Markets have been on a bullish trend, with Nifty recently touching the much awaited 20,000 mark. This milestone is particularly noteworthy considering the six weeks of consolidation the market experienced from mid-July until the end of August. In just seven days, the market has skyrocketed from 19,200 to 20,000 which displays the strength of Indian markets.

Despite global markets facing numerous headwinds such as growth issues and inflation concerns, the Indian market remains strong and relatively under-leveraged. Unlike the past, where the stock market F&O section was often over-leveraged, the current market seems to be showing signs of normalcy. While there may be some overheating in small and mid-cap sectors, overall leverage in the market appears to be relatively stable.

Additionally, the banking sector has been keeping pace with the movement of the Nifty. The Nifty heat map reflects a positive trend, with most sectors performing well. There has been profit-taking in coal India and ONGC, but beyond that, most sectors have seen an upward trajectory.

However, despite these positive indicators, it is crucial for investors to be cautious and selective in their stock selection. A study conducted on existing NSE stocks revealed that approximately 51% of stocks are still below 25% or more of their all-time highs. Around 29% of stocks have experienced a decline of more than 50%, while 22% of stocks have seen a decrease of between 25% and 50%. This highlights the importance of stock selection and the need to hold on to winners in the market.

However, despite these positive indicators, it is crucial for investors to be cautious and selective in their stock selection. A study conducted on existing NSE stocks revealed that approximately 51% of stocks are still below 25% or more of their all-time highs. Around 29% of stocks have experienced a decline of more than 50%, while 22% of stocks have seen a decrease of between 25% and 50%. This highlights the importance of stock selection and the need to hold on to winners in the market.

PSU banks have shown a remarkable 3.1% gain in just one day, reflecting an incredible run. Other sectors that have performed well include metals and autos, which recorded gains of 1.8% and 1.7% respectively. Energy commodities saw an increase of 1% each, while consumption stocks, FMCG infrastructures, real estate, and private banks all showed positive movement.

In the past decade, many sectors, such as public sector enterprises, real estate, and public sector banks, were under-owned in the market. However, the tables are gradually turning, and sectoral rotation should be a crucial aspect of any portfolio strategy. Investors need to identify sectors that are performing well and allocate their investments accordingly. Similarly, if a sector is not performing, it may be wise to exit and reallocate funds to more promising sectors. This automatic rotation, similar to momentum investing, is vital for the long-term well-being of a portfolio.

Mid & Smallcaps Performance

The Nifty midcap 100 index has witnessed a stellar run in the last six to seven sessions, rising from 39,000 to 41,400. Similarly, the small-cap 250 index reached 12,487, displaying an unprecedented upward trend. This prolonged run without any significant downward movement does raise concerns about potential overheating in these sectors. Nonetheless, it is essential to carefully monitor these indices for any signs of instability.

The Nifty bank has displayed commendable performance after a period of consolidation. It has experienced a substantial rise, surging from 44,400 to nearly 45,600. With such positive momentum, it is unlikely that the Nifty bank will slow down before hitting a new high.

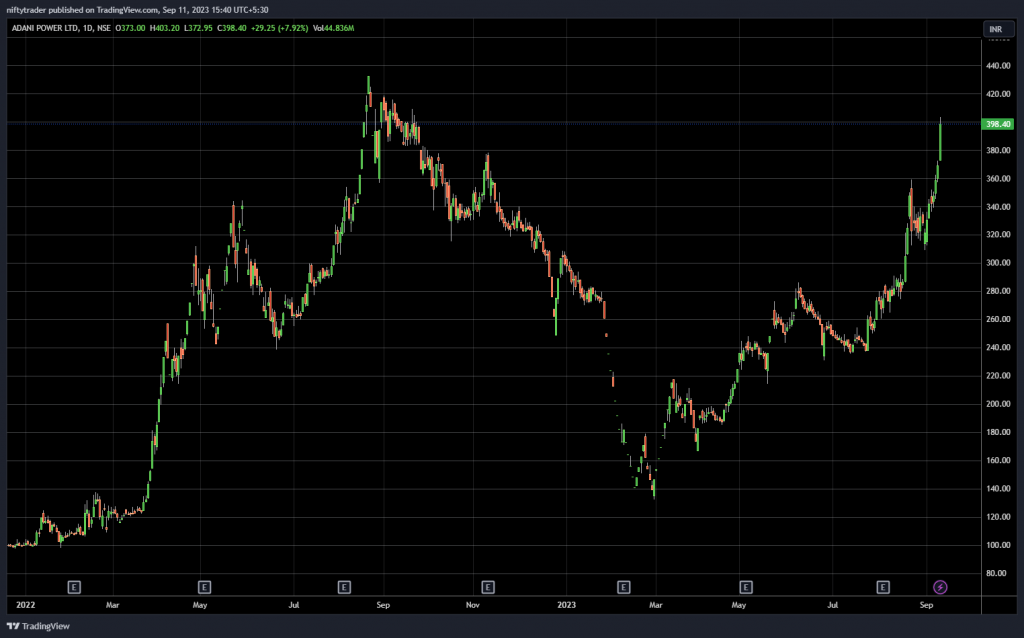

We would like to emphasise the significance of allowing the price action to guide stock selection rather than being influenced by preconceived notions or narratives surrounding specific stocks. Adani Power serves as an excellent example. In 2022, its stock price soared from 100 to 400, providing an opportunity for investors to go long. Conversely, in 2022, the stock plummeted from 400 to 100, indicating a clear selling signal. However, in 2023, the stock’s price surged once again from 140 to 398. By being open to analysing price action, investors can make informed decisions and capitalise on market opportunities.

Similarly, this principle applies to public sector enterprises, rail stocks, and banking stocks, which were once heavily criticised due to biassed views against them. However, their stock prices have defied expectations and experienced significant growth. For instance, one stock has risen from Rs40 to nearly Rs190 and continues to show upward momentum. Opportunities like these are not unique and tend to recur yearly. It is crucial for investors to position themselves wisely, allocate their resources, and patiently wait for these promising opportunities to arise.

While the US Dollar Index has remained relatively stable, a potential drop in its value could result in an influx of dollar flows into the Indian market. This surplus liquidity could pose a unique challenge, similar to what Japan and India experienced in the past.

When an abundance of liquidity targets a limited number of stocks, prices can skyrocket due to heightened demand. This process mirrors an auction, where a scarce resource’s value rises exponentially until the bidding frenzy subsides. As an investor, it is crucial to have a well-defined strategy and allow the market to run its course.

Download the WeekendInvesting App

If you have any questions for us. please write to us on support@weekendinvesting.com. You can also get on a 1-1 meeting with us should you need more clarity about the strategies or process.