How are the Markets Looking ?

On November 15, 2023, the markets made a decisive move above 19,440, indicating a positive trend. We are back in the middle portion of the range, very much possible to move towards 20,000, the volumes are good.

The first indicator of the market’s strength was its internals. After the opening bell, the market remained flat for the first few hours before experiencing an upward movement in the afternoon. This sustained upward trajectory showcased the market’s resilience and indicated strong investor sentiment. Additionally, there was no attempt to close the gap, further solidifying the market’s strength.

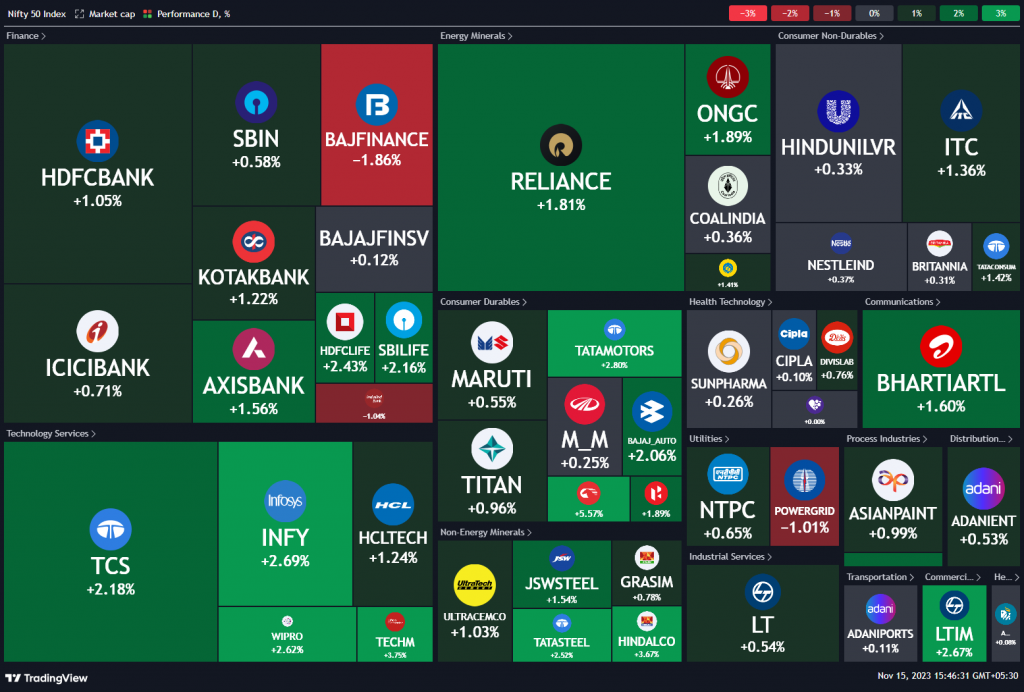

Nifty Heatmap

To better understand the market’s overall performance, let’s take a closer look at how various sectors fared on that day. Almost every sector, including banks, oil and gas, energy, autos, steel, cement, and IT stocks, witnessed positive movement. However, it was the real estate stocks that stole the show. In a single day, the Real Estate Index gained a staggering 3%. This gain extended to the weekly, monthly, three-month, and twelve-month timeframes, with increases of 4.7%, 11.5%, 29.5%, and 44.6% respectively.

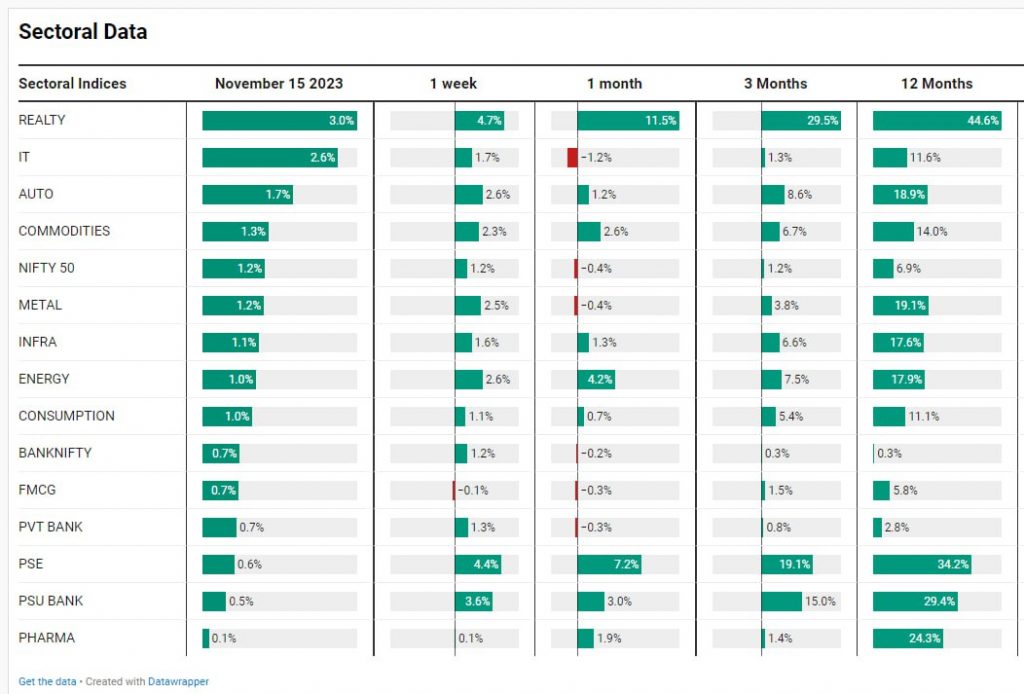

Sectoral Overview

The real estate sector’s exceptional performance is especially noteworthy because it often acts as a leading indicator for the broader market. When a market downturn occurs, the real estate sector tends to be the first to recover, indicating the potential for a broader market turnaround. In this case, the real estate sector’s surge suggests that the broader market, including the Nifty and other indices, may follow suit. This is a positive sign for investors and indicates an overall bullish sentiment.

Mid & Small Cap Performance

Mid cap 100 up from 41,000 to 41,400, nearly a 1% gain, closing very near the previous high and we are about to make a new high on the midcap 100. On Smallcap 250 is in different zone, new high with a new gap up, the strongest part of the market. It is very important to see what the strongest part of the market does because it has led the recovery of the market. Nifty and other parts of the market will follow this as this has been the leading indicator of the market.

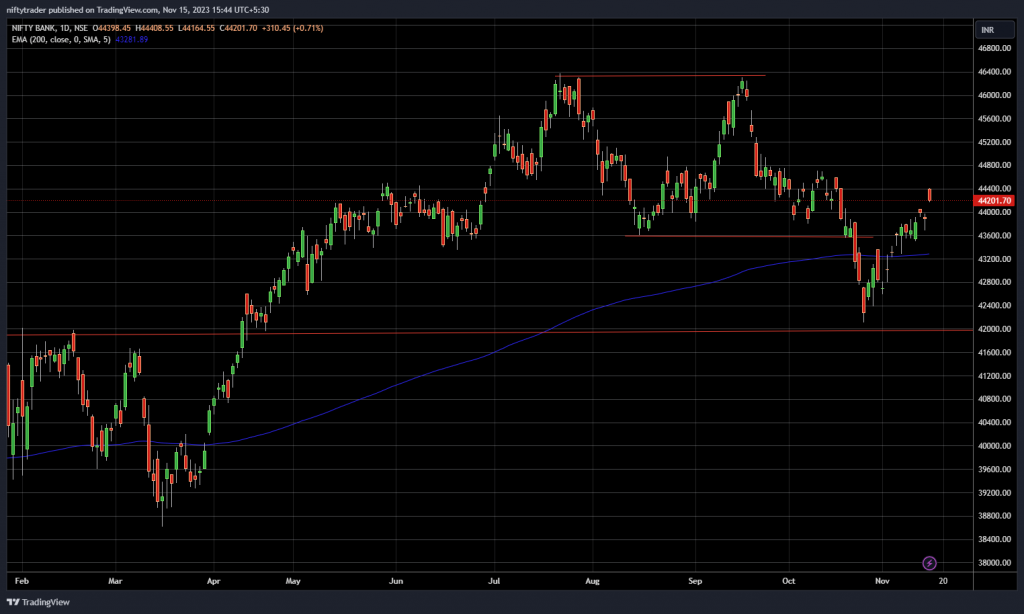

Bank Nifty Performance

Nifty Bank has been the laggard of the market, nowhere near the all time high. It is still above the 200 DMA, tried to go back today so this is the weak part of the market but it is being dragged along by the enthusiasm of the rest of the market.

Stock in Focus – Religare Enterprises

The stock of the day is Religare Enterprise. There was a recent open offer by the Burmans Octavar Limited to acquire stake into this company and they had made an offer at 235. There is a contentious battle for control taking place between the current management and potential suitors. As it can be seen in the chart below, the market knew this information much before. The market ran from 160 to 280 before this offer was disclosed – the market knows it all, as we say “Bhav Bhagwan Che”. Despite the stock’s initial surge on the news of a new management team, the market is now concerned about potential fallout from the conflict. This uncertainty highlights the importance of closely monitoring price movements and using them as leading indicators for market sentiments.

Highlights

The US markets experienced a breakout, signalling a potential end to the lower low lower high trend that had been forming. Additionally, lower-than-expected inflation rates in the US provided the markets with even more confidence that the interest rate hike cycle may be nearing its end. Although, cuts are nowhere in the picture. Whenever in the history, there have been sharp cuts in the market, markets have not done well.

The global market’s impact is often tied to the strength or weakness of the US dollar. When the dollar strengthens, emerging markets, precious metals, and commodities often experience outflows. Conversely, when the dollar weakens, these assets receive a liquidity boost as investors shift their focus away from the dollar. Currently, the US dollar index is projected to fall towards a level of 101. As a result, Indian markets is likely to witness a further uptrend.

If you have any questions, please write to support@weekendinvesting.com