Market Outlook

Quite a remarkable day as the Nifty continued to bleed in. In the last five sessions, almost all sessions have been down, with yesterday being just a minor blip up. The market appears nervous and seems to be buying into the narrative that the election outcome numbers may be lower than expected.

We’ve now closed very near a trend line, although the significance of trend lines diminishes if money flows out of the market. However, there are some positive aspects to consider. We’re close to where we started the calendar year, indicating decent consolidation over the past five months. The 200 DMA has caught up to 20,800, just 6% away from the current level.

Despite the recent turbulence, the market hasn’t seen a dramatic run-up in the last four or five months, which is a positive sign

Nifty Heatmap

The Nifty heat map showed significant selling pressure in HDFC Bank, Bajaj Finance, Reliance, ONGC, Coal India, ITC, Britannia, NTPC, and L&T, indicating likely foreign investor selling. While State Bank of India posted fantastic results, it closed only marginally up due to market conditions

Sectoral Overview

PSE index damage 3.4% today. Energy index damage 3%. Metals indexed nearly 3%. Autos is the only one at plus 0.8%. So not so good market.

Most of the sectors are 50, 60, 100% up. Only very few sectors like banking did not really do well in the last twelve months. But other than that, very, very healthy gains over last twelve months. So whenever you will have a fantastic class tier, you may have a sober next year. That is always par for the course and one should be ready for that. One can’t expect every year to be a sixer.

Nifty Mid and Small Cap

Mid caps broken down. I think this is not a good chart at all. But the good thing is that four or five months we have consolidated at this similar level.

We are about 10% from where the 200 DMA small caps also has broken down. They will need some consolidation or some great news which overturns the current narrative to go up again. So it is going to be maybe, maybe winter is here early.

Nifty Bank Overview

Nifty Bank has come back to December levels, showing no gains over the past six months.

Nifty Next 50

Nifty next 50 is, is the index, which was going up dramatically. So it went up, you know, in the last six months from 44,000 to 66,000, almost a 50% gain. So 50% gain if it drops maybe like 20% from the top.

Nifty PSU Bank

PSU banking index did not fall much today, but that was precisely because of State bank of India. I suppose if State bank of India starts to gain, maybe the fall here will get arrested.

Nifty Auto Index

Auto index made a new high during the morning session. Gave up some of the gains in sympathy with the market, but is looking very strong at very, very much at near new highs.

Nifty FMCG Index

FMCG index has given up the entire two, three days of gain it had. It is now retesting the breakout. I’m not very sure if this holds, but there is some evidence that is coming around that rural growth is now doing better than urban growth. And that is what the FMCG companies were waiting for. So hopefully this will bounce off from here tomorrow.

Nifty Energy Index

Energy index again, trend line is broken. Coming down can come down much further. It has rallied quite a bit. So this is looking like sort of a weak chart here.

Nifty Infra Index

Similarly for infra index is near this particular support, but it doesn’t look like, you know, very, very strong right now. It needs to consolidate, have at least three, four, five sessions after the fall like this and then build up. So maybe some consolidation will happen here before the next build up. To expect a V shape recovery is probably expecting too much, maybe right now

Nifty PSE Index

Public sector enterprise, which we thought yesterday had bounced off the breakout region, has broken down again. So this entire breakout has been nullified, it looks like coming down and below this, this 9250 kind of level

I think there can be very sharp move downs down here in PSE index because PSE index has come off from a very, very low bottom and a lot of folks are sitting on with lot of profits in these counters.

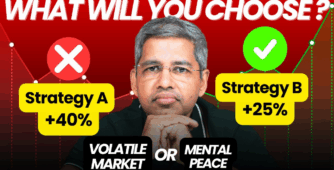

The way most human psychology in most portfolio works is that sell off, whichever has the most profit, you should do the reverse, actually sell off, which is stocks that are giving you losses or which have not gained despite such a bull run and not give up all the gains.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz