How are the Markets Looking ?

It has been a rather uneventful week in the Indian stock market, with minimal movement in the indices. The Nifty has been stuck within a tight range, unable to break out of the long candle that formed on November 15. Despite a brief attempt to surpass the 19,850 mark, the Nifty remained flat throughout the week.

Nifty Heatmap

Upon examining the heat map, we can observe a decline in several stocks, such as Wipro, HCL Tech, Infosys, and TCS in the IT sector. FMCG stocks like ITC, Nestle, Britannia, and Tata Consumers were also down, while Reliance and SBI remained flat. However, HDFC Bank showed a slight increase, and the pharmaceutical sector stood out as the only bright spot in an otherwise dull week.

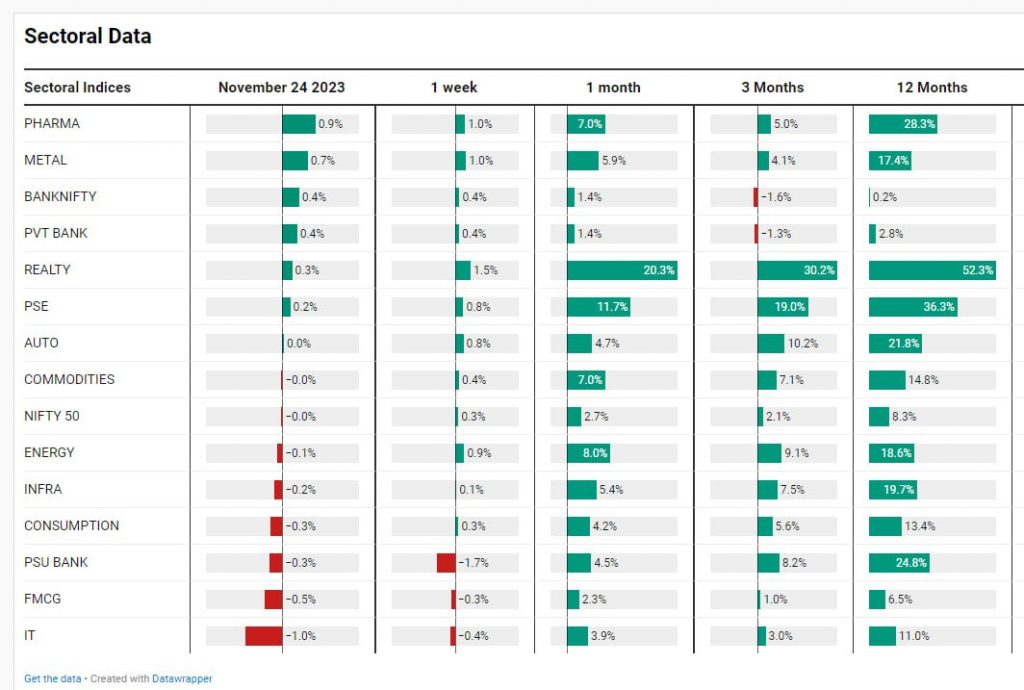

Sectoral Overview

Defensive stocks, such as pharmaceuticals, made gains while other sectors, including infrastructure and automobiles, took a backseat. The pharmaceutical sector posted a 0.9% increase, while metals and private banks experienced modest gains. Real estate also saw some slight growth. Overall, it was a lacklustre week in the market, reminiscent of the holiday season where activity tends to dwindle.

Mid & Small Cap Performance

While the stagnation might seem discouraging, it’s important to recognize that consolidation or a period of range-bound trading can be a healthy sign for the market. Our mid-cap stocks are nearing their all-time highs, with the Nifty Midcap index reaching 42,000. Small-cap stocks are also close to their all-time highs of 12,984. This suggests that the market is taking a breather before potentially making further gains.

Bank Nifty Overview

The Bank Nifty, in a pleasant surprise, ended the week on a positive note. It closed at 43,770, marking the highest close in the last six days of consolidation. This positive momentum might indicate a potential rally to fill the recent gap in the chart. Although the Bank Nifty remains weak, it hasn’t shown any significant downward movement, which builds hope for the upcoming weeks.

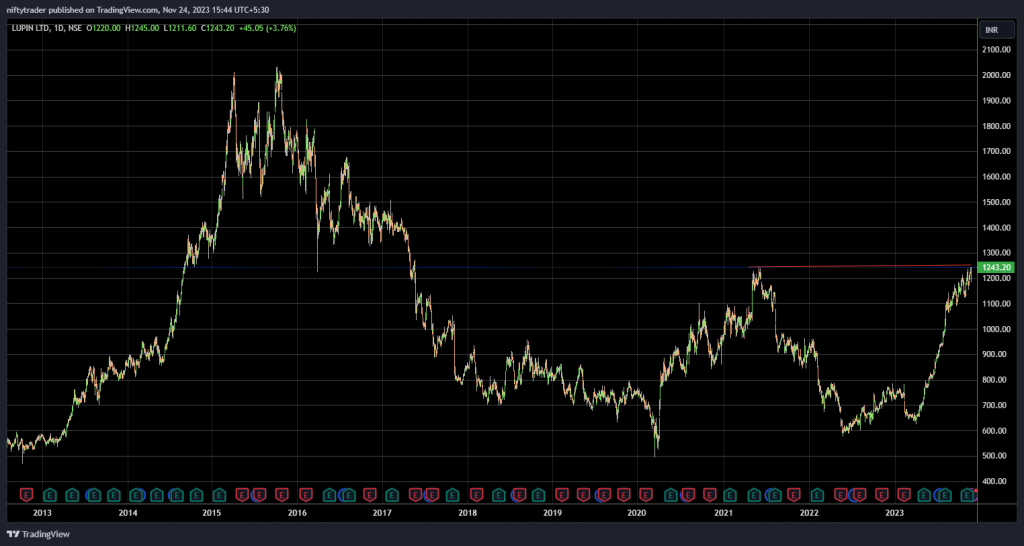

Stocks in Focus – Divis Lab, Lupin, SunPharma

Within the pharmaceutical sector, there are several stocks showing promising potential for a breakout. For those looking for discretionary positioning, stocks like Dr. Reddy’s Laboratories (Divis Lab), Lupin, and Sun Pharma Advanced are worth exploring. DV’s Lab is on the verge of breaking out above an inverse head and shoulders pattern, while Lupin is about to surpass a two-year-plus high—a strong breakout point. Sun Pharma Advanced has already broken out of a head and shoulders inverse pattern, indicating positive momentum.

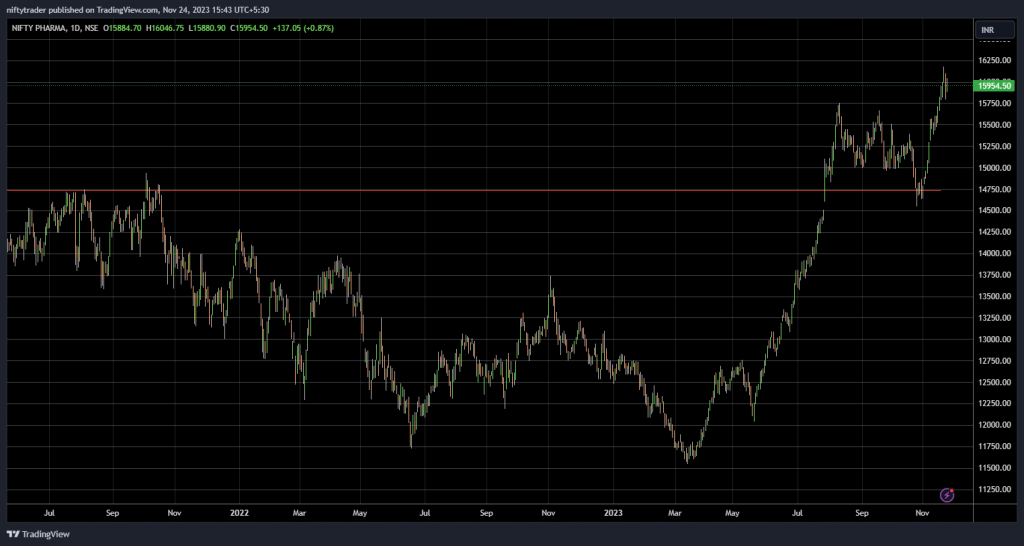

Highlights – Nifty Pharma Index

It’s important to note that it’s generally better to see the entire sector moving up before considering individual positions within the sector. The Nifty Pharma index broke out in August and retraced to retest the breakout. It now appears to be in a bullish trend, suggesting a positive outlook for the pharmaceutical sector. This could also indicate market rotation towards defensive stocks, signalling a potential stagnation at these levels.

Looking Forward

The market lacks a clear trigger for the next significant movement. However, state election results are due to be announced in December, which could provide some direction. Additionally, the vote on account budget and the general elections in the near future will likely impact the market. Investors should keep an eye on these developments as they may influence market sentiment.

If you have any questions, please write to support@weekendinvesting.com