How are the Markets Looking ?

The market opened on a positive note but soon took a downturn after the Reserve Bank of India (RBI) meeting. The market perceived the RBI’s remarks as being hawkish, leading to a lack of confidence among investors. The RBI did not make any changes in the repo rates, disappointing market expectations. Many were hoping for indications of future liquidity, such as a potential decrease in repo rates, but the RBI provided no such assurance. This spooked the market, particularly the banking sector, which experienced a decline in stock prices. The Nifty returned to a crucial support level around 21,750 and closed at that level.

Previously, there were indications of a potential double top formation in the Nifty. With the pivot break at the support level of 21,750, the market may see further declines, potentially leading to a retest of the 2020 peak at 21,200.

Nifty Heatmap

The Nifty heat map shows a predominantly red market, with only PSU and PSB stocks providing support. State Bank of India witnessed a significant 3.5% increase, while Coal India and ONGC saw gains of 1.5% and Power Grid by 1.25%, respectively. However, private banking stocks suffered, with ICICI Bank and HDFC Bank dropping by 3.2% and 2%, respectively. HDFC Bank is now less than 10% away from its 2021 peak.

ITC, one of the heavyweight stocks in the Nifty, experienced a sell-off due to rumours that one of its parents may be looking to sell their stake. ITC’s stock price had reached nearly 500 previously, driven by the buzz surrounding a potential demerger. However, it has now fallen below 400, neutralising the hype that was created during its upward journey. Another heavyweight stock, Nestle, also fell by 3%, while Britannia was down by 4%. The FMCG sector as a whole suffered, with its index experiencing significant losses.

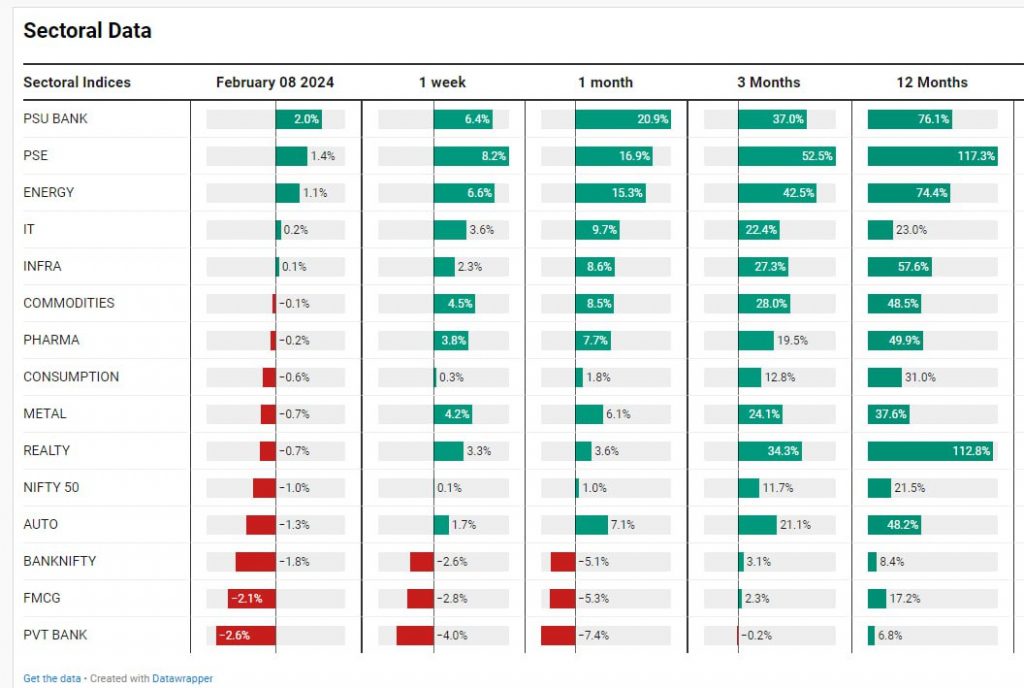

Sectoral Overview

Most sectors, including FMCG, auto, real estate, and metals, experienced declines, suggesting a market-wide cooling off. However, PSU banks and public sector enterprises, influenced by the prime minister’s recent speeches highlighting promises for public sector enterprises, held strong. The overall market seems to be waiting for consolidation at this stage. PSU banks and public sector enterprises led the sectors with gains of 2% and 1.4%, respectively. Energy stocks also performed well, with a 1.1% increase.

Mid & Small Cap Performance

Mid-cap stocks did not experience significant declines even though they opened with a gap up and came down during the day, maintaining their relative stability. Smallcaps were also marginally down from yesterday

Nifty Bank Overview

The Nifty Bank initially fell to 46,400, then witnessed a rebound to 46,800. However, it is now retracing from its intermediate top. The overall trend shows lower lows and lower highs, indicating a potential search for support around 44,400.

Nifty Next 50 Rally

On the other hand, Nifty Next 50, an index consisting of the next 50 companies after Nifty, has been performing relatively well compared to other indices. It experienced a gain today, continuing its positive momentum.

This indicates the potential for strong returns with the WeekendInvesting NNF10 strategy, which has gained around 70% in the last year. In comparison, Nifty gained 25% and Nifty Next 50 gained 45%.

Highlight – Paytm

Paytm experienced significant losses today, displaying a bearish engulfing candlestick pattern that suggests further downward pressure. It is essential to exercise caution and wait for at least two consecutive days of high closing prices before considering investment in stocks that have recently fallen. Rushing in to catch falling knives can be dangerous, as it exposes investors to unnecessary risks.

Highlight – PSU Bank

PSU banks, including State Bank of India, showed remarkable strength, rallying consistently. Despite their recent financial results falling below expectations, these banks exhibited strong performance. While there is uncertainty regarding future performance, these stocks have provided an opportunity for those who were able to identify and ride this upward wave.

Highlight – HDFC Bank

In contrast, HDFC Bank has been experiencing a consistent decline for the past six weeks. The stock has not given any respite to investors and is currently trading near October 2001 levels. Observers should keep an eye on potential support levels at 1,250-1,275.

If you have any questions, please write to support@weekendinvesting.com