Let’s start by examining the larger caps. The Nifty, the benchmark index of the National Stock Exchange of India, has been hovering around the 20,000 mark. It crossed this threshold several times during the day, consolidating near 20,000 after a seven-day streak of continuous growth. We believe further consolidation at this level would be beneficial before the market makes another upward move.

When we look at the Nifty Heat Map, we see that most sectors were down, with a few exceptions. Larsen & Toubro (L&T) saw an increase due to an upgraded buyback price, and ITC also saw a 0.9% increase. On the other hand, we saw major damage among stocks such as Mahindra & Mahindra and Tata Motors, which were affected by rumors of an additional 10% GST on diesel vehicles. Despite the rumor being denied, the stocks did not recover.

Energy stocks, including BPCL, took a hit as rising crude oil prices caused margin issues for marketing companies. Coal India and lever stocks also saw a decline, along with Reliance, State Bank of India, steel stocks, and Adani stocks

In terms of sectoral overview, all sectors were down except for Information Technology (IT) and Pharma, which showed marginal gains. FMCG and real estate stocks also experienced losses.

While this corrective move may appear significant, it is essential to understand its context. The mid-cap index has witnessed a 40% gain, growing from 30,000 to 42,000. In a normal market correction, the index would retrace approximately 25% to 33% of this gain. In other words, even if the index were to drop to around 37,000, it would still be considered a normal correction.

Given the recent rumour of a fund manager front-running mid-cap and small-cap stocks, it is important to assess whether this correction is a knee-jerk reaction or part of a more gradual and shallow correction. The involvement of Society General, as rumored, may have caused a significant sell-off, leading to the market’s decline. However, as this does not seem to be a systemic risk, we anticipate the market recovering from this setback quickly.

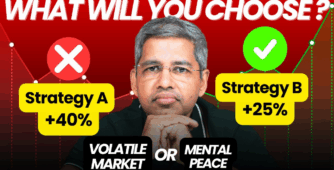

Small cap stocks tend to exhibit a unique pattern – they surge ahead, then pull back, only to surge ahead once again. This volatility makes the small cap space both exciting and risky for investors. By using well-defined strategies, it is possible to capture the majority of the upswing while avoiding the downswing. At Weekend Investing, we employ such strategies to maximise returns from small caps.

Although the correction has impacted mid and small cap stocks, the larger caps remain stable. This suggests the possibility of a shift from small and mid caps back into large caps. Such shifts have occurred in the past, most notably in 2018 and 2020. Investors should consider this possibility and explore potential opportunities in large cap stocks.

It is worth noting that over a longer period, small cap and Nifty returns are essentially similar. However, small caps tend to experience more significant short-term fluctuations. By effectively capturing the upward movements and mitigating the downward ones, investors can still achieve substantial gains from small caps. At Weekend Investing, we have developed strategies designed to take advantage of these market dynamics.

Download the WeekendInvesting App

If you have any questions for us. please write to us on support@weekendinvesting.com. You can also get on a 1-1 meeting with us should you need more clarity about the strategies or process.