Nifty

The market experienced a significant downturn, with Nifty opening lower by about 100 points and then dropping further by almost 200 points. However, it did manage to recover most of the losses after the initial slump.The market now displays a long-legged candlestick pattern, which usually signifies a level of support and could potentially indicate a short-term bottom for the market. However, the situation is uncertain, and the cues from the overseas markets will strongly influence the market’s direction.

The ten-year yield on US treasury bonds is currently hovering around 5%, causing anxiety across various sectors like emerging markets, commodities, and equity markets. The strengthening US dollar is also impacting global markets, emerging markets, with other assets experiencing relative declines.

Nifty Heat Map

In terms of specific stocks, the Nifty heat map showed a sharp decline in banking stocks, with State Bank experiencing a significant cut of 2.7%. On the other hand, Axis Bank’s plan to raise 10,000 crores through QIP was struck down by 4.3%. ICICI Bank was 1% down, and Bajaj Fin also faced losses, while HDFC Bank managed to gain 1.4%, providing some relief in an otherwise bearish market.

On the positive side, stocks like Hindustan Unilever and Nestle marked remarkable gains of 1.5% and 3% respectively. However, ITC faced a slight setback with a 0.8% decline, which is attributed to some discussions around the reintroduction of cesses on tobacco.

IT giants TCS and Infosys witnessed modest gains of nearly three-quarters of a percent. Adani Enterprise also saw an increase in investments by the Abu Dhabi Investment Trust, leading to a 3.2% rise in their stock price. However, NTPC, Coal India, Power Grid showed a downward trend. Autos and steel stocks were also negatively impacted, with Tata Steel losing 2% due to news of export duties in Europe.

Sectoral Overview

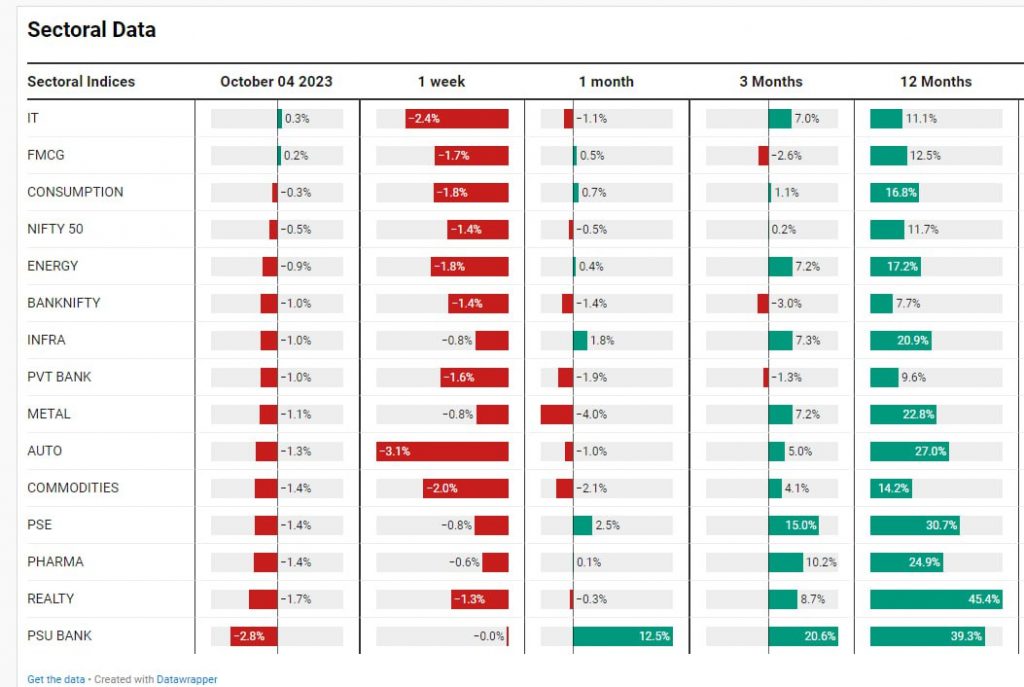

The most affected sector today was the public sector banks, which had been performing exceptionally well until now. They experienced a significant decline of 2.8%, highlighting their vulnerability in adverse market conditions. Real estate stocks also faced a day of reckoning, as they are typically sensitive to rising interest rates. Soba Reality, one of the leading real estate companies, encountered serious tax liabilities, causing a downturn in the real estate index.

Pharmaceuticals, PSE, commodities, autos, metals, and private banks all lost 1% or more, indicating the widespread impact of the market’s bearish sentiment. However, IT, FMCG and consumption sectors were comparatively less affected. Energy, Bank Nifty, and infra sectors also experienced some losses but to a lesser extent.

The past week has been extremely challenging for the automobile and IT sectors, with losses of 3% and 2.4% respectively. Many gains made during the last month have been erased or have slipped into negative territory. However, PSU banks have managed to hold up well so far, with a gain of 12.5%.

Mid & Small Cap Performance

Mid-caps broke down from a flag-like trend line but eventually bounced back to close similar to where we were two days ago. This provides a glimmer of hope, suggesting that the mid-cap segment might recover soon.

Small-caps were also at the verge of breaking down but managed to stay in contention, within 2% of their all-time highs.

Bank Nifty

Bank Nifty continued to lose ground, dropping from 46,300 to below 44,000 in just two weeks, losing 5% in the past 2 weeks. In my opinion, the market seems a bit oversold at this point.

Highlights – Suzlon Energy

Let’s examine a standout stock, Suzlon Energy. Despite its turbulent past, the stock is currently showing significant strength and relative outperformance. In May, the stock was trading at Rs8, and it has now reached a multi-year high of Rs28, demonstrating its resilience in the face of market volatility. This is a prime example that past failures do not necessarily indicate future performance.

Stocks in Focus – ITC

Now let’s focus on the stock of the day, ITC. It has formed a perfect Head and Shoulders pattern, indicating a possible downtrend. The red candle was formed on the announcement of the ITC Hotel Demerger affected the stock’s movement, creating a clear distinction before and after the announcement. As of now, those who bought shares on the announcement day might feel trapped. If the stock sustains below the 435 mark, it could potentially target the sub-400 level target over time. However, it is hard to tell what may happen, but positioning a stop loss at 455-460 for all short positions is advised.

Download the WeekendInvesting App

If you have any questions, please write to support@weekendinvesting.com