Every investment strategy operates differently, tailored to specific risk-reward profiles and objectives. Just like how different models of cars have varying engine tunings for performance or fuel efficiency, investment strategies are tuned for specific purposes. For instance, momentum-based strategies share the same core principles of buying winners and selling losers but may differ in how frequently they assess stocks, how aggressively they cut losses, and how well diversified they are.

The Case of Tanla Platforms

Consider the case of Tanla Platforms, a stock that soared from Rs87 to Rs1000 within months, yielding an impressive 800% gain. While this stock performed exceptionally well in one strategy, it didn’t appear in many others. There are several reasons for this. It could be that the stock didn’t meet the volume criteria for certain strategies or wasn’t part of their universe. Each strategy has its unique selection criteria.

After exiting Tenla Platforms at Rs790, the stock surged again, reaching Rs2000. However, some strategies, like absolute momentum ones, may have missed this opportunity due to their specific rules for adding new stocks. While luck plays a role in investment success, momentum investing primarily relies on analytical and quantitative factors.

The beauty of momentum investing lies in its ability to capitalize on opportunities as they arise, maximizing gains while minimizing downside risks.

WeekendInvesting Strategy Spotlight

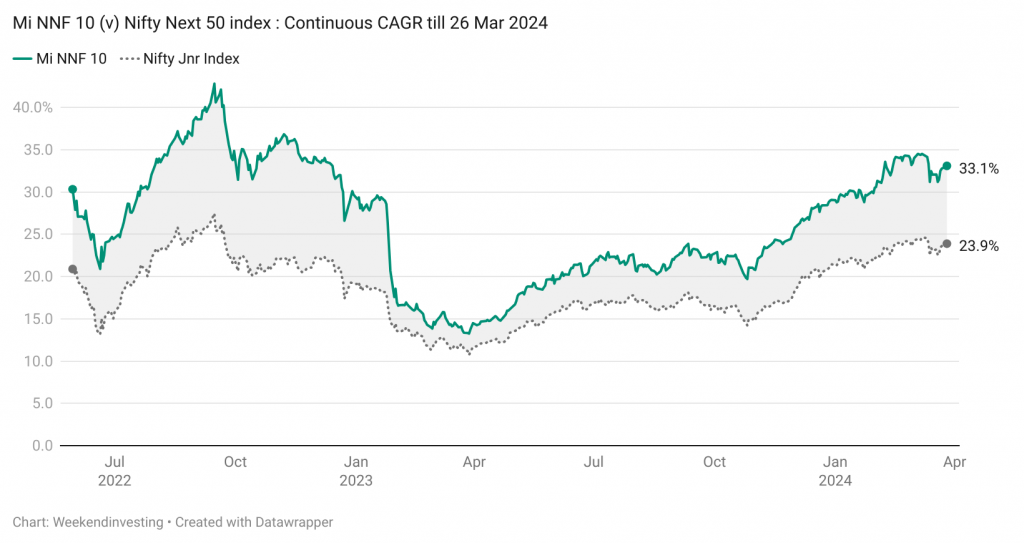

Mi NNF 10’s performance has been a great example to showcase the immense ability of a robust non discretionary, momentum strategy based on large caps, specifically – the Nifty Next 50 index.

With about a week to go for the end of FY 24, the strategy has achieved 81% gains so far compared to 52% on the Nifty Next 50 Index demonstrating solid outperformance. The CAGR since going LIVE (12 Nov 2020) stands at 31% compared to 22% on the Nifty Jnr Index.

WeekendInvesting Strategy Spotlight

This chart denotes the CAGR of both Mi NNF 10 and its benchmark, the Nifty Jnr Index on which the strategy is based. The strategy has recorded a CAGR of 33% compared to 24% on the Nifty Jnr (Period : 12 Nov 2020 to 26 Mar 2024 – 3 years and 4 months)

The sheer consistency in outperformance of the strategy is essentially an outcome of ;

– Picking and riding the strongest stocks within its universe in a non discretionary – rule based manner.

– Allocating a standard 10% weightage to all stocks without any bias towards market capitalization

– Riding winners as long as momentum exists and dumping losers as soon as momentum fades away

The subscription fee for Mi NNF 10 shall be increased to Rs 9,999 from current fee of Rs 7,499 effective – 01 Apr 2024 onward. Go ahead and make use of this opportunity to subscribe to to Mi NNF 10 before the price increase.

If you have any questions, please write to support@weekendinvesting.com