Another week of amazing volatility has gone by. Nifty started the week from a trend mode and spent the whole week more or less in a range.

Bank Nifty weakened towards the end of the week and remained indecisive.

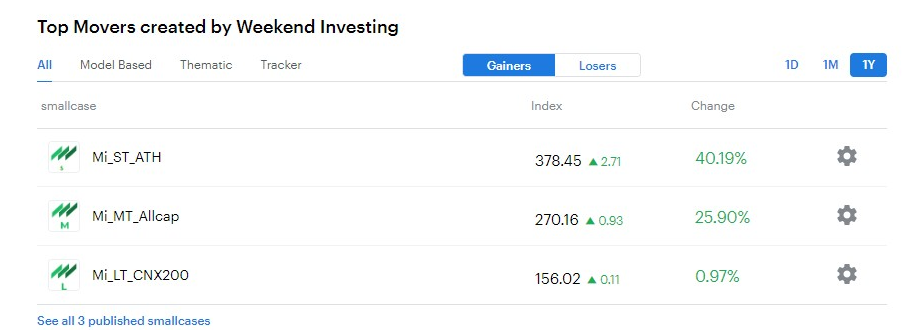

The weekendinvesting small case products have done well this week and for the year so far barring the Long term case. From this week I will update the smallcase re-balance notification here as well

Mi_LT_CNX200 : ADD 1 new stock.

Mi_MT_Allcap : NO CHANGE

Mi_ST_ATH :Replace 1 stock.

Since Inception in Apr 16, all these strategies have beaten the benchmarks by a wide margin.

In the LIVE product strategies, all products gained with Mi25 and Mi50 standing out. The over diversification of Mi50 has not impeded the performance in any way contrary to popular belief. All in all the LIVE products provides a mature ground for more diversified and lower risk strategies than the smallcases.