How are the Markets Looking ?

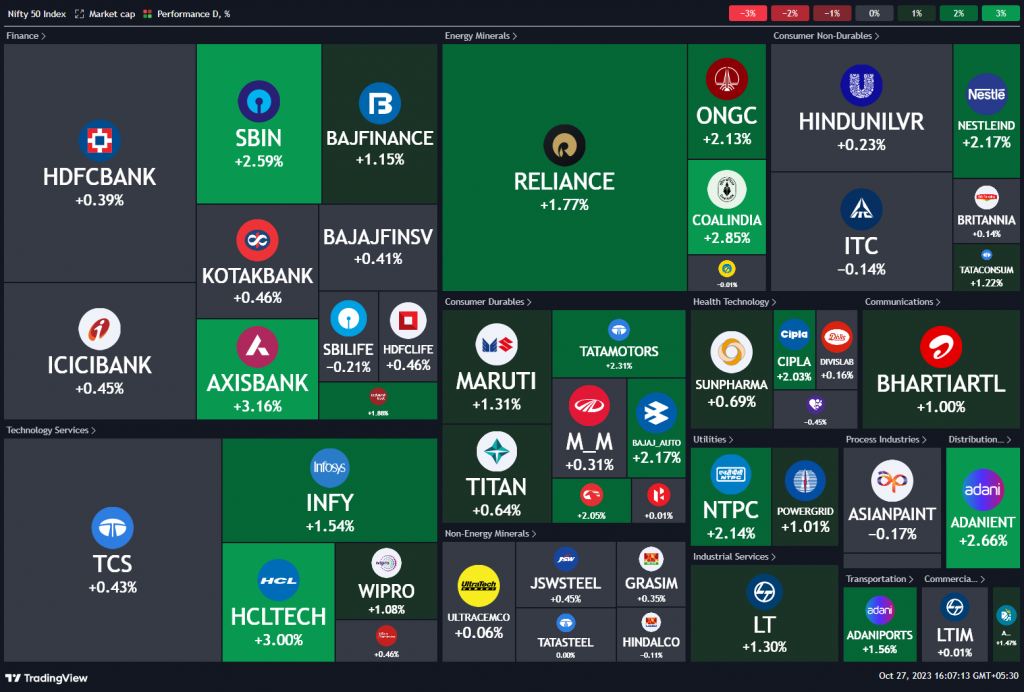

The stock market has been experiencing a series of downward movements in the past seven sessions. However, finally today, a bounce finally occurred. It is important to note that this bounce falls exactly at the 200 DMA (Day Moving Average), which indicates that it is currently following a textbook-style bounce.

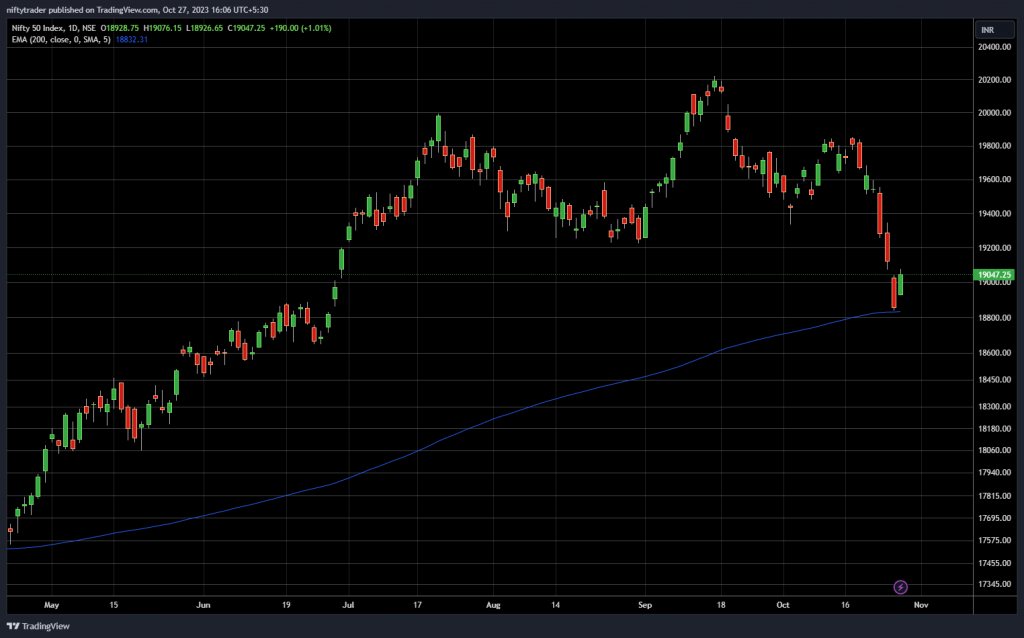

Nifty Heatmap

In order to better understand the potential outcome of this bounce, it is necessary to analyse various scenarios. One possibility is that the bounce may end at this point or perhaps extend slightly further. A good bounce would generally retest the bottom at around 19,200, which equates to approximately a 150-point increase. Following this, there is a high likelihood that the market will come back to retest the 200 EMA (Exponential Moving Average). The market can either fall through it or bounce back up, which is a common play in these situations.

Reversals in the stock market are typically seen in hindsight and cannot be accurately predicted on the day of the reversal. It is possible that this bounce marks the beginning of a reversal, but currently, the probability of that occurring is considered low. To make a more informed judgement, it would be necessary to observe the strength and extent of the bounce over the next couple of days.

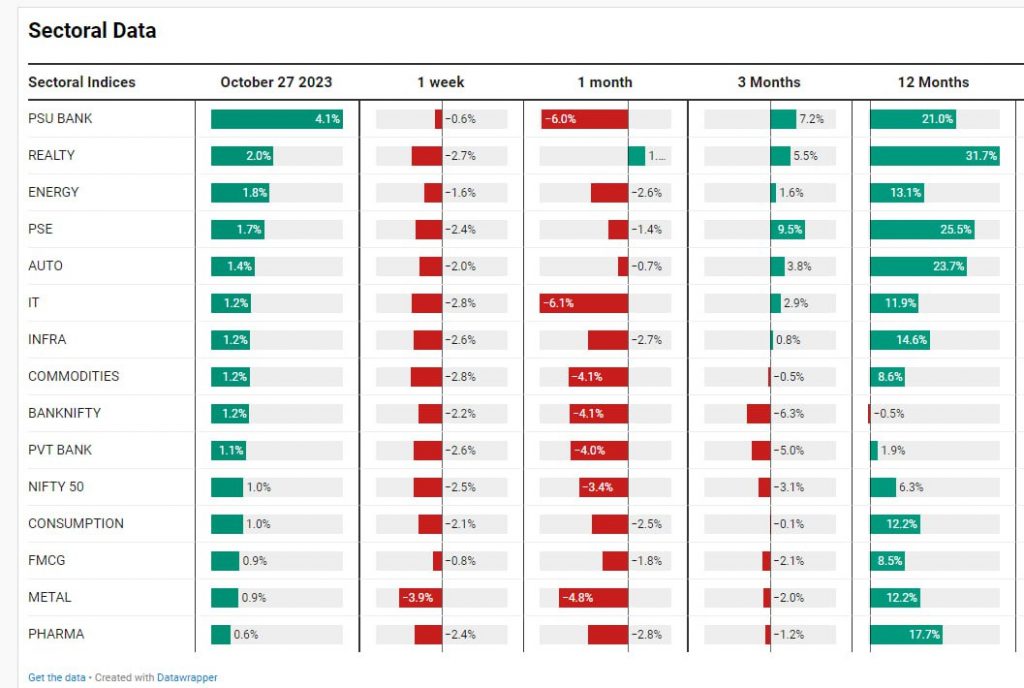

Sectoral Overview

Reviewing the performance of different sectors during this bounce, we can observe some interesting trends. State Bank of India (SBI) emerged as the leader of the charge with a 2.6% increase. The PSU banks, including Canara Bank and several others, displayed strong performance after their results were announced. It is worth noting that PSU banks operate in a different zone compared to private banks, and this divergence is evident in their stock prices.

While PSU banks performed well, private banks, such as HDFC Bank and ICICI Bank, only saw marginal gains of 0.39% and 0.45%, respectively. On the other hand, Industrial Bank, Kotak Bank, and Axis Bank demonstrated relatively better performance, with gains of 1.8% and 3%.

IT stocks were on a rise. Infosys up 1.5%, HCL Tech up 3%, Reliance up 1.7% along with Coal India and ONGC, showing that the Energy Sector was also on an uptrend. Furthermore, there was a bounce in the automobile sector, evident in the increase of stocks like Tata Motors, Maruti, Mahindra, and Bajaj Auto. Cement and steel experienced a mild bounce, while in FMCG (Fast Moving Consumer Goods), ITC and Hindustan Unilever remained flat. Nestle bounced due to the stock split news. NTPC Power grid along with Infra stocks L&T also up.

In terms of the market indices, the PSU banks sector displayed an astounding gain of 4.1%. This gain managed to offset the losses incurred throughout the week, reducing the overall decline to just 0.6%. The real estate sector also made a strong comeback, rising by 2%. Energy and Public Sector Enterprises showed gains of approximately 1.7% to 1.8%. Autos, IT, Infra, Commodities,Bank Nifty, Private Banks between 1-1.5% gains. FMCG, Pharma and Metal were slightly less.

Analyzing the performance of the market throughout the week, it is evident that all sectors ended in the negative zone, except for the real estate sector for the month, which remained mildly positive. Overall, the entire month of October has proven to be challenging, with all sectors experiencing losses. Entering the month of September, the market has been continuously on a downward trajectory. However, PSU banks, PSEs (Public Sector Enterprises), and mid-cap real estate stocks managed to achieve minor gains during this period.

Mid & Small Cap Performance

Mid caps had a good gap up jump opening above yesterday’s high, which is a very good sign. Upon analysing the index charts, it is clear that small-cap stocks showed promising signs during the bounce. The long-legged candlestick pattern indicates a positive trend, and the gap-up opening above the previous day’s high further reinforces this positive sentiment. Small-cap stocks have returned to the zone from which they initially broke down, indicating a potential bullish trend.

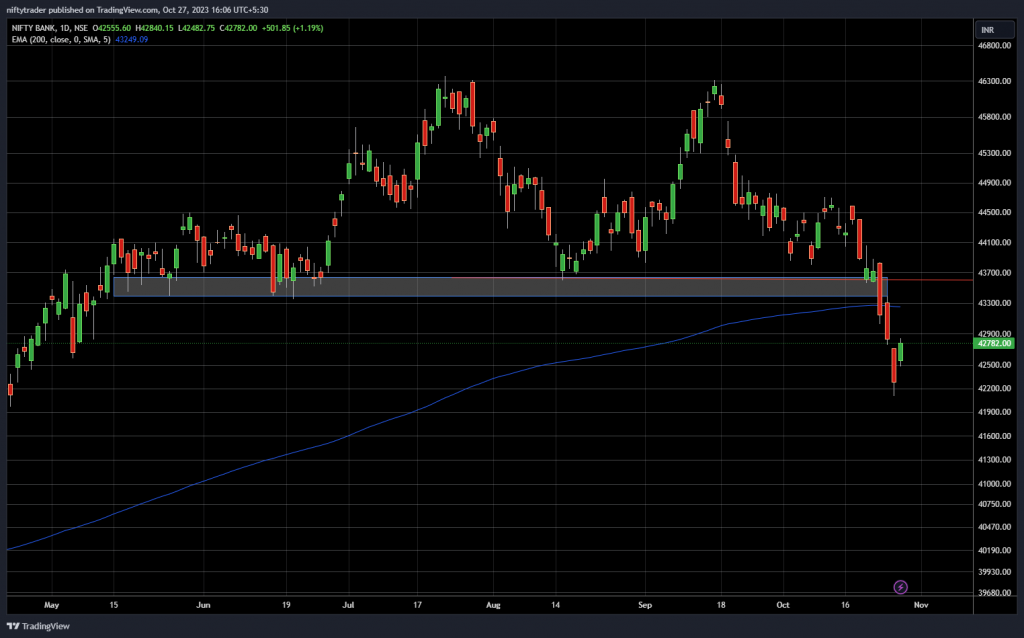

Bank Nifty Overview

Nifty Bank, although making a small comeback, has not shown significant strength. The index covered a small gap from the previous day’s morning, but its overall performance remains relatively weak. A minor gain was observed, but it did not surpass the previous day’s high. In contrast, Nifty Public Sector Enterprise stocks delivered significant gains, and the charts for Nifty PSU banks remain relatively stable, providing a positive outlook.

Highlights

In contrast, Nifty Public Sector Enterprise stocks delivered significant gains, and the charts for Nifty PSU banks remain relatively stable, providing a positive outlook. Nifty PSU Banks reached 4% gains. Additionally, Nifty Real Estate Index had good gains reaching 2 day highs.

Stock in Focus – HDFC Bank

However, it is essential to keep a careful eye on the performance of private banks. HDFC Bank, for instance, has been on a continuous decline since July, losing approximately 300 points from its initial value of 1760. It opened slightly higher than yesterday’s close, went up and then closed much below. Though other banks experienced a massive bounce, HDFC Bank did not reflect such a significant increase. This observation suggests relative weakness in private banks, even during bounce days. While this weakness persists, it is crucial to monitor the stock closely and reevaluate its strength in the future.