In a recent tweet by Zafar Sheikh of Investors Capital, a fascinating comparison of index returns from various global markets over the past five, ten, and 15 years was shared. These insights provide valuable perspective on how different markets have performed over time.

Five-Year Performance Snapshot

Looking at the returns over the last five years, the Nifty index from India has emerged as a top performer, yielding an impressive 60% return. Surprisingly, China lagged behind with a -7% return, while other markets like Japan, Dow Jones, and Germany showcased significant growth, ranging from 40% to 53%.

The Ten-Year Perspective

Expanding the timeframe to the past decade, the Nifty index continued to shine with a substantial 166% return, solidifying its position as a top performer. Dow Jones followed closely behind with a 155% return. Interestingly, markets like Nikkei from Japan also demonstrated strong growth, further highlighting the diversity in global market performances.

Long-Term Trends

Zooming out to a 15-year period, it becomes evident that certain markets, particularly the US and India, have consistently outperformed others. Both the Dow Jones and Nifty indices have delivered remarkable returns, showcasing the resilience and growth potential of these markets over the long term.

Reflecting on these insights, it’s essential to acknowledge the privilege of participating in markets like India and the US, which have been leaders in terms of growth compared to the rest of the world. Investors in these markets have witnessed significant wealth creation opportunities, underscoring the importance of gratitude and appreciation for the favorable investing environment.

Additionally, these findings challenge common misconceptions about market performance, particularly regarding the Nifty index’s performance relative to the US market. Contrary to popular belief, the Nifty has consistently outperformed the US market even in dollar terms over extended periods, highlighting its strength and potential.

WeekendInvesting Strategy Spotlight

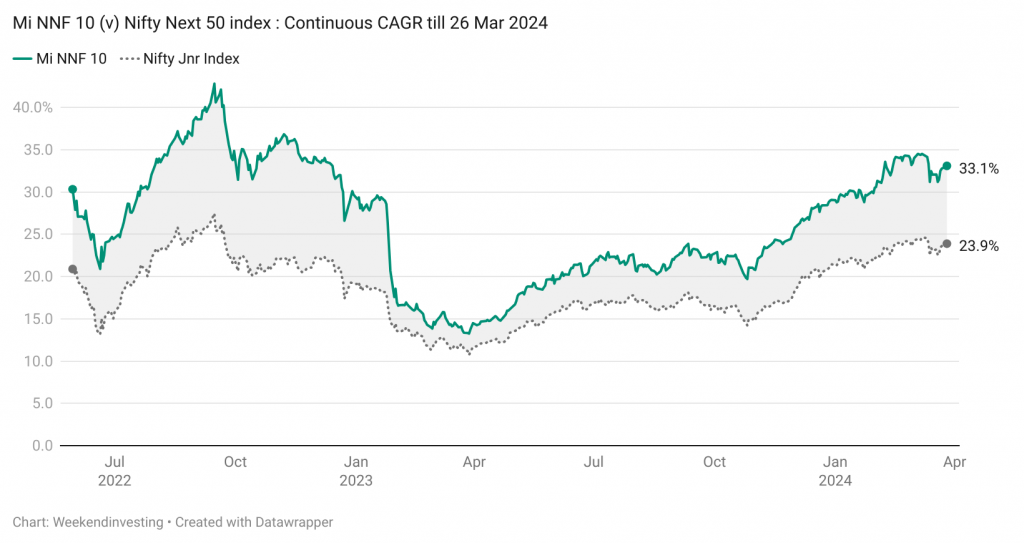

This chart denotes the CAGR of both Mi NNF 10 and its benchmark, the Nifty Jnr Index on which the strategy is based. The strategy has recorded a CAGR of 33% compared to 24% on the Nifty Jnr (Period : 12 Nov 2020 to 26 Mar 2024 – 3 years and 4 months)

The sheer consistency in outperformance of the strategy is essentially an outcome of ;

– Picking and riding the strongest stocks within its universe in a non discretionary – rule based manner.

– Allocating a standard 10% weightage to all stocks without any bias towards market capitalization

– Riding winners as long as momentum exists and dumping losers as soon as momentum fades away

The subscription fee for Mi NNF 10 shall be increased to Rs 9,999 from current fee of Rs 7,499 effective – 0

99 effective – 01 Apr 2024 onward. Go ahead and make use of this opportunity to subscribe to to Mi NNF 10 before the price increase.

If you have any questions, please write to support@weekendinvesting.com