How are the Markets Looking ?

In today’s market, we witnessed some interesting movements and good volatility. Yesterday, the market experienced a significant decline from 22,000 to nearly 21,650. However, in the second half of the day, we saw a strong recovery. As a result, the market closed at a congestion level, ranging from 21,700 to 21,750. This range has acted as both support and resistance in recent times. Despite certain pockets of correction, there seems to be no panic in the market.

Nifty Heatmap

Public sector banks in India, like State Bank of India, saw an unexpected increase of 3.67%. This surprised many market participants who were expecting these banks to face a crackdown. Alongside State Bank of India, other banks such as ICICI Bank saw 2% gains while HDFC Bank was flat, while certain public sector stocks like NTPC, ONGC, and public sector enterprises faced selling pressure.

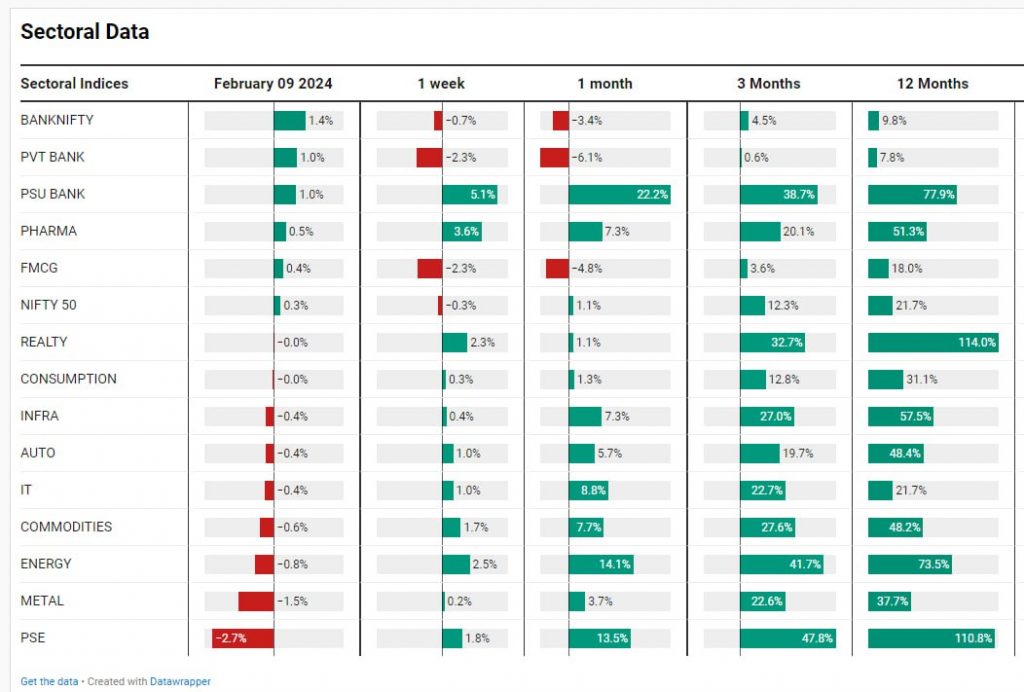

Sectoral Overview

When looking at the broader picture, public sector enterprise stocks are still up 110% over the past twelve months. While there was a decline of 2.7% in this category, it is important to recognize the overall positive performance they have had.

Metals experienced a decline of 1.5%, and there was no relief from the Chinese market. Commodities and energy also faced a slight decline of 0.6% and 0.8%, respectively. Surprisingly, the Bank Nifty saw a positive movement of 1.4%, with both private banks (+1%) and PSU banks also contributing 1%. Pharma and FMCG sectors also saw slight gains, making it an overall decent day in the market.

Mid & Small Cap Performance

When looking at the mid-cap and small-cap segments, we see that they are still holding their ground. While there have been some corrections, the overall trend remains intact.

Nifty Bank Overview

The Nifty Bank saw a commendable rise and did not collapse to its support level of 44,400. This represents a strong rally for the Nifty Bank.

Nifty Next 50 Rally

Additionally, the Nifty Next 50 index performed well, bouncing back from lower levels and closely approaching yesterday’s close.The long tailed candlestick seen here, as mentioned earlier, signifies strength at lower levels and hence it is being brought up again.

Highlight – Paytm

In recent days, Paytm has faced a decline, but today’s doji candlestick suggests the emergence of support at current levels and default from here may not be steep now. It may consolidate around this point for some time before any significant movement. As a thumb rule, waiting for the stock to close above the two-day high is advisable before attempting any long positions.

Highlight – PSU Banks

PSU banks have shown strength today, mostly due to the strong performance of State Bank of India.

Highlight – Power Finance Corp

Power Finance Corporation, on the other hand, faced a decline of nearly 10% today at one point in the day but overall, it has witnessed a climb back up from Rs. 200 to Rs. 480. However, this stock may experience some give-up in the future.

Highlight – Zomato

Taking a closer look at specific stocks, Zomato has seen significant growth recently climbing to Rs. 150 from Rs.45-50, tripling its value in less than a year. The price action started around nine months ago while the results of the company can be seen now.

To see the discussion on the interest in investing in the US market survey done on the WeekendInvesting App, check out the detailed video analysis linked below and join the WeekendInvesting community now !

If you have any questions, please write to support@weekendinvesting.com