How are the Markets Looking ?

The Nifty index, a benchmark index for the Indian stock market, has consistently been making upward moves. As of the latest update, it has maintained a gap-up from the previous day and closed at 19,653. This marks a substantial gain of over 300 points in just two and a half sessions. Despite the challenges posed by yield pressures both domestically and overseas, the markets have sustained well.

The Reserve Bank of India (RBI) recently held a meeting where they decided to keep the rates unchanged. However, they expressed their intention to absorb the liquidity in the banking system by issuing more bonds. Consequently, yields are expected to tighten up.

Nifty Heatmap

Several stocks have performed well, driving the upward movement of the index. Bajaj Finance and Bajaj Finserv have gained 4% and 6%, respectively. Some banks have remained muted but still showed positive movement like ICICI, Kotak, State Bank, Indusind Bank. TCS was up pre-empting the buyback call; Infosys also up. Unilever down 0.8%. Stocks like ITC, Coal India, Maruti, Tata Motors, and Mahindra; and steel stocks have also experienced slight upward shifts.

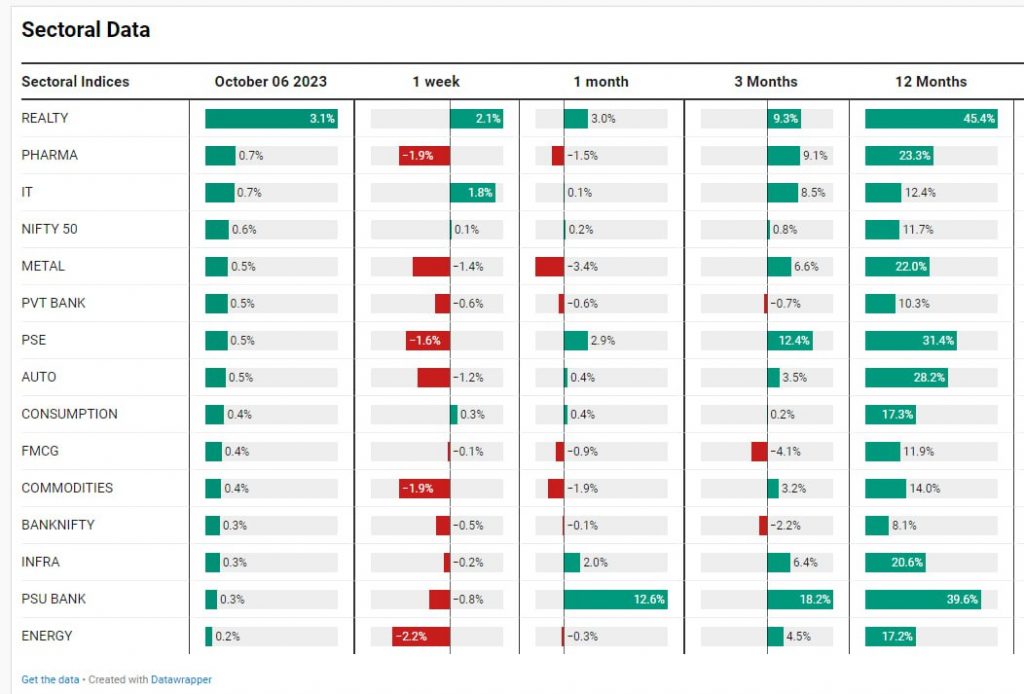

Sectoral OverviewHow Momentum can catch the Real Estate Surge

Notably, the real estate sector has witnessed a significant rally, with a single-day increase of 3.1%. This rally aligns with the broader trend observed across the country.

The real estate sector has been the standout performer recently, with an astounding rally of 45% in the past twelve months. In the last week alone, it has experienced a net increase of 2%, and in the past three months, it has surged by 9.3%. Such growth in the sector is remarkable, even though there are concerns and speculations surrounding it.

Some speculate that this rally in real estate could be a result of unaccounted money flowing into the sector or even the emergence of a bubble. However, the fact remains that the sector is thriving and showing no signs of slowing down.

The current cycle in real estate, which began in 2021 after the COVID-19 pandemic, is only in its second year. The rally is likely to continue for the next four to six years, leading to significant potential gains for well-managed real estate stocks.

However, caution must be exercised to avoid froth in some segments of the real estate market. Identifying the right opportunities and playing accordingly is crucial. Due diligence, research, and keeping an eye on market trends are essential to make informed investment decisions.

For investors looking to capitalise on the momentum in the real estate sector, a momentum investing strategy can be beneficial. Momentum investing focuses on investing in stocks that have exhibited strong performance recently. By adopting this approach, investors can ride the wave of the sector’s success without the need to worry about stock selection or sector allocation. The strategy automatically brings in stocks that are performing well and drops those that are not, eliminating any regret of missing out on a particular rally.

Mid & Small Cap Performance Overview

Mid caps had a decent consolidation that continued at 40,300.

Small cap is looking better than mid cap and ready to go up. We are only a couple of percent away from the all time high, which is not much for small caps.

Bank Nifty Overview

The Nifty Bank, for instance, attempted to go up but failed to cross the two-day high. This indicates that banks remain a concern in the current market environment.

Highlights – Indian government bond 10 year yield

Another significant concern is the movement of Indian government bond 10 year yield. Currently, it is approaching a resistance level at 7.35% or 7.36%. So far it hasn’t broken out this classic flagpole pattern. However, If it successfully breaks out of this resistance level, it could potentially lead to yields reaching 9%, which may disrupt the economy. However, it is yet to be seen if the chart suggests a drop-off from the resistance level.

Global News

On a global scale, the cooling off of the dollar index provides some relief. However, it is still too early to determine the long-term trend, as it would require the index to come below 103 and start to go lower to get rid of the threat.

Download the WeekendInvesting App

If you have any questions, please write to support@weekendinvesting.com