How are the Markets Looking ?

The market opened with a gap down on November 7 but eventually turned green unexpectedly. This deviation from the previous four days of continuous gains is a welcome move as it indicates a much-needed rest or correction. The Nifty closed near 19,0046, very close to the top of the range of the previous day, suggesting the potential for upward movement.

Nifty Heatmap

Looking at the heat map of the day, it is noteworthy that nearly 60% of the stocks in the Nifty closed in the green. However, upon closer examination, there were no significant gainers or losers. The top gainers included Sun Pharma, BPCL, NTPC, and Dr. Reddy’s Laboratories, all within a 1.5% increase. On the other hand, JSW Steel, Bajaj Finance, HeroMoto, and Mahindra were among the top losers, all experiencing a percentage loss. Overall, there were no major moves in the market.

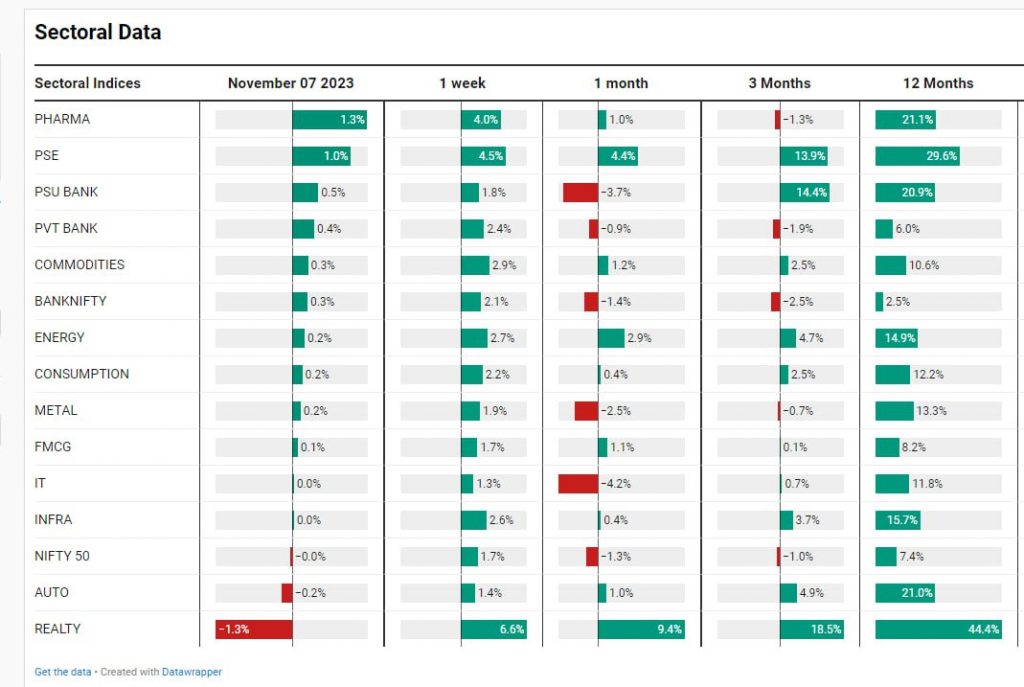

Sectoral Overview

In terms of sectoral data, the pharma sector emerged as the top gainer with a 1.3% increase, followed by public sector enterprises with a 1% gain and PSU banks with a half percent gain. Commodities and energy stocks also showed gradual upward movement. The real estate sector experienced a correction with a -1.3% decrease. It is important to note that real estate has performed remarkably well over the past week, month, and three months, so a correction was expected.

Mid & Small cap Performance

In the mid-cap segment, the Nifty mid-cap index moved up and closed above the range of the previous day, reaching above 40,000. This indicates positive momentum and suggests that the Nifty small-cap index may achieve a new weekly high close by the end of the week. This is particularly encouraging considering the sharp downward moves witnessed in the market over the past six weeks. The sustained performance of the small-cap index implies that unless there is significant negative news from overseas, the market is unlikely to experience a decline.

Bank Nifty Overview

The biggest surprise of the day was seen in the Nifty banking space. After initially cracking down below yesterday’s low and filling the gap, the bank Nifty made a sharp recovery and closed at 43,737. This indicates that the bank Nifty has completed its downward movement and is now positioned for an upward trajectory.

Stock in Focus – Zomato

Moving on to the stock of the day, we have Zomato. Over a significant period of time, Zomato experienced a price fall of nearly Rs40. However, there was no reason to engage in the stock during this downward trend. Now that the stock has started to rise, it presents a potential opportunity for growth. Many of our strategies involved entering Zomato at around Rs85, resulting in a profit of 30-40%.

The key takeaway from Zomato’s performance is the importance of avoiding capital loss during market downturns and not missing out on potential opportunities. It is crucial to wait for the right moment when the probability of a rise in stock price is high. We are currently trailing Zomato and have formulated a plan for any potential outcomes, whether it reaches Rs150, Rs200, or drops back down to Rs100.

If you have any questions, please write to support@weekendinvesting.com