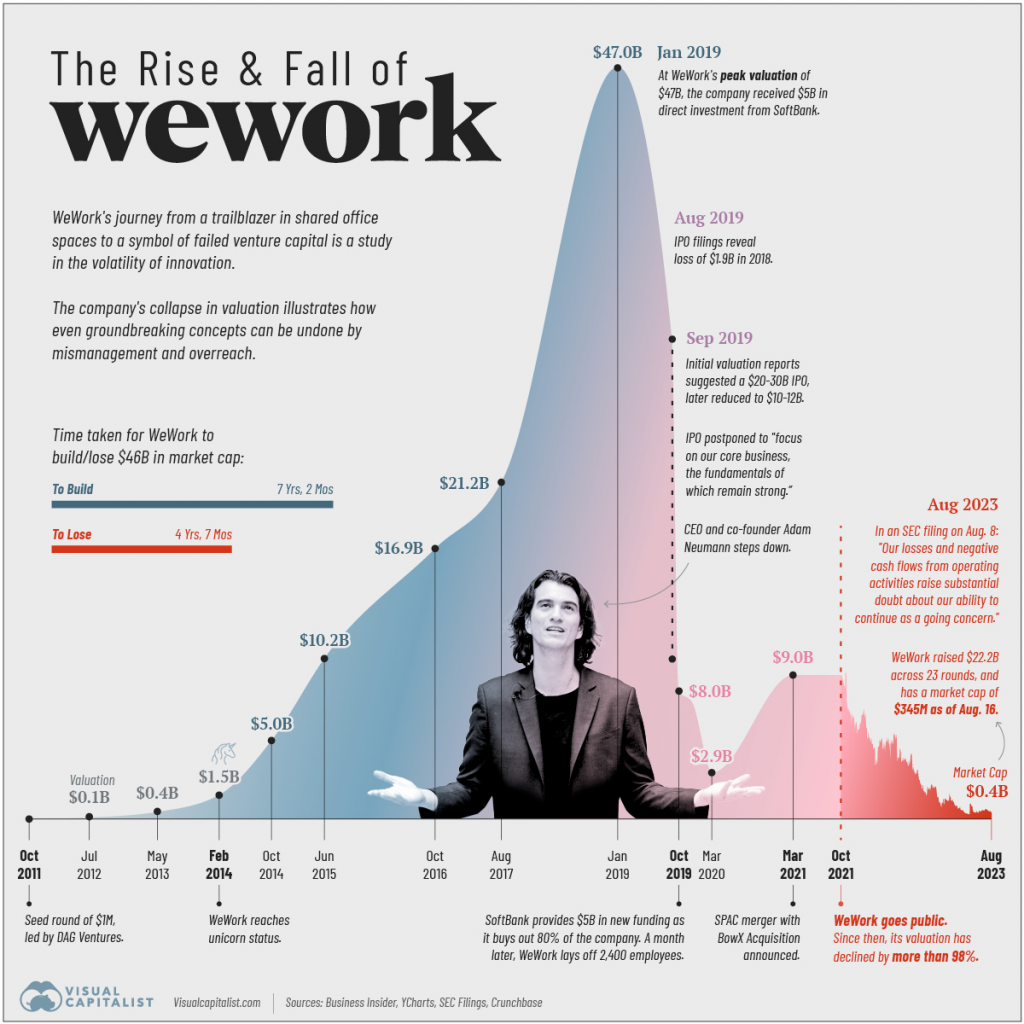

The Rise and Fall of WeWork: Lessons for Investors

WeWork, the shared working space and innovation company, had a meteoric rise and an equally dramatic fall. In just 12 years, WeWork went from virtually zero to a peak valuation of $47 billion, only to end in bankruptcy. This journey offers valuable insights and lessons for investors.

This brilliant infographic by Visual Capitalist, reveals the staggering speed at which WeWork’s valuation grew. Imagine investing $100,000 in July 2012, and within seven years, your investment would have grown to a valuation of $470 million! This exponential growth was unprecedented. However, it’s important to note that market caps can rise quickly but also fall even faster.

After reaching its peak valuation, WeWork faced a series of challenges that led to its downfall. In September 2019, the company filed for an initial public offering (IPO), which revealed its significant losses. The revelation caused its valuation to plummet from $47 billion to just $8 billion, an 80% decrease within a matter of months.

As an individual investor, the question arises: What would you do if you were in this situation? Despite being left with 20 lacs from your initial 1 crore investment, it’s tempting to hold onto the hope that the valuation will rebound to its previous glory. However, it’s essential to evaluate the situation objectively and make informed decisions.

Psychologically, investors often suffer from “anchoring bias.” Even if the investment has grown 80 times over, the anchor of the previous $470 million valuation leads investors to resist booking the loss. This biassed thinking can be detrimental, as the stock’s volatility continues to erode the investment’s value and eventually reaches zero.

Investments can go sour despite the initial success. There is no guarantee that what has been steadily rising will continue to do so indefinitely. Such occurrences are rare and affect less than 0.1% of stocks. Therefore, it’s essential to assess the performance of your investment and not assume that it will continue on an upward trajectory forever.

By overcoming anchoring bias and making objective decisions, investors can protect their gains and potentially minimise losses. In the case of WeWork, if investors were able to detach from the initial $470 million valuation anchor, they could have saved not only the 80% decline in value but also their initial capital.

If you have any questions, please write to support@weekendinvesting.com