Analyzing Gold Price Trends

In this insightful analysis, we’re diving into the gold price trends, specifically in INR. Over the past couple of months, there has been little change in the USD to INR exchange rate, making the gold price chart in both currencies practically identical. What’s fascinating to note is the significant surge in gold prices in India starting from mid-February, right after Valentine’s Day. We’ve seen prices soar from 61,000 per 10 grams to a remarkable 75,000, marking a substantial gain of over 20%.

Understanding Market Dynamics

Large round numbers often trigger certain behaviors among investors. For instance, reaching the 75,000 mark may prompt some individuals to consider selling off their gold holdings, leading to consolidation in the market. Despite this, the recent rally in gold prices, offering approximately 25% returns in just over two months, is quite spectacular. Such movements far surpass the average annual returns one might expect from this asset class, emphasizing the current extraordinary nature of the market.

As the saying goes, “trees don’t grow to the skies.” In other words, continuous upward trends are unsustainable in the long run. After a strong upward trend like the one we’ve witnessed in gold prices, it’s common to observe retracements. These retracements often hover around 38% to 50% of the gains, signaling a temporary pause or pullback in the market. Currently, the price retracement suggests a potential support level around 70,000 to 69,700 INR per 10 grams.

For investors, especially those who allocate to gold as part of their portfolio diversification strategy, these retracement levels present favorable buying opportunities. Buying on dips is a popular strategy in uptrending markets like gold’s current trajectory. Keeping a close eye on key support levels, such as the anticipated 70,000 to 69,700 range, can help investors make informed decisions about entry points.

Long-Term Perspective

It’s essential to maintain a long-term perspective when investing in assets like gold. While short-term fluctuations may occur, the overarching goal is to achieve consistent returns over time. Implementing a systematic investment plan (SIP) in gold, similar to investing in equities, can help mitigate risks and provide a hedge against currency-based investments.

Spotlight : The Casino Math behind Mi NNF 10

In today’s rapidly evolving world where the rate of emergence of new market leaders is at an all time high, having an agile strategy at work becomes an absolute must.

You might be good at identifying a good stock or a sector but what if it doesn’t turn out well ? What if another stock or a sector starts performing relatively better ?

Is your strategy agile enough to dump the sluggish stocks and identify new leaders ?

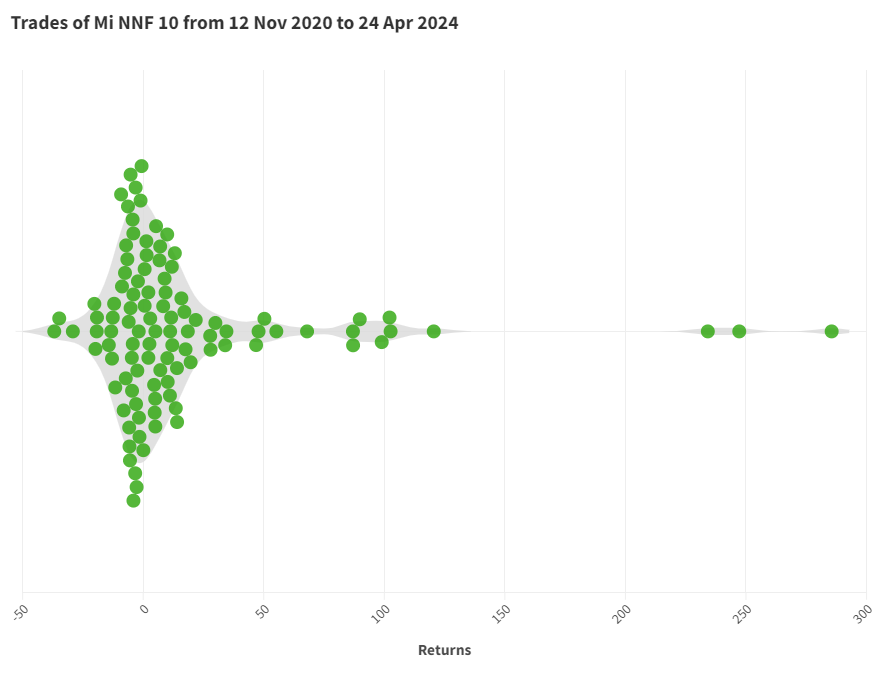

Below is a chart depicting the performance of all the trades that Mi NNF 10 has taken since going live on 12 Nov 2020 (till 24 Apr 2024)

Some of momentum investing’s core principles that can be evidently validated from this chart are ;

– Winners are allowed to run far while losers are discarded early. The biggest winner has clocked 285% while the biggest loser has returned (-37%).

– 44% of the trades are loss making while 56% are winners.

– 76% of the trades fall in this crowded zone of -20% to +20% but the stat that makes the strategy successful is that the average winner returns a healthy +39% while the average loser returns only -9%.

– This is the casino math that has enabled the strategy to outperform its benchmark by a very healthy margin.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com