Today, we’re discussing the softer tone in the broader markets. The Nifty opened with a gap down but managed to recover for most of the day. However, the overall sentiment remains one of softness and weakness, with many earlier gainers and past winners in various sectors gradually drifting down, if not outright falling.

Before diving into the details, a quick update: today is the last day to subscribe to Mi Evergreen at the old prices, as pricing will increase starting tomorrow. Now, let’s turn our attention to the alarming surge in young traders. I’ll be presenting some statistics from ET and Mint, and I’ll share my views on this phenomenon—how it’s caught the attention of young folks and why it might not be the best path for them.

Market Overview

where is the market headed? The market remains quite resilient. While the Nifty opened slightly down, it eventually recovered, closing 0.34% higher. This suggests that the market is not in a rush to decline, as we haven’t seen significant consecutive drops.

Nifty Next 50

Looking at the Nifty Junior, support has come from the 40-day moving average, with the index recovering most of its losses and closing near the day’s high—a positive sign. The index ended up 0.515%, recovering much of the day’s weakness.

Nifty Mid and Small Cap

Similarly, mid-caps took support at their moving average, closing only 0.25% down after being over a percent down at one point. Small caps, on the other hand, closed down 0.83%, but they have been on a different trajectory compared to other market segments, showing no significant damage.

Nifty Bank Overview

Profit-taking has occurred in several sectors, particularly in defense and public sector enterprises, including public sector banks, which continue to decline. Stocks that had risen exponentially may be the ones to fall more, leading to market normalization. The Bank Nifty, however, was a strong performer today, recovering nearly 1% from its previous session’s losses—a positive sign as it leads the markets upward.

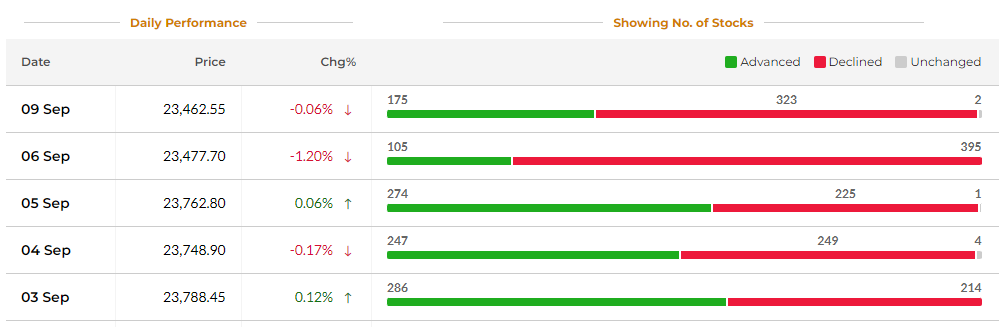

Advanced Declined Ratio Trends

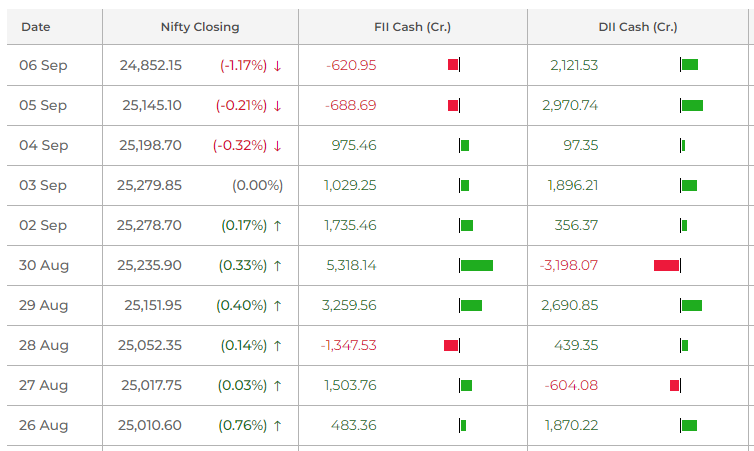

Momentum trends show an advance-decline ratio of nearly two to three, with the skew leaning towards declines over the past few sessions. However, today’s fall was arrested, which is encouraging. Foreign Institutional Investors (FIIs) continue to sell, but their selling volume has decreased dramatically compared to June and July, when they were offloading large amounts daily. Domestic Institutional Investors (DIIs) continue to buy.

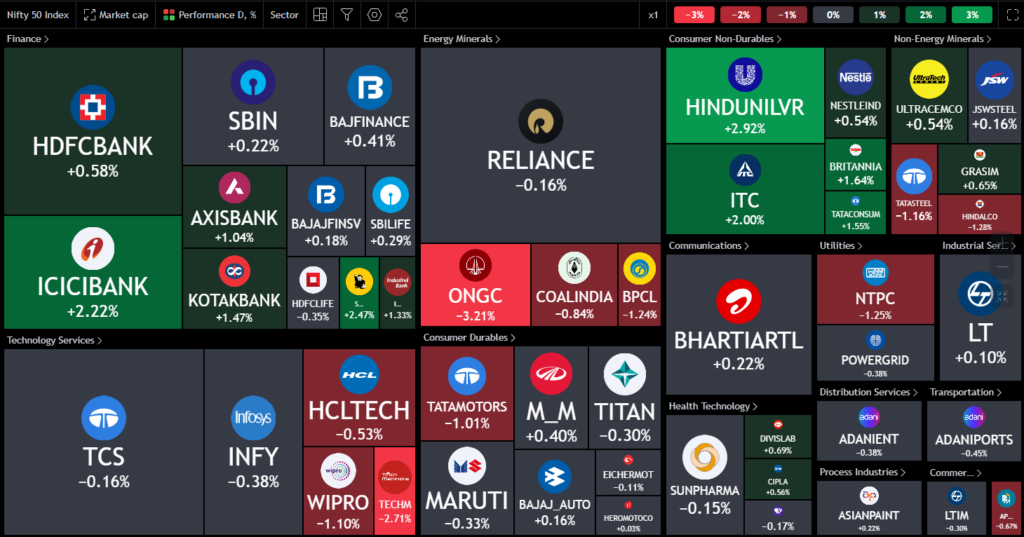

Nifty Heatmap

In terms of stock-specific movements, ONGC and Tech Mahindra were among the worst performers, while ICICI Bank, ITC, Hindustan Lever, Britannia, and Tata Consumers held up the Nifty. There was no consistent trend across sectors, with Nifty Next 50 also seeing some drops in public sector finance stocks like REC, PFC, and IRFC, although they recovered from their intraday lows. Bajaj Holdings, after several days of gains, saw a drop. On the other hand, VBL, Dabur, United Spirits, Godrej Consumer, Marico, Chola Finance, and Bosch Limited performed well.

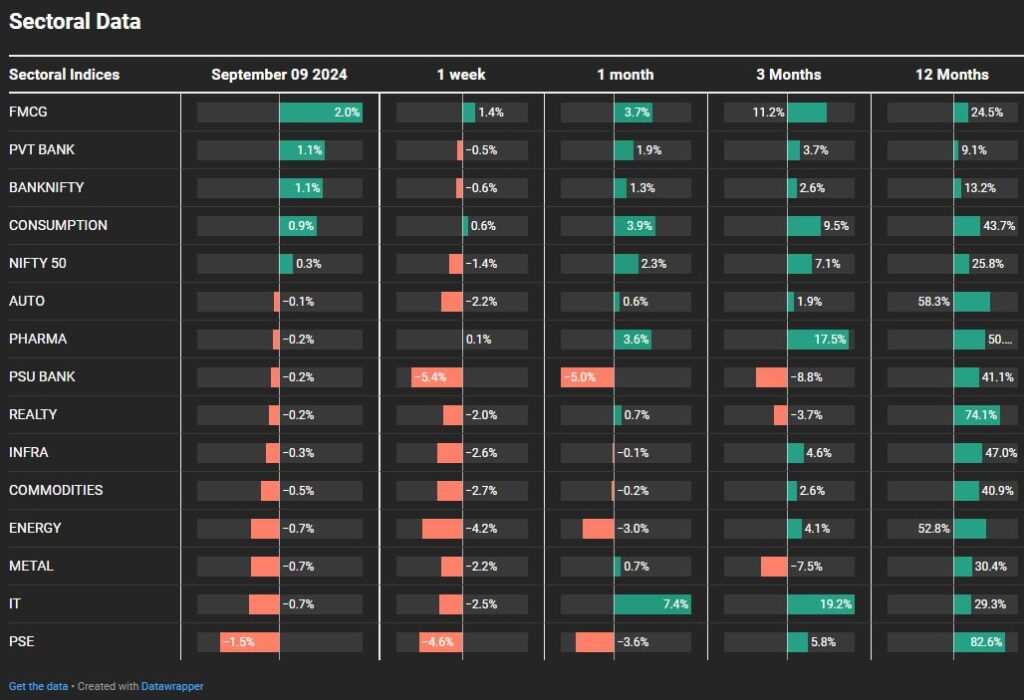

Sectoral Overview

Sectorally, FMCG stocks saved the day for the Nifty, acting as a defensive shield during the market’s softness. While FMCG, Pharma, and IT typically lead on bad days, IT was clobbered today, down 0.7%, although it remains the leader on a three-month basis. Public sector enterprises lost the most, down 1.5%, followed by energy and metals, each down 0.7%. Private banks, however, were a standout, leading the Bank Nifty higher, along with consumption stocks, which benefited from the upcoming festive season.

Sectors of the Day

Nifty FMCG Index

FMCG stocks hit new highs, with companies like Lever, Godrej Consumer, United Spirits, ITC, Britannia, Marico, and Tata Consumer all performing well.

Stocks of the Day

Alembic Pharma

APL Limited was up 8.8%, recovering to new highs after gains in June, July, and August. Stocks that do well on relatively poor days are worth watching.

Story of the Day: Alarming surge in young traders

Some statistics indicate that in the financial year 2023-24, 9.2 million individuals and proprietary firms incurred a loss of ₹51,000 crores. Of these investors, 85% lost money, and 90% ended up with losses. This is a well-known fact, highlighted in a SEBI report. The registered investor base at the NSE has grown steeply, from 31 million in March 2020 to 100 million in August 2024, a significant increase in just over four years.

While many of these investors may be inactive, the sheer volume of new investors reflects a strong trend. As prices rise, more people are attracted to the market, but as prices fall, many may exit. This is the natural cycle of market participation, driven by fear of missing out (FOMO) during rallies and the eventual cooling off when short-term returns diminish.

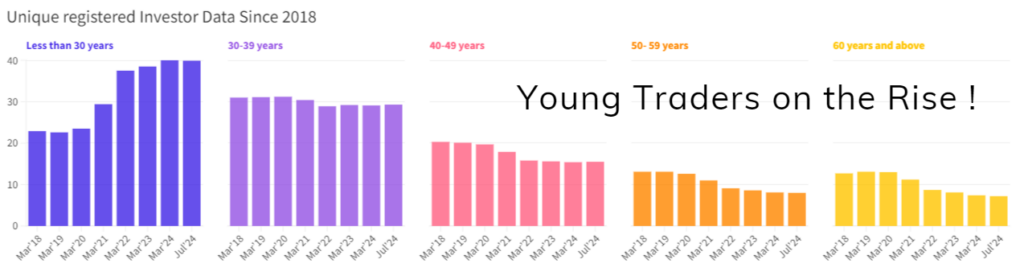

A notable trend is the dramatic increase in participation by young investors. Since March 2018, the proportion of unique investors under 30 years old has risen from 22-23% to 40%. Meanwhile, participation from other age groups has slightly decreased. This influx of young investors is significant, especially considering they have only experienced buoyant markets over the past few years without witnessing a bear market. This lack of experience can lead to unrealistic expectations about future market returns.

Intraday trading has also surged, with the number of traders increasing from 1.5 million to 6.9 million. However, the majority of these traders—71% on average—are losing money, a figure that has increased from 65%. Most people are not making significant gains in the market, and the capital gains filings from last year show that only a small handful of individuals reported capital gains exceeding ₹5 lakh.

In response, SEBI has tried to curb this euphoria by regulating influencers who were promoting brokerages. Many of these influencers were effectively misselling, encouraging people to open brokerage accounts without fully understanding the risks involved. SEBI has now mandated greater accountability, leading brokerage firms to cease payments to influencers acting as affiliates.

The market is currently at a point where unbridled enthusiasm is being checked, both by regulators and by the natural cooling off of investor sentiment. Options trading has seen a 100% increase in pricing and taxation, and capital gains taxes have also risen. These factors, along with the regulator’s focus on curbing speculative activity in SMEs, are leading to more consolidation in the market. However, investor greed remains a challenge. While regulators aim to protect innocent investors, those driven by the desire to double their money quickly may continue to take unnecessary risks.

For those who haven’t made money in the last few years, it’s time to reassess their strategies. The past few years have been among the easiest periods to make gains, so if trading hasn’t worked out, it might be worth considering a shift to long-term investing. Trading requires a high level of discipline and quick decision-making, which may not suit everyone. For those attempting trading on the side while holding full-time jobs, the odds of success are slim.

In conclusion, trading may not be for everyone, and those struggling to make consistent gains should consider other avenues for wealth-building. Start small, limit your capital at risk, and only scale up if you find that you are consistently improving. Otherwise, it’s important to protect your capital and avoid falling into the traps of short-term speculation.

Mi EverGreen’s Subscription Fee goes up tomorrow –

10 Sep 2024

Effective tomorrow, 10 Sept 2024 , Mi EverGreen’s subscription fee will be increased for the first time since launch.

Old Pricing : Rs 2,499 (Quarterly) | Rs 7,499 (Annual)

New Pricing : Rs 4,999 (Quarterly) | Rs 14,999 (Annual)

Nothing changes for current subscribers at all. You shall continue to enjoy access to the strategy at your current subscription fee as long as you do not break your subscription loop. Kindly ensure that you keep your auto renew ON and renew your subscription on time.

For those who haven’t subscribed yet

This is a great opportunity to subscribe to Mi Evergreen at its current pricing. Use the link given below to subscribe