Market Outlook

the market saw green closings, exactly where it closed yesterday. This indicates no further damage today, but it doesn’t necessarily mean the fall may be over. The head and shoulders pattern highlighted yesterday still have room to complete if the support levels need to be retested. Despite the interim relief, FIIs are still selling big time on a daily basis, causing more damage to the market.

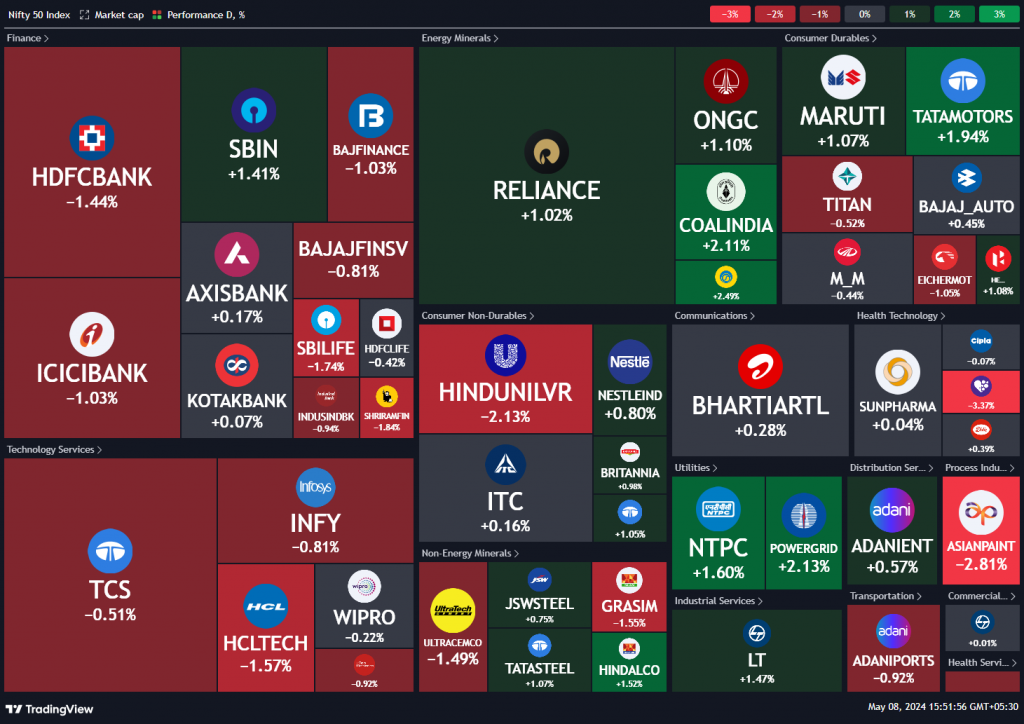

Nifty Heatmap

There were some bright spots, with utility stocks, energy stocks, auto stocks, commodities, and metals making a comeback.

The Nifty Next 50 heat map showed more green, with stocks like REC and PFC, which were heavily hit two days back, recovering significantly. Public sector enterprise stocks like HAL, BEL, and IOC also moved up rapidly, along with capital goods companies like ABB, Ingersoll Rand, and Siemens.

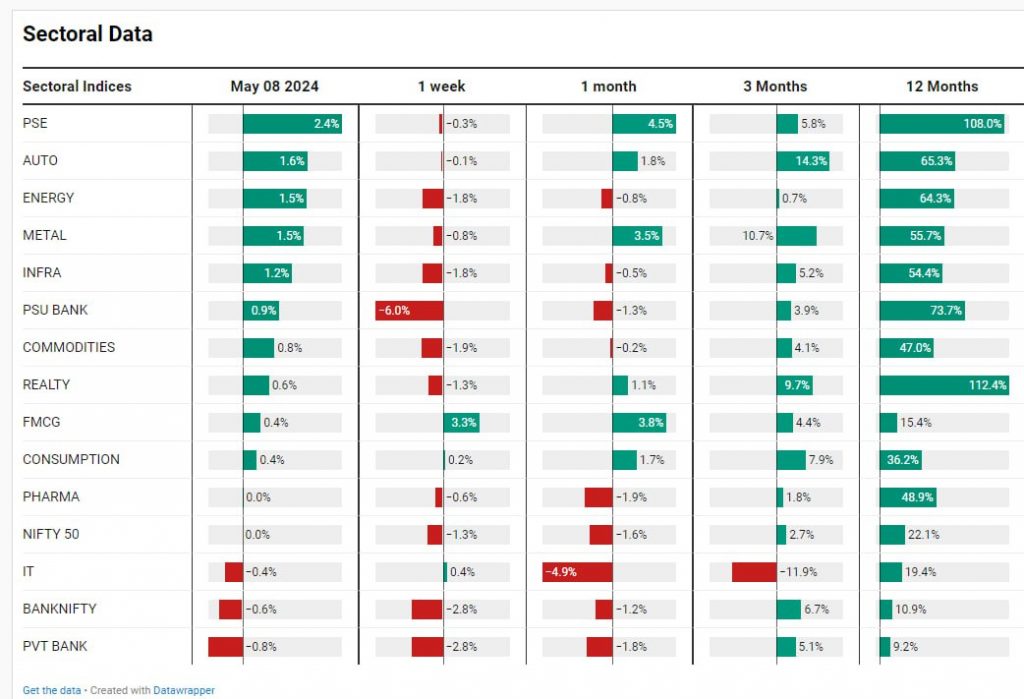

Sectoral Overview

FMCG is now the leader of the pack in terms of this current week at 3.3%, 0.4% today. And you also had, on the positive side, energy and metals, as I mentioned. So significant damage that was done in the last three days is, has been recovered. PSU banks, of course, still quite damaged this week at -6% and private banking further slipped 0.8% at -2.8% for the week. So sort of a mixed bag, a interim sort of relief in terms of falling. So we didn’t fall the fourth day running, but, you know, just about, you know, essentially just nothing sort of a day

Nifty Bank Overview

Nifty bank continued its fall for the 6th consecutive session, a worrying sign. Small caps showed insignificant movement

Nifty Next 50

Nifty Next 50 made significant progress, capturing back much of yesterday’s down move.

Century Textiles

Century Textiles and Ingersoll Rand were among the stocks that performed well despite market weakness.

Ingersoll Rand

Ingersoll Rand, as I mentioned, made a huge move going from 4100 to 4400. So some of these stocks that defied the weakness in the market going to all time high, it kind of tells you that the broader base of the market is not weak yet.

Padamji Paper

Some paper stocks like Padamji Paper and Bharat Forge also saw positive movement, with Bharat Forge completing an inverted head and shoulders pattern.

In the last few sessions itself it has gone from 63-64 to about 90 plus.

Bharat Forge

Bharat Ford was another great mover today. Post results and post the commentary about the next year. It was completing a very nice inverted head and shoulders pattern here, a continuation pattern on this occasion. And this is really talking at length that the stock really wants to go up and on every dip to, you know, maybe 1320 is probably a buy going forward. And the bottom of today’s candle probably is your medium term sell point, stop loss point.

Nifty PSE Index

Public sector enterprise stocks roared back, forming a retest pattern of the breakout line, indicating potential stability. Overall, it was a flat day with nothing significant to report. The hope is for a positive green day soon to revert the current weakness.

Market sentiment may see a positive change post the phase three polling, and the US market’s positive outlook may also rub off. With improved confidence, the market may recover, provided FIIs sell a little less.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz