing shifts in market leadership as we approach the election season. Metals, real estate, and auto stocks led the gains over the past month, suggesting a rotation in market favorites.

Mid & Small Cap Performance

Mid-caps demonstrated resilience, recovering most of the ground lost in the previous day’s session, and small caps approached their previous high, showcasing a V-shaped recovery since late March. This recovery in the broader market adds depth to the Nifty’s bullish trend.

Nifty Bank Overview

The banking sector, particularly Nifty Bank, closed at a new all-time high, reinforcing the market’s strength. This move, spearheaded by HDFC Bank’s continuous uptrend, bodes well for the market’s prospects.

Nifty Next 50

The Nifty next 50 index has done really well. From 56,400 odd levels, we’ve gone to 63,000 in matter of couple of weeks. So Nifty next 50 is that great segment where we are getting new winners for Nifty coming forth.

Nifty Auto

Autos seem to be the flavor which is coming back very very strongly. Although on ground people are saying that there are so many discounts on so many vehicles that you know the demand is lacking. But autos on in the market is doing extremely well plus 2.2% today. So for the week up 3.2%.

Exide Industries

Exide Industries was one of them and there was news about their EV charging joint venture with Kia Motors. And besides the narrative, whatever is the narrative, you can see that it made a high in 2018 at around rs290 and then it went to as low as 121, stayed in this consolidation zone and only then recently has made a new high. In the end of 2023, went to 300. It came back and retested this breakout point, you can see, and now has gone complete bonkers up. So again, I mean, if you have some plan of exit, you could exit a stock, use this entire time for opportunities elsewhere. And once the stock is back in action, you could look at it again.

Bandhan Bank

One stock which division was not doing so well was Bandhan Bank, I think five or 6% down today also. So this is the classic example where, you know, 2020 top before pre, pre COVID top was 640, and we are now sitting at 175. So we’ve lost 70% or so of the capital value and have lost four years of time. So this is, these are the type of stocks which you know, your strategy should remain away from. Yes, at some point of time it will go up and, you know, you can catch it at that point of time. But why should we sit in darkness with this talk for so long waiting for things to happen? And what if, you know, it breaks 150? I think then there will be a complete collapse on this. So these are some lessons that we can learn from these failures, that let’s not allow narratives in the market biases to not allow us to have a fair stock picking mechanism in the market for our portfolio.

Key Takeaway

Run your portfolio like a business. If one unit of your business there you have ten divisions or 15 divisions, and one division is not doing well, obviously you will close it off and shut it down and look for new opportunities. Why we have to stay and stick around with that and try to make up for it.

Nifty Energy

Energy index was another one where the performance since mid of March has been. We are coming to a point where this also can rally very, very hard. Of course, auto index, as I mentioned, is going completely in a rocket like fashion. Although on ground, uh, things are not matching to. To what is being shown so many times. What will happen is market will run up, it’ll discount the next few years of whatever growth is there and then may go flat while the on ground earnings or numbers catch up. So you can never really equate what is happening in the market versus what is happening on the ground.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz